“[C]onceived it to be the privilege of every citizen, and one of his most essential rights, to bear arms, and to resist every attack upon his liberty or property, by whomsoever made. The particular States, like private citizens, have a right to be armed, and to defend by force of arms, their rights, when invaded.” – Roger Sherman, Debates on 1790 Militia Act

- Ad USA Berkey Water Filters - Start Drinking Purified Water Today!#1 Trusted Gravity Water Purification System! Start Drinking Purified Water now with a Berkey water filtration system. Find systems, replacement filters, parts and more here.

- Ad LifeSaver 20K JerryCan Water PurifierThe best water jerrycan you can buy on the market! Mention Survivalblog for a Free Filter ($130 Value)

Preparedness Notes for Sunday — November 12, 2023

On November 12, 1970, the Bhola cyclone struck East Pakistan (now Bangladesh), killing hundreds of thousands of people in the densely populated Ganges–Brahmaputra delta; it was perhaps the deadliest tropical cyclone in recorded history and one of the greatest natural disasters.

—

Today is the birthday of USMC Sergeant Major Daniel Joseph “Dan” Daly (born 1873, died April 27, 1937). He was one of only nineteen men (including seven Marines) to twice receive the Medal of Honor.

—

November 12th, 1950 was the birthday of Corporal John Alan Coey (died 19 July 1975). He was the first American volunteer killed in Rhodesia. His journal was published poshumously, under the title A Martyr Speaks.

—

SurvivalBlog Writing Contest

Today we present another entry for Round 109 of the SurvivalBlog non-fiction writing contest. The prizes for this round include:

First Prize:

- The photovoltaic power specialists at Quantum Harvest LLC are providing a store-wide 10% off coupon. Depending on the model chosen, this could be worth more than $2000.

- A Gunsite Academy Three Day Course Certificate. This can be used for any of their one, two, or three-day course (a $1,095 value),

- Two cases of Mountain House freeze-dried assorted entrees in #10 cans, courtesy of Ready Made Resources (a $350 value),

- A $250 gift certificate good for any product from Sunflower Ammo,

- American Gunsmithing Institute (AGI) is providing a $300 certificate good towards any of their DVD training courses.

- Two sets of The Civil Defense Manual, (in two volumes) — a $193 value — kindly donated by the author, Jack Lawson.

Second Prize:

- A SIRT STIC AR-15/M4 Laser Training Package, courtesy of Next Level Training, that has a combined retail value of $679

- Two 1,000-foot spools of full mil-spec U.S.-made 750 paracord (in-stock colors only) from www.TOUGHGRID.com (a $240 value).

- Two Super Survival Pack seed collections, a $150 value, courtesy of Seed for Security, LLC.

- Montana Survival Seed is providing a $225 gift code for any items on its website, including organic non-GMO seeds, fossils, 1812-1964 US silver, jewelry, botany books, and Montana beeswax.

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun. There is no paperwork required for delivery of pre-1899 guns into most states, making them the last bastion of firearms purchasing privacy!

Third Prize:

- A $300 gift certificate from Good2Goco.com, good for any of their products: Home freeze dryers, pressure canners, Country Living grain mills, Emergency Essentials foods, and much more.

- Three sets each of made-in-USA regular and wide-mouth reusable canning lids. (This is a total of 300 lids and 600 gaskets.) This prize is courtesy of Harvest Guard (a $270 value)

- A Royal Berkey water filter, courtesy of Directive 21 (a $275 value),

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun.

—

More than $850,000 worth of prizes have been awarded since we started running this contest. We recently polled blog readers, asking for suggested article topics. Refer to that poll if you haven’t yet chosen an article topic. Round 109 ends on November 30th, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging.

- Ad Survival RealtyFind your secure and sustainable home. The leading marketplace for rural, remote, and off-grid properties worldwide. Affordable ads. No commissions are charged!

- Ad SIEGE belts: The essential go-anywhere GRAY MAN accessory. Solid 5.5 to 7 oz of persuasive power has saved many. Revered "Thousand-Year Buckles" with stunning hand-crafted finishes. Never go out/travel without one. Complements CCW. Lear more...SIEGE STOVES: prepare for the great outdoors with the ultimate portable survival stove. SIEGE BELTS have saved many: NEW: Use code "SBLOG" at checkout for $20 off any belt!

