2018 has just begun. What will a new year bring for the gold market?

Macroeconomic Outlook Will Remain Unpleasant

The current economic expansion is surprisingly durable, as it has already lasted more than 100 months. It worries many investors who are afraid of the upcoming recessions. Surely, there are many reasons to worry, and the recession will eventually come. But we are not at this point yet. The current expansion is unusually long, but it is exceptionally sluggish. This year we expect that the global economic growth will continue. Actually, it may even accelerate and become more synchronized among countries. Moreover, with relatively strong business momentum, the labor markets in advanced economies should strengthen further. And although inflation is likely to rise, it will remain low. Hence, the macroeconomic outlook will remain unpleasant for the gold market, as the yellow metal prefers periods of economic turmoil or stagnation.

Fed Will Be Gold’s Enemy

The Fed will continue its gradual tightening. In 2017, the U.S. central bank lifted interest rates three times. We expect similar number of hikes this year. The unwind of the Fed’s enormous balance sheet would withdraw some liquidity from the market, exerting an additional tightening effect for the financial conditions. Moreover, Jerome Powell will replace Janet Yellen as the Fed’s Chair. And we will also see a few other significant personal changes at the U.S. central bank. We predict, thus, that the FOMC will be more hawkish in 2018 than in 2017. The Committee will include more hawks (due to the normal rotation among the regional Fed Presidents, Trump’s nomination to the Board of Governors), but also all the members could vote in a more hawkish way, given the strong economic momentum. A lot will depend on inflationary dynamics, but we believe that a modest hawkish shift is likely this year. Gold reacts more to the real interest rates, not to the federal funds rate, but the Fed’s hawkish rhetoric should be a headwind for the yellow metal.

