Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, I’m taking an unusual traverse from the normally-posted fodder to instead post a reminder about my tangibles investing philosophy, and how it drives me to write this column three days a week:

A Reiteration of My Tangibles Investing Philosophy

My readers and consulting clients often ask me why I so strongly emphasize tangibles. This because I consider tangibles a mitigation for risks to the U.S. Dollar as a currency unit. Like all other fiat currencies, the Dollar is doomed. It has lost 98% of it purchasing power since the establishment of the Federal Reserve in 1913. The government benefits from price inflation because it is a hidden, indirect form of taxation.

Of course other countries are playing the same game with fiat Funny Money. The Forex market is a fanciful game of “My trash is better than your trash.” The ups and downs in the Forex are just extrapolations of the monetary policies of the various nations. Those that inflate without a corresponding growth in their economy and exports see the foreign exchange value of their currencies decline. All of the fiat currencies are on downhill slopes. The only difference is the relative pitch of the slopes, for each. Thus, the myth of “strong” versus “weak ” currencies has developed. There are NO truly strong fiat currencies. The fiats are all weak, albeit some of them are weaker than others. The only genuine strength is in precious metals and other barterable tangibles.

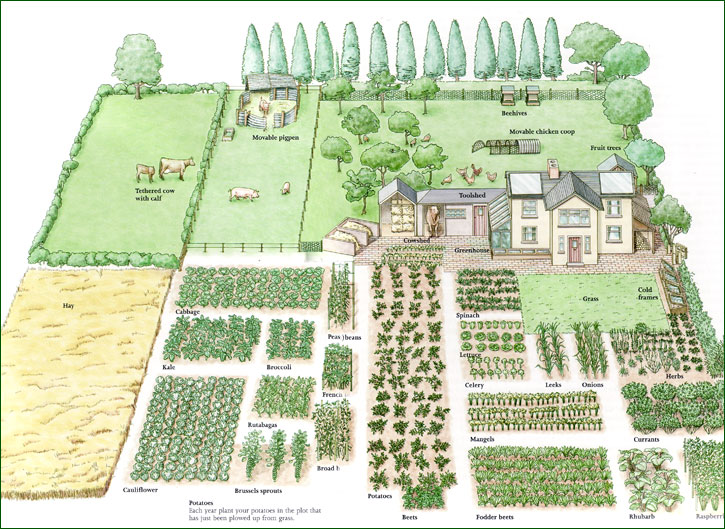

The gradual erosion of the Dollar can be offset by properly storing carefully-selected tangibles. Just look through the archives of the past few years of this column, for details on various tangible investments. In the age of inflation, it is wise to have more than half of your net worth in tangibles. The house you live in should of course be your main tangible investment. Beyond that, there is wisdom in diversity: Productive farm land, silver, gold, platinum, hand tools, guns, ammunition, fine wristwatches, and even classic cars are all viable options. What they have in common is that they are denominated in themselves–not in some artifice of a currency digit. Those digits will all inevitably decline in real terms, and some will dramatically go “poof.” But the well-guarded contents of my gun and coin vaults will never go “poof.”

The Federal Reserve banking cartel and the U.S. Treasury have conspired to have a very loose monetary policy, ever since the dot.com bubble burst, back in 2000. So we’ve thusfar had 19 years of charades, artificially low interest rates, and Quantitative Easing prestidigitation. I believe that the inflationary chickens will soon come home to roost.

In mass inflation, your best shelter will be in tangibles. The formula for success as a tangibles investor in essence: Buy low, sell high, and then replace them with other tangibles that are depressed at the time, but that are likely to see similar gains. Lather, rinse, repeat. Yes, there are lots of other investments, and many of these can outpace inflation. But you core holdings should always be tangible ones.

Tangibles are the raison d’être for penning this column, week in and week out. Granted, other investments interest me, but none of them run so close to the core of my psyche. To me, all of those paper-based investments, and the new purely conceptual investments (such as cryptocureencies) seem downright laughable in comparison to tangibles. If I cannot lay my hands on it, then it cannot be depended upon–especially when the Schumer hits the fan.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often get the scoop on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!