Homesteading – A Cautionary Tale – Part 3, by SaraSue

(Continued from Part 2. This concludes the article.)

Why I will continue to homestead

It’s really fun to watch videos of the perfect “permaculture” setup. It’s quite another to implement it. Sitting down and thinking it all through is a great idea, even drawing up plans – which will require you to know the lay of your land, the slopes, the direction the wind comes from, where the morning sun comes up, what shadows are thrown during the day, the climate and growing zone, etc. But, what if you have no idea what you’re doing?

When I started out, I only wanted chickens. Then I decided that goats were the way to go to keep the land cleared. Then I tried meat rabbits. Well, the goats were given away sooner rather than later because they don’t graze the land, they browse the bushes and trees. Sheep are much better grazers, but I wasn’t ready for sheep and I knew nothing about them. I got some breeding rabbits for all the right reasons – low cost, small footprint, easy reproduction, great source of protein on a small scale… Absolutely beautiful rabbits, but it’s way too hot and humid where I live for the rabbits to be happy. I had no way to keep them cool so I gave them away. Then I got a bee in my bonnet for a milk cow, then that morphed into 3, and there were calves involved. Of all the animals, I love the cows the most. Then I decided I could get a couple of feeder pigs, then purchased a breeding group. Lord have mercy! I do like the pigs, but I’ve learned that I need a lot more electric fencing than I have.Continue reading“Homesteading – A Cautionary Tale – Part 3, by SaraSue”

- Ad Trekker Water Station 1Gal Per MinuteCall us if you have Questions 800-627-3809

- Ad Civil Defense ManualClick Here --> The Civil Defense Manual... The A to Z of survival. Looks what's in it... https://civildefensemanual.com/whats-in-the-civil-defense-manual/