U.S. Dollar Will be Key to Gold’s Future

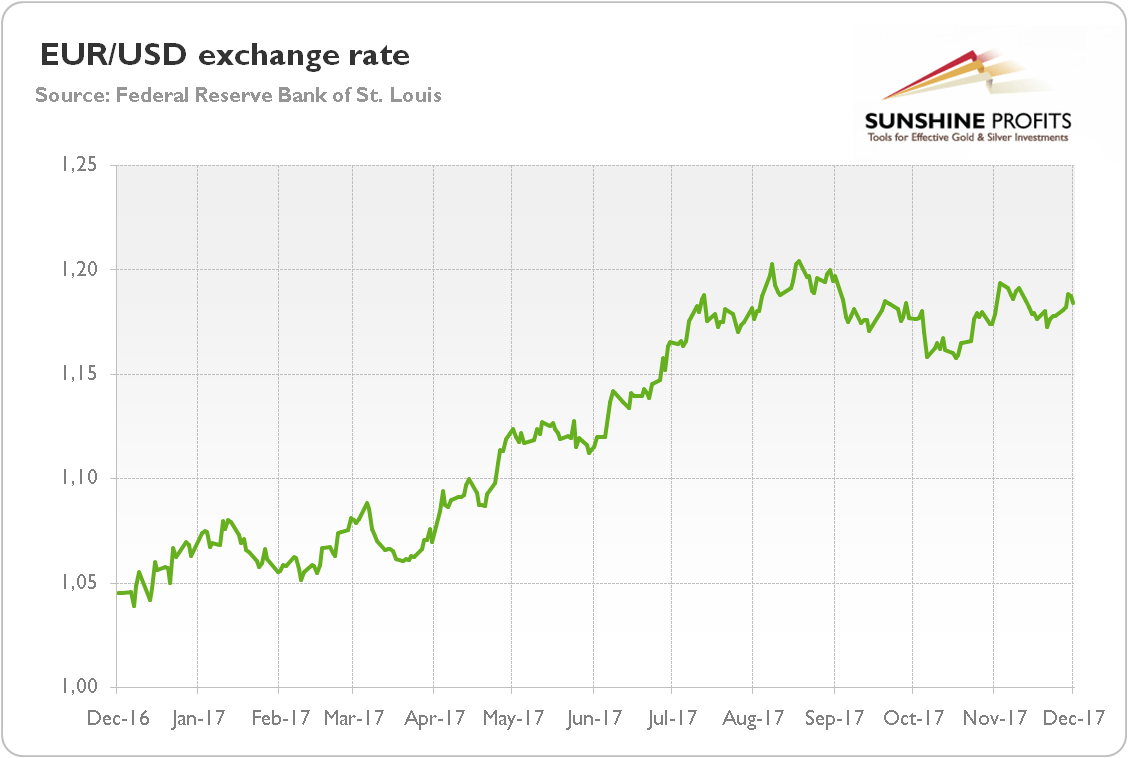

As we explained last week, the gold performed well in 2017 despite an unpleasant macroeconomic environment and the Fed’s interest rate hikes because of a greenback’s depreciation. The price of gold is closely tied to the fate of the U.S. dollar not only because bullion is prices in greenback, but mainly because gold is considered to be the bet against the U.S. dollar. It is the ultimate safe-haven, purchased as a hedge against the collapse of the greenback. In 2017, the U.S. dollar fell about 15 percent against the euro, as one can see in the chart below.

Chart 1: EUR/USD exchange rate over the last year.

On the one hand, the depreciation could continue this year. There are three reasons for that: first, the strong economic momentum in the Eurozone; second, the expectations that the ECB will tighten its monetary policy in the near future; and, third, the investors’ distrust in positive long-term effects of Trump’s economic policies. The tax cuts, increased government spending, and economic nationalism may provide some stimulus in the short-term, but at the expense of higher fiscal deficits and with no effect on the labor productivity.

On the other hand, there are also some arguments that the greenback will rebound this year. First of all, the Fed will hike its interest rates even further. Higher interest rates should make U.S. dollar-denominated assets more attractive than their foreign peers. We know that the Fed’s hikes have not strengthened the greenback so far, but investors should remember that during the previous Fed’s tightening cycle the USD didn’t rally until the 4th rate hike. If history repeats, the greenback may catch its breath, which will be negative for the gold market.

Conclusion

To conclude, our fundamental gold outlook for 2018 is rather bearish than bullish, although the fact that the business cycle is more advanced in the U.S. than in the Eurozone could be an important tailwind for the yellow metal. And if black swans arrive this year, the gold prices will be additionally supported. Last but not least, a lot depends on the market sentiment. In 2016 and 2017, the shiny metal rallied in January and February. In 2018, gold has already jumped above $1,300, so there might be a replay from previous years, although later in the year gold may struggle. Anyway, the persistence of low volatility in the gold market for another year is rather unlikely. Stay tuned and be prepared for the investment opportunities in the gold market in 2018!

This article originally appeared at Sunshine Profits.

Biography

Arkadiusz Sieroń is a certified Investment Adviser. He is a long-time precious metals market enthusiast, currently a Ph.D. candidate, dissertation on the redistributive effects of monetary inflation (Cantillon effects). Arkadiusz is a free market advocate who believes in the power of peaceful and voluntary cooperation of people. He is an economist and board member at the Polish Mises Institute think tank. He is also a Laureate of the 6th International Vernon Smith Prize. Arkadiusz is the author of the Market Overview reports and Gold News Monitor for Sunshine Profits.

1) One thing that might prevent the Fed from raising US interest rates — and making the dollar stronger — is the flattening of the yield curve. Difference between 10 year and 2 year rates is only 0.56 percent at this point.

2) The best investment for the deflation of a depression is long term US Treasuries–NOT gold. The current demand for long term Treasuries –as shown by the low long term rates — suggests that the smart money is not all that confident re the global economy.

An inverted yield curve — short term rates going higher than long term rates — is a pretty good 1-year leading indicator of a major recession. It predicted the 2000 Clinton Internet bust — which would have been worse absent the massive government spending in response to Sept 1, 2001 attack and it also predicted the 2008 crisis — the yield curve inverted in January 2007.

3) However, one oddity is that much of the demand for Treasuries is from foreigners –who accept low rates for safety. Our NIIP –net debt owed to foreigners — soared during the 8 years of Obama’s administration. From 2 Trillion to over $8 Trillion

4) And much of the stock market rise has been due to Obama allowing CEOs to steal from Corporate pension plans — and allowing the federal government to steal from our Social Security/Medicare plans. US pensions are now greatly UNDERFUNDED because Obama allowed an accounting fiction — CEOs can assume they are going to earn 5% per year over the next 25 years on pension assets. So plans that are underfunded with assets less than 80% of needed levels are listed as being funded at 95%.

