Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at small business owners choosing to not re-open. (See the Economy & Finance section.)

Precious Metals:

We’ll start out wit this news from Zero Hedge: “The Largest Ever Physical Transfer Of Gold”

o o o

Arkadiusz Sieron: Will The Fed Trigger Inflation This Time, Boosting Gold?

o o o

Just as I predicted, the silver-to-gold price ratio has recently dropped from 118-to-1 down to around 97-to-1. But I still consider silver a relative bargain. Therefore, I recommend that my readers do some comparison shopping to find a local dealer that sells silver a low premium, over spot. Ideally, find one that is willing to directly ratio trade your physical gold for their physical silver in one transaction. Don’t wait until the ratio drops to 70-to-1, to do this!

Economy & Finance:

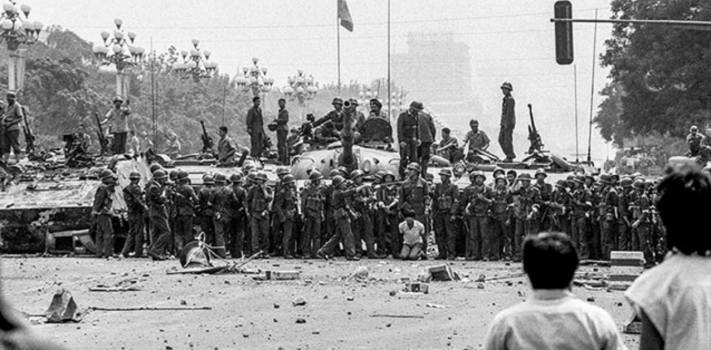

NBC Chicago reports: Small Businesses Suffering After Riots, Coronavirus Pandemic. JWR’s Comments: Put yourself in the shoes of a typical “Mom & Pop” small business owner, who is now looking at a fire-damaged store with smashed windows, empty shelves, a huge mess on the floor, and a new, much higher business insurance quote. What is the motivation to rebuild, re-stock, and re-hire? I suspect that many will just choose to retire early, or switch to Internet-only sales, or simply take up another line of work.

o o o

At Zero Hedge: Bill Dudley: “The Fed Is Basically Creating A Little Bit Of Moral Hazard”

o o o

o o o

At Wolf Street: From Ice-Cold to Hot: Daily Pending Home Sales in May so Far, 15 Cities Around the US

o o o

College Enrollment in the Spring Fell for 9th Year in a Row, and Now Comes CovidContinue reading“Economics & Investing For Preppers”