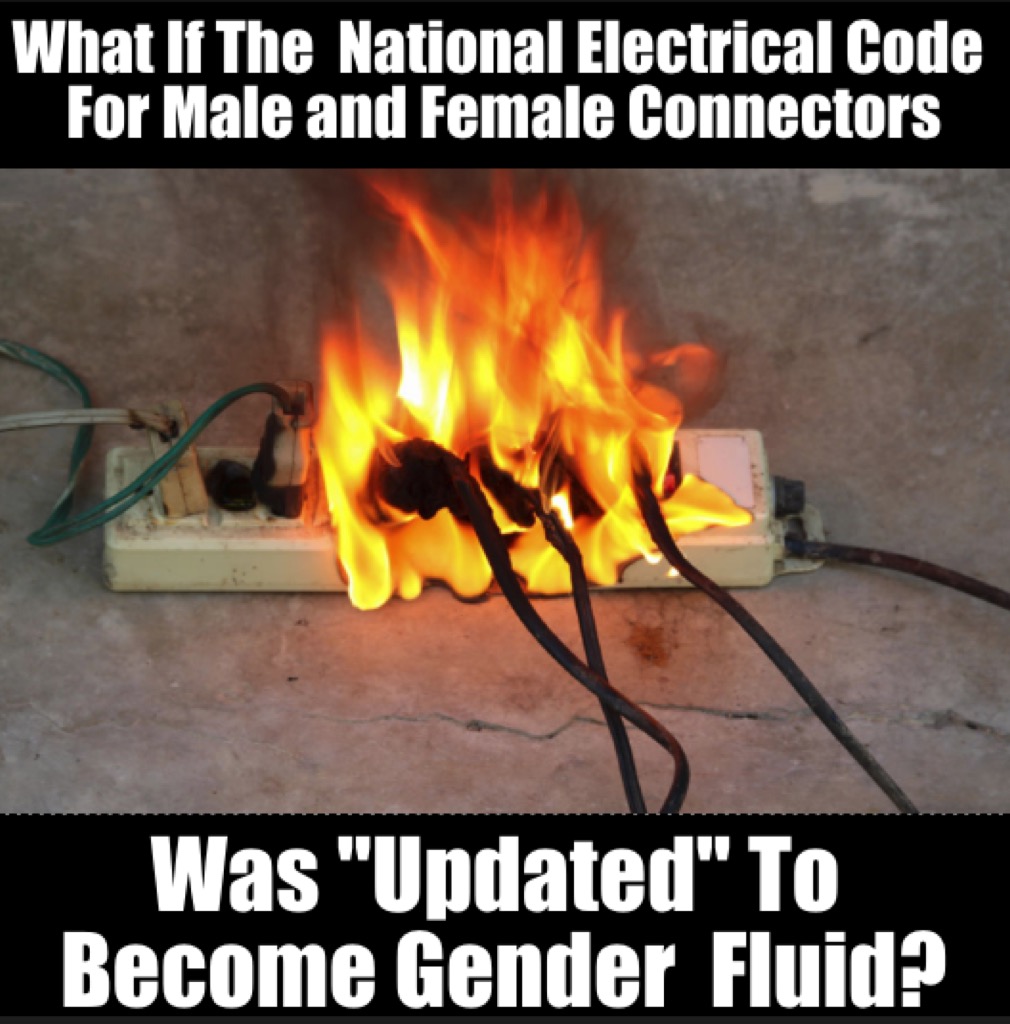

JWR’s Meme Of The Week:

The latest meme created by JWR:

Meme Text:

What If The National Electrical Code For Male and Female Connectors

Was “Updated” To Become Gender Fluid?

Notes From JWR: Do you have a meme idea? Just e-mail me the concept, and I’ll try to assemble it. And if it is posted then I’ll give you credit. Thanks!

Permission to repost memes that I’ve created is granted, provided that credit to SurvivalBlog.com is included.

- Ad California Legal Rifles & Pistols!WBT makes all popular rifles compliant for your restrictive state. Choose from a wide range of top brands made compliant for your state.

- Ad STRATEGIC RELOCATION REALTYFOR SALE: Self-sustaining Rural Property situated meticulously in serene locales distant from densely populated sanctuary cities. Remember…HISTORY Favors the PREPARED!

The Editors’ Quote of the Day:

“I am the true vine, and my Father is the husbandman.

Every branch in me that beareth not fruit he taketh away: and every branch that beareth fruit, he purgeth it, that it may bring forth more fruit.

Now ye are clean through the word which I have spoken unto you.

Abide in me, and I in you. As the branch cannot bear fruit of itself, except it abide in the vine; no more can ye, except ye abide in me.

I am the vine, ye are the branches: He that abideth in me, and I in him, the same bringeth forth much fruit: for without me ye can do nothing.

If a man abide not in me, he is cast forth as a branch, and is withered; and men gather them, and cast them into the fire, and they are burned.

If ye abide in me, and my words abide in you, ye shall ask what ye will, and it shall be done unto you.

Herein is my Father glorified, that ye bear much fruit; so shall ye be my disciples.

As the Father hath loved me, so have I loved you: continue ye in my love.

If ye keep my commandments, ye shall abide in my love; even as I have kept my Father’s commandments, and abide in his love.

These things have I spoken unto you, that my joy might remain in you, and that your joy might be full.

This is my commandment, That ye love one another, as I have loved you.

Greater love hath no man than this, that a man lay down his life for his friends.

Ye are my friends, if ye do whatsoever I command you.

Henceforth I call you not servants; for the servant knoweth not what his lord doeth: but I have called you friends; for all things that I have heard of my Father I have made known unto you.

Ye have not chosen me, but I have chosen you, and ordained you, that ye should go and bring forth fruit, and that your fruit should remain: that whatsoever ye shall ask of the Father in my name, he may give it you.

These things I command you, that ye love one another.

If the world hate you, ye know that it hated me before it hated you.” – John 15:1-18 (KJV)

- Ad Click Here --> Civil Defense ManualNOW BACK IN STOCK How to protect, you, your family, friends and neighborhood in coming times of civil unrest… and much more!

- Ad USA Berkey Water Filters - Start Drinking Purified Water Today!#1 Trusted Gravity Water Purification System! Start Drinking Purified Water now with a Berkey water filtration system. Find systems, replacement filters, parts and more here.

Preparedness Notes for Saturday — November 11, 2023

At 5:00 a.m. on this day in 1918, the Allied powers and Germany signed an armistice document in the railway carriage of Ferdinand Foch, the commander of the Allied armies, and six hours later World War I came to an end. Ever since then, November 11th has been celebrated as Armistice Day — later called Veteran’s Day.

—

This is also the birthday of General George S. Patton, Jr.. (Born 1885, died December 21, 1945).

—

On November 11, 1880, Australian outlaw Ned Kelly, who was the most famous of the bushrangers (bandits of the Australian outback), was hanged in Melbourne.