5) And the Me Too movement is a Democratic Con desiged to divert women’s attention away from how Obama screwed them out of $40,000 to $100,000 in Social Security benefits. Which he did by destroying women’s right to claim 1/2 of their Spouses’ benefits from age 66 to 70 so that their own accounts could grow in value.

6)So the real question is how much more of US assets can Democrats steals and hand off to foreigners to keep Bill Clinton’s “Globalization” con going. A con that is enriching Democrat billionaires while slowing destroying America’s middle class– of all races.

Gold is only valuable if you can sell it. One method is a coin shop at $30 dollars off market price or the second method is private buyers.

And both pay in cash, but if these two buyers do not by, all one has is an expensive paper weight.

And the idea gold and silver will be used in the collapse is based on what? Food and ammo will be the currency of the day.

If gold hits anyway near $2,000, sell it and sell it fast.

The markets manipulators will crush the price spike again

I sigh heavily as I repeat this.

Of course you need food, buy and stockpile it as you need.

Of course you need ammo, probably not as much as you think, but fine, load up.

Now get out of debt, get good farm land, etc

Once you are there buy silver and gold, its better than currency!

I know its hard for new preppers to imagine having all their poop in a pile, but a few of us have, and then we invest in the future. My grandchildren will probably profit from my insight.

Well said, a youtube channel described taking care of priorities in this order:

1. Water

2. Food

3. Medical/Hygiene

4. Security

5. Barter items

First run through the list for a 3 day supply, then 1 month, and finally 6 months. Obviously the timeline can vary, but a 6 month supply of silver barter should never take precedent over 3 days worth of water.

It is stating to look like ammo may become the coin of the realm in California, at least until the Justice Department arrests and prosecutes the current legislators for their crimes against the people. Restricted ammo sales and violation of Interstate Commerce laws. Add adding and abetting federal criminals, i.e. Illegal Immigrants, as well as conspiracy to commit criminal activity. I say Get to work Federal Justice Dept. earn your pay.

Joe :

It’s easier and cheaper just to move out of Kommunist Korruttafornia. I did it 15 years ago and now I’m better off.

Joe:

It would be easier and cheaper to just move out of Kommunist Korruptafornia. I did it 15 years ago and I am better off now.

Just be sure that opsec is the highest priority. I had a lot of my weapons stolen out of a secured area as well as a super max safe. I never will have all my eggs in one basket again. I wasn’t In country so that is the way it is. I don’t have any family members that are awake. Even in your house, never show anyone including family you can’t fully trust where you might have your precious metals.. I have replaced most weapons, but I would highly recommend the NRA insurance. Montana farmer , you are so correct.

The Constitution for the united States of America still mandates gold and silver coin as tender for the payment of debt; anyone aware of any amendment, proposed or ratified, which may have changed this?? Didn’t think so. So Skip wake up son your about to fall off the back side of the power curve ….

LT Mike

You are correct about gold and silver as legal tender but so what? Have you used gold to pay your property tax? Some states allow but others not so much.

Also the idea of gold as money is a foreign concept to millions. My friend tried an experiment trying to pay for a tank of gas with a one ounce gold coin, the attendant did not have a clue what it was.

And now the counterfeit gold coins is brutal. My coin shop told me these gold coins have been drilled out and fill with a similar weighted metal.

Now I did not say sell all of ones gold or silver, take profit but if one thinks he will use it after a economic collapse, good luck to you. I would rather have stores and equipment.

Skip :

I do not blame you for not fully getting in on the ” gold and silver ” are going to be currency when TSHTF, how ever do not rule it out and plan accordingly. Next, and this is probably just a little more important than getting on the ” gold and silver ” wagon what is the one thing that we are constantly told to invest in by JWR? Tangibles!

Tangible items will go as far if not farther than any currency when things go ” pear shaped ” . Do both. God Bless.

In the case of gold, your coin shop was probably referring to the tungsten fake gold coins from China. (Tungsten has a density close to golds, which makes it hard to detect with scales and volume measurements.)

https://www.nbcnews.com/business/business-news/glitters-not-gold-fake-gold-silver-coins-flooding-market-n591201

See also

http://www.tungsten-alloy.com/tungsten-alloy-scan-gold-coin.html