HJL,

I was going to leave a short comment but this deserves wider exposure.

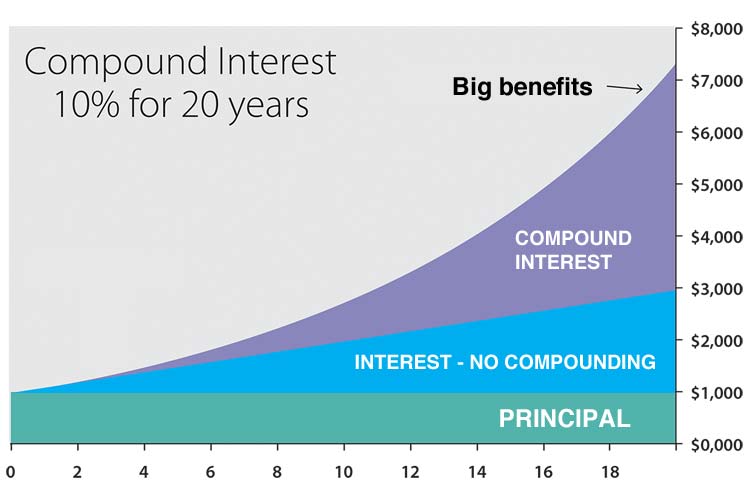

Amen to all that about debt in the Zero Hedge article. Compound interest is not your friend if you are paying it. I bought into leverage for asset acquisition. Robert Kawasaki (intentionally incorrect) has a special place in my heart or is that some place much lower… It is a serious mistake not to take the income sheltered by depreciation and put it toward loan principal reduction. When you hit 50 and want to be out of debt the cold reality hits that profit and income must be earned and taxed to reduce principal. Practically speaking, you have to earn 140% of the principal in order to pay it off because you have run out of depreciation and you are in your prime earning years and therefore in a higher tax bracket.

The creepy part is to be personal guarantee element. Even if you have just one asset still financed you are vulnerable when SHTF. After every economic disaster there is a wave of lawyers and opportunists that buy up delinquent financial instruments for pennies, add legal fees to the tune of 300% of the original debt and then go to court to get judgments in Federal court. Understand that the retainer for a defense lawyer in Federal court is $10,000. At that point they just take assets that are paid off.

I have watched my secretary’s car get hauled off from the parking lot at my office. Her husband closed down an excavation company and returned the equipment to the lender in top notch shape in the recession of the early 2000s. The lender sold the note after selling the equipment at recession prices. $50,000 in debt became a $300,000 judgment. Just look at the mass migration during the 1930’s of farmers during the great depression. Same deal. Foreclosure of what was leveraged and confiscation of what was not. Same story in the Western Reserve during the banking crises created by Jackson’s war on the Bank of the United States. They use the law to steal your stuff. – RV

After a recent trip to Folsom New Mexico and a review of some interesting documents in their Museum, I discovered that during the twenties the local Merchant bought up vast amounts of Ranch Land for about $0.80 an acre for back taxes. I haven’t researched this thoroughly but it’s my guess that most people lost their land to back taxes during the Depression. That may still be the greatest risk.

Best prep you can make is to become 100% debt free. The freedom you will experience then is unbelievable, especially if you have spent years clamoring over bills. We got completely out of debt almost a decade ago now. The first year after that we were able to prep more in that year than we had in the previous five years.

Don’t allow any “use OPM” arguments to sway you, the borrower truly is servant to the lender as Soloman pointed out. There may be a time when you know you have to relocate, but if your tied up with debt, you won’t be able to and therefore could risk your family’s safety and survival.

The flipside of this coin is that as survivalists and supposedly conservatives we all have to get out of this socialist mindset of complaining about and blaming others for the debt WE took on. This “it ain’t my fault!” attitude is Bravo Sierra and is ruining America.

I’m on the other side of this coin regularly with one of my businesses collecting money and it’s NEVER that people can’t pay, it’s that people simply WON’T pay. If you took on a high interest rate loan for a car, or a high interest rate loan for an overpriced house, well who do you have to blame for that? Certainly the lender did not put a gun to your head to make you sign. Blame the man in the mirror. We all make mistakes, it took us several years to slowly dig out of about $25K of our mistakes- but we did.

We have to break this socialist talk in the prepper community. We should be better than that. Pay your debts, it builds character. I would definitely rather team up with someone who worked their butt off and repaid everything they owned then someone who walked away and left creditors hanging- he will do the same when you need him. BT and experienced that.

To prove that this socialist mindset is pervasive in the “prepper” community, just watch the comments after this and see how many complain about the post. 🙂

Debt is an age old issue. In some of my reading I was surprised to find out how much of the Southern plantation system ran on massive debt and how much of even the early frontier ran on debt. All with the associated problems.

An interesting thing I found out about years ago doing investment research. When Bill Gates was still CEO of Microsoft they would run zero long term debt, only enough short term debt to function and maintain cash reserves in the 10’s of billions. This was part of their business model that allowed them to buy new technology when it appeared. It was said that Bill Gates ran his personal finances similarly with virtually all of his assets in Microsoft stock that he would sell off at the maximum legal and practical rate that would not harm the price and convert to conservative government bonds, essentially cash.