—

And, today is the birthday of Hugh Everett (born 1930, died July 19, 1982), the American physicist who first proposed the many-worlds interpretation (MWI) of quantum physics, which he termed his “relative state” formulation.

—

SurvivalBlog Writing Contest

Today we present another entry for Round 109 of the SurvivalBlog non-fiction writing contest. The prizes for this round include:

First Prize:

- The photovoltaic power specialists at Quantum Harvest LLC are providing a store-wide 10% off coupon. Depending on the model chosen, this could be worth more than $2000.

- A Gunsite Academy Three Day Course Certificate. This can be used for any of their one, two, or three-day course (a $1,095 value),

- Two cases of Mountain House freeze-dried assorted entrees in #10 cans, courtesy of Ready Made Resources (a $350 value),

- A $250 gift certificate good for any product from Sunflower Ammo,

- American Gunsmithing Institute (AGI) is providing a $300 certificate good towards any of their DVD training courses.

- Two sets of The Civil Defense Manual, (in two volumes) — a $193 value — kindly donated by the author, Jack Lawson.

Second Prize:

- A SIRT STIC AR-15/M4 Laser Training Package, courtesy of Next Level Training, that has a combined retail value of $679

- Two 1,000-foot spools of full mil-spec U.S.-made 750 paracord (in-stock colors only) from www.TOUGHGRID.com (a $240 value).

- Two Super Survival Pack seed collections, a $150 value, courtesy of Seed for Security, LLC.

- Montana Survival Seed is providing a $225 gift code for any items on its website, including organic non-GMO seeds, fossils, 1812-1964 US silver, jewelry, botany books, and Montana beeswax.

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun. There is no paperwork required for delivery of pre-1899 guns into most states, making them the last bastion of firearms purchasing privacy!

Third Prize:

- A $300 gift certificate from Good2Goco.com, good for any of their products: Home freeze dryers, pressure canners, Country Living grain mills, Emergency Essentials foods, and much more.

- Three sets each of made-in-USA regular and wide-mouth reusable canning lids. (This is a total of 300 lids and 600 gaskets.) This prize is courtesy of Harvest Guard (a $270 value)

- A Royal Berkey water filter, courtesy of Directive 21 (a $275 value),

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun.

—

More than $850,000 worth of prizes have been awarded since we started running this contest. We recently polled blog readers, asking for suggested article topics. Refer to that poll if you haven’t yet chosen an article topic. Round 109 ends on November 30th, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging.

- Ad Ready Made Resources, Trijicon Hunter Mk2$2000 off MSRP, Brand New in the case

- Add Your Link Here

Homesteading – A Cautionary Tale – Part 2, by SaraSue

(Continued from Part 1.)

The urgent drives out the merely important on a homestead

Maintenance is of critical importance. If you do not maintain the fencing, for example, you may find yourself chasing animals down a country road. That seems to happen often around these here parts. Someone’s horses or cows are always out. Dogs abound. I have a neighbor who brings their pregnant cows to the adjacent acreage to calve. I only had to track my neighbors down once to let them know a cow was out. The cow was peacefully grazing in the graveyard nearby! They have since repaired the fencing. Thankfully, there are no nearby bulls that want to bother my dairy girls. I’ve only had to chase pigs once down the road and that was because a gate was left open by some hired help. I had to have a couple of new fences put in and a couple of new gates. In a Spring storm, a large tree fell down next to my bigger barn and thankfully not on top of that barn. I would’ve cried a river if the barn roof had caved in. I still need to get a tree trimmer out here to clear out that area. Those trees provide wonderful shade but some are old and should be cut down. I have a long, gravel, driveway. After a few storms with torrential rains, my driveway pretty much washed out and now it’s filled with ruts. A couple of storms last Spring ripped up the ground cover in my garden, twice. Thankfully, no tornadoes touched down here, but did in a nearby town and the damage was horrible. No matter where you live, weather is a big deal and it will determine your workload and budget.Continue reading“Homesteading – A Cautionary Tale – Part 2, by SaraSue”

Editors’ Prepping Progress

To be prepared for a crisis, every Prepper must establish goals and make both long-term and short-term plans. In this column, the SurvivalBlog editors review their week’s prep activities and planned prep activities for the coming week. These range from healthcare and gear purchases to gardening, ranch improvements, bug-out bag fine-tuning, and food storage. This is something akin to our Retreat Owner Profiles, but written incrementally and in detail, throughout the year. We always welcome you to share your own successes and wisdom in your e-mailed letters. We post many of those –or excerpts thereof — in the Odds ‘n Sods Column or in the Snippets column. Let’s keep busy and be ready!

Jim Reports:

We’ve had some rainy weather, with nighttime temperatures in the high 30s. But it definitely feels like winter is coming on. I used my air compressor to blow out some hoses and waterlines, to be ready for winter. To do so, I use a simple brass fitting that is readily available on eBay. (You can get by with just one, and then to match male or female brass fittings attach either a coupling or a nipple.) They also sell these at most farm and ranch stores. These are also made with Schrader (tire) valve stems. If you live in a cold climate, then I consider these a “must-have.”

I made a trip to a consulting client’s ranch. I also got the last of this summer’s firewood stacked and covered.

With the recent rains, I’ve also kept myself busy organizing my workshop. Because I’m still in the process of remodeling and partitioning it, there is a lot of lumber stacked inside. For convenience, I had been stacking all of the 4′ x 8′ sheets of plywood (of various thicknesses), pegboard, and foam insulation board in separate piles. That was fine during summer construction, but since each pile takes up 32 square feet of floor space, they had to be consolidated into just three piles. This freed up space to get vehicles inside, for winter. I also got our garden hoses, canoes, and kayaks up off the shop floor, and stowed them up in one of the storage lofts. Together, those tasks turned out to be a multi-hour chore. And doing so revealed lots of sawdust and insulation scraps. So I had some broom and Shop-Vac work to do, the next day. But it feels good to have the shop ready to move in vehicles or to receive cargo.

Now, for Lily’s report…Continue reading“Editors’ Prepping Progress”

The Editors’ Quote of the Day:

“The stranger that is within thee shall get up above thee very high; and thou shalt come down very low.

He shall lend to thee, and thou shalt not lend to him: he shall be the head, and thou shalt be the tail.

Moreover all these curses shall come upon thee, and shall pursue thee, and overtake thee, till thou be destroyed; because thou hearkenedst not unto the voice of the Lord thy God, to keep his commandments and his statutes which he commanded thee.” – Deuteronomy 28:43-45 (KJV)

Preparedness Notes for Friday — November 10, 2023

On this day in 1871, according to his journal, explorer Henry Stanley greeted David Livingstone, the fellow explorer in search of the source of the Nile River, with the famous words “Dr. Livingstone, I presume?”

—

November 10th is remembered in the United States as the “birthday” of the U.S. Marine Corps.

—

November 10th is also the birthday of the late Mikhail Timofeyevich Kalashnikov, born in 1919, died December 23, 2013. He didn’t design a lot of different guns, but one of his few designs was the prototype for what turned out to be the world’s most widely produced assault rifles.

—

November 10th is the anniversary of the sinking of the Great Lakes ore ship Edmund Fitzgerald, in 1975.

—

SurvivalBlog Writing Contest

Today we present another entry for Round 109 of the SurvivalBlog non-fiction writing contest. The prizes for this round include:

First Prize:

- The photovoltaic power specialists at Quantum Harvest LLC are providing a store-wide 10% off coupon. Depending on the model chosen, this could be worth more than $2000.

- A Gunsite Academy Three Day Course Certificate. This can be used for any of their one, two, or three-day course (a $1,095 value),

- Two cases of Mountain House freeze-dried assorted entrees in #10 cans, courtesy of Ready Made Resources (a $350 value),

- A $250 gift certificate good for any product from Sunflower Ammo,

- American Gunsmithing Institute (AGI) is providing a $300 certificate good towards any of their DVD training courses.

- Two sets of The Civil Defense Manual, (in two volumes) — a $193 value — kindly donated by the author, Jack Lawson.

Second Prize:

- A SIRT STIC AR-15/M4 Laser Training Package, courtesy of Next Level Training, that has a combined retail value of $679

- Two 1,000-foot spools of full mil-spec U.S.-made 750 paracord (in-stock colors only) from www.TOUGHGRID.com (a $240 value).

- Two Super Survival Pack seed collections, a $150 value, courtesy of Seed for Security, LLC.