I am one of the very few who have no debt. When I say No debt I mean debt incurred by me. Not peripheral debt such as property taxes/bonds/levies, utilities, Insurance. you know, the debt that cant be avoided. There is debt that is heaped on people, even when a person diligently avoids it.If you are reading this comment, you have an internet debt. There is no way around staying out of debt.

It’s really just a game, and the players can always prop up their argument by insisting that their side is the more righteous of the two. Not unlike attempting to pick up the clean end of the turd. The collector/ lender goes self righteous by claiming nobody forced you into debt… The borrower cant be a productive member of society without playing along and joining the madness, you gotta live somewhere, and it usually comes with rules like mandated garbage service,water, sewer,taxes if you own, rent payments if you dont etc, etc.. and the leaders of our country keep trying to convince us that the game is beneficial to both sides. ( Anyone else remember Bush telling everyone to go spend money after 9/11 ?)

There are laws on the books that force you into being a borrower. Driving your paid for car requires you to go into debt. You now owe an insurance debt, a gas tax debt, a license debt, a registration debt..and dont forget the “Privilege” debt. Every few yrs you are required to pay tribute to the state in the form of a drivers license, for the privilege of moving around..Of coarse the lender, being the state in this case, will tell you that nobody is forcing you to renew.

The problem with our debt ridden society today is that there is a general lack of respect for the players of the game. It’s morphed into a game that emphasizes payments and what you can afford every month, instead of the bottom line that needs to be paid off. People now lease their smart phones because they have no money to make the purchase. So much so that you will have a hard time actually BUYING a smart phone out right from your carrier, because the carriers have tapped leasing as another avenue of forever payments..lenders now pad their contracts with ” Insurance”, Just in case you cant make your payments.

I understand that this is a bit out of context, when people talk about debt they normally talk about credit cards and cars and all the other debts that they have incurred, But before you start convincing yourselves that the problem will go away when you finally make that last American Express payment.. dont hold your breath.. It never ends, and no matter how far back you think you can dial back your life.. debt in one form or another will always be waiting for you in your mailbox. Other than living on the street, You are in the game, and the only way out is death. Don’t listen to the people blather on about what coulda, shoulda, woulda been done. People who quit smoking are the loudest, most obnoxious people when it comes to the topic of quitting. same goes for drinkers..same goes for people who * think* they are out of debt.

In terms of debt, All anyone can hope for is to carve a life out of society, that minimizes your obligations to other people, so you can then focus on self preservation.. so you can be there for your family.

1) I would note that you are NEVER out of debt.

2) The IRS always has a 15-28% lien on the yearly income you need to have in order to eat/pay for medical care.

Plus the local teachers union will take out several thousand more in property taxes on the house you supposedly own free and clear.

And then there is always the yearly inflation tax imposed by the Fed/Washington. With a far higher tax imposed on “collectibles” if you try to keep your wealth stored in real money.

My husband and I decided in the 90’s to jump in the rental “business”. He was retired police, so he had a pension and I was working fulltime. We spent a few years working and building up to 14 rental units. I quit work and we lived from 2001 to 2007 on his retirement and the rental income. Our main reason for doing this is that we wanted to home educate our children.

Everyone says the housing collapse was in 2008, but for us it started in 2006. Everyone that could bought a house. As we know now alot of people had no busineess doing this, and it made for few good tenants. We could not find decent tenants for about 4 years. Thankfully we are both frugal people and had saved a good amount of money back, so we were able to float along until things turned around. Both of us went back to work. We managed to still home educate. God made sure the lights stayed on and all the bills were paid. It was a hard lesson to learn. In 2006, we started selling off the properties, trying to get out of debt. We prayed for a way to be debt free again. Tomorrow we are closing on the sale of 4 duplexes. We have had them for sale for 11 years. We had offers, but none that were serious enough for us to accept. Tomorrow if all things go through, we will have enough money to pay the taxes, pay off the loan, tithe, and pay off the two remaining rental properties. God’s timing is perfect. If we had sold them a few years ago when prices were down, we would have walked away with nothing. God waited to send us a buyer now. I’ve been telling everyone that tomorrow is day one. I can’t even express the relief I already feel knowing that we will be debt free going into the next crisis we all know must come. I am so thankful. I am so bless. I am so humbled by God’s timing.

It might be good to keep in mind the statute of limitations on debt varies between states. Creditors and debt buyers cannot sue to to collect debts older than the statute of limitations.

https://www.thebalance.com/state-by-state-list-of-statute-of-limitations-on-debt-960881

“Momma’s” experience is really close to home. I am in the throws of selling off what is least productive and simplifying life. It is the tax side that is wearing me out. I see that I should have paid an amount equal to depreciation on the loan each year.

I dawdled in 2007 selling by holding out for the last buck and had to hold another 10 years for the current “re-bound” or “re-inflation”. Sometimes the bulls make money and sometimes the bears make money. Pigs, however, always get slaughtered.

It is important not to be a pig.

RV, I agree about the taxes. We couldn’t believe how harsh a tax master Uncle Sam is. Our sale went through on Monday. Since closing, I’ve been one breathe away from tears because of the overwhelming thankfulness I feel. I will be praying that your plans go smoothly and you get the simpler life you seek.

Pigs get fat,hogs get butchered