- Montana Survival Seed is providing a $225 gift code for any items on its website, including organic non-GMO seeds, fossils, 1812-1964 US silver, jewelry, botany books, and Montana beeswax.

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun. There is no paperwork required for delivery of pre-1899 guns into most states, making them the last bastion of firearms purchasing privacy!

Third Prize:

- A $300 gift certificate from Good2Goco.com, good for any of their products: Home freeze dryers, pressure canners, Country Living grain mills, Emergency Essentials foods, and much more.

- Three sets each of made-in-USA regular and wide-mouth reusable canning lids. (This is a total of 300 lids and 600 gaskets.) This prize is courtesy of Harvest Guard (a $270 value)

- A Royal Berkey water filter, courtesy of Directive 21 (a $275 value),

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun.

—

More than $850,000 worth of prizes have been awarded since we started running this contest. We recently polled blog readers, asking for suggested article topics. Refer to that poll if you haven’t yet chosen an article topic. Round 109 ends on November 30th, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging.

Homesteading – A Cautionary Tale – Part 1, by SaraSue

Living The Dream

First off, why do I homestead? My passion is to provide a safe haven for my large family away from the world’s chaos. A place where food can be grown, the air is clean and fresh, no noise or people pollution, no homeless encampments, and precious little crime. A safe, productive, hideaway. Realizing that nowhere is completely safe, we know that some places are better than others. Just look around. If you live in the country, you might have a million-dollar view from the porch of a humble home. I do. I can scarcely take it in. It’s restful to the eyes and soul. I take no credit whatsoever for this place. I stumbled upon it for a variety of reasons and feel that it was a gift from the Lord. After possibly decades of reading Survivalblog, I had a mental checklist for a retreat property and this one fit the bill. I had no intentions of “homesteading” other than a deep desire to become as “self-sufficient” as possible. I didn’t even know what I was going to do with this property other than raise some chickens. That’s how it started.

A lot of people are trying to “homestead” now, and for various admirable reasons. Some are looking to get out of the rat race and live a simpler life. Some see that bad things are happening and feel a need to grow their own food and be self-sufficient. Others started out with chickens on a small plot, and as is said, “Chickens are the gateway drug to homesteading.” They end up getting more animals – some have tried goats, turkeys, quail, cows, pigs, rabbits, sheep, etc. In many cases, they think they can quit their job, grow their own food, and have little if any expenses. I’m here to tell you that unless you have a good source of income, it’s not possible. Sorry to mess with your Cheerios this morning, but homesteading costs money. I’ve spent more money “homesteading” than I ever spent as a professional working woman living in the suburbs. I’m here to share my experiences, be they good or bad.Continue reading“Homesteading – A Cautionary Tale – Part 1, by SaraSue”

Economics & Investing For Preppers

Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. This column emphasizes JWR’s “tangibles heavy” investing strategy and contrarian perspective. Today, another look at “Shrinkflation”. (See the Inflation/Deflation Watch: section.)

Precious Metals:

Metals on the Move: Silver breakout signals next run to $50.

o o o

Economy & Finance:

SurvivalBlog reader K.B. sent this: Why Banks Are Suddenly Closing Down Customer Accounts. JWR’s Comment: As someone who has been de-banked, I can attest that some of these account closures are politically motivated.

o o o

Tim Pool: The US Is Printing $100k EVERY THREE SECONDS, The US Debt Crisis Is OUT OF CONTROL.

o o o

Switzerland Considers Limiting Bank Withdrawals After $185 Billion Bailout, While the Fed Moves Toward ‘Friction Tech’ – Implications for Future Bailouts. (A hat tip to D.S.V. for the link.)

o o o

WeWork, once valued at $47 billion, files for bankruptcy. JWR’s Comment: And just like that, they went from WeWork, to WeWoke, to WeBroke.

o o o

Bringing home the bacon: Biden unveils $16.4 billion rail grants at Amtrak in ‘blue-state’ Northeast Corridor.

o o o

Martin Armstrong: The Coming Great Crash?

The Editors’ Quote of the Day:

“Rulers have no authority from God to do mischief.” – Jonathan Mayhew

Preparedness Notes for Thursday — November 9, 2023

On November 9th, 1799, the Coup of 18–19 Brumaire began in Paris, marking Napoleon‘s rise to power and the end of the French Revolution.

—

After several weeks of civil unrest, the East German government announced on November 9, 1989 that all GDR citizens could visit West Germany and West Berlin. Crowds of East Germans crossed and climbed onto the Wall, joined by West Germans on the other side in a celebratory atmosphere.

—

Harvest Guard Reusable Canning Lids has announced a 40% discount on all orders over $75, through the end of 2023. This discount is only being offered to SurvivalBlog readers, using the code “survivalblog” during checkout.

—

SurvivalBlog Writing Contest

Today we present another entry for Round 109 of the SurvivalBlog non-fiction writing contest. The prizes for this round include:

First Prize:

- The photovoltaic power specialists at Quantum Harvest LLC are providing a store-wide 10% off coupon. Depending on the model chosen, this could be worth more than $2000.

- A Gunsite Academy Three Day Course Certificate. This can be used for any of their one, two, or three-day course (a $1,095 value),

- Two cases of Mountain House freeze-dried assorted entrees in #10 cans, courtesy of Ready Made Resources (a $350 value),

- A $250 gift certificate good for any product from Sunflower Ammo,

- American Gunsmithing Institute (AGI) is providing a $300 certificate good towards any of their DVD training courses.

- Two sets of The Civil Defense Manual, (in two volumes) — a $193 value — kindly donated by the author, Jack Lawson.

Second Prize:

- A SIRT STIC AR-15/M4 Laser Training Package, courtesy of Next Level Training, that has a combined retail value of $679

- Two 1,000-foot spools of full mil-spec U.S.-made 750 paracord (in-stock colors only) from www.TOUGHGRID.com (a $240 value).

- Two Super Survival Pack seed collections, a $150 value, courtesy of Seed for Security, LLC.

- Montana Survival Seed is providing a $225 gift code for any items on its website, including organic non-GMO seeds, fossils, 1812-1964 US silver, jewelry, botany books, and Montana beeswax.

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun. There is no paperwork required for delivery of pre-1899 guns into most states, making them the last bastion of firearms purchasing privacy!

Third Prize:

- A $300 gift certificate from Good2Goco.com, good for any of their products: Home freeze dryers, pressure canners, Country Living grain mills, Emergency Essentials foods, and much more.

- Three sets each of made-in-USA regular and wide-mouth reusable canning lids. (This is a total of 300 lids and 600 gaskets.) This prize is courtesy of Harvest Guard (a $270 value)

- A Royal Berkey water filter, courtesy of Directive 21 (a $275 value),

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun.

—

More than $850,000 worth of prizes have been awarded since we started running this contest. We recently polled blog readers, asking for suggested article topics. Refer to that poll if you haven’t yet chosen an article topic. Round 109 ends on November 30th, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging.

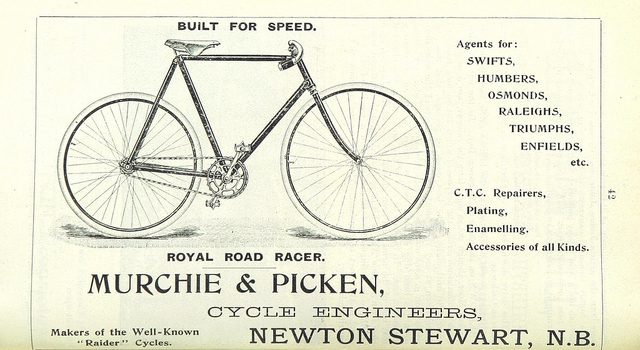

Mobility Without Petroleum or Electricity, by C.H.

Introduction

This article will focus on the bicycle as a transportation solution in a situation where the electrical grid has failed, and petroleum products are either completely unavailable or in extremely limited supply. Given those parameters, I will not be discussing E-Bikes. I also have no experience with them. I bought a hybrid bicycle in early 2005 due to a fuel spike that was killing my budget. With further deployments and changes in employment the bicycle was set aside and gather dust in the garage. My semi-serious foray into cycling only begins a couple years ago when I pulled the old hybrid out of storage. After an overhaul at the local cycling shop, I spent a summer and autumn on it learning the limitations of a hybrid while cycling over the gravel roads and trails in the region. From the beginning of this, I began to think of the bicycles’ utility in an extended grid-down scenario. It is only now, that I’ve started to put some thoughts on paper.Continue reading“Mobility Without Petroleum or Electricity, by C.H.”