“To doubt everything or to believe everything are two equally convenient solutions; both dispense with the necessity of reflection.” – Henri Poincaré

- Ad Click Here --> Civil Defense ManualNOW BACK IN STOCK How to protect, you, your family, friends and neighborhood in coming times of civil unrest… and much more!

- Ad SIEGE belts: Our famous "Thousand-Year Buckles" are hand-crafted in USA from a solid metal block with 5.5 to 7 oz of incredible persuasive power. Built for comfort. Go anywhere-even salt water. A must-have for EDC & travel. The perfect gift!SIEGE STOVES: prepare for the great outdoors with the ultimate portable survival stove. SIEGE BELTS have saved many: NEW: Use code "SBLOG" at checkout for $20 off any belt!

Preparedness Notes for Monday — April 28, 2025

On April 28, 1937, the first trans-Pacific flight by a commercial passenger airliner was completed when Pan American Airways’ Martin M-130, China Clipper, arrived at Hong Kong. The flight had departed San Francisco Bay, California, on the 21st of April with seven revenue passengers and then proceeded across the Pacific Ocean by way of Hawaii, Midway Island, Wake Island, Guam, Manila, Macau, and finally Hong Kong.

—

April 28, 1965: US Marines invaded the Dominican Republic. They stayed until October 1966.

—

Today’s feature is by SurvivalBlog staff writer Tom Christianson.

—

We need more entries for Round 118 of the SurvivalBlog non-fiction writing contest. More than $950,000 worth of prizes have been awarded since we started running this contest. Round 118 ends on May 31st, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging. In 2023, we polled blog readers, asking for suggested article topics. Please refer to that poll if you haven’t yet chosen an article topic.

- Ad Civil Defense ManualClick Here --> The Civil Defense Manual... The A to Z of survival. Looks what's in it... https://civildefensemanual.com/whats-in-the-civil-defense-manual/

- Ad LifeSaver 20K JerryCan Water PurifierThe best water jerrycan you can buy on the market! Mention Survivalblog for a Free Filter ($130 Value)

American Hat Company Range Hat, by Thomas Christianson

A range hat is designed to allow over-the-head, earmuff-style hearing-protection to be worn comfortably over the hat. It accomplishes this by forgoing two features that are common to most baseball caps. Those features are a fabric-covered button (squatchee) on the crown of the hat and the hatmaker’s buckram reinforcement of the front two panels of the hat. Without the squatchee and the buckram, a ranger hat is better able to conform to the shape of the wearer’s head under the muffs.

The American Hat Company version of the range hat is made of lightweight, ripstop cotton with a comfortable sweatband and a velcro adjuster in the back. It is just as comfortable for everyday wear as it is for range wear. As an added bonus, the hat is made in the USA.Continue reading“American Hat Company Range Hat, by Thomas Christianson”

- Ad Trekker Water Station 1Gal Per MinuteCall us if you have Questions 800-627-3809

- Ad USA Berkey Water Filters - Start Drinking Purified Water Today!#1 Trusted Gravity Water Purification System! Start Drinking Purified Water now with a Berkey water filtration system. Find systems, replacement filters, parts and more here.

Recipe of the Week: Super Easy Trail Mix

The following recipe for a fairly healthy Super Easy Trail Mix is from SurvivalBlog reader T.W.. She recommends: “I suggest you buy most of the ingredients in bulk, to cut down on the cost of the mix.”

Ingredients

- 1 c. of your preferred low-salt nut(s), mixed (I like almonds and pecans)

- 1 to 1-/12 c. of chocolate chips, M&Ms, or Reese’s Pieces candy (can be omitted if you are on a diet)

- 1 c. of Animal Crackers (or other small crackers) and/or small pretzels. (I like cheese-flavored ones)

- 1 c. of your preferred dry breakfast cereal or low-moisture granola/museli.

- 1 c. of dried fruit(s) or raisins (Be sure that it’s a low-moisture fruit, or it will make your trail mix a sticky mess!)

Directions

Just pour all of the ingredients into a large mixing bowl and stir them well with a large mixing spoon or spatula.

STORAGE & Trail Servings

Store the mix in an airtight container, like Tupeprware.

Dispense into small, very sturdy ziploc bags, for the trail. Pack all of those small bags inside a larger (gallon-size) ziploc bag, in case one of the small ones bursts.

—

Do you have a well-tested recipe that would be of interest to SurvivalBlog readers? In this weekly recipe column, we place emphasis on recipes that use long-term storage foods, recipes for wild game, dutch oven recipes, slow cooker recipes, and any recipes that use home garden produce. If you have any favorite recipes, then please send them via e-mail. Thanks!

- Ad Ready Made Resources, Trijicon Hunter Mk2$2000 off MSRP, Brand New in the case

- Ad California Legal Rifles & Pistols!WBT makes all popular rifles compliant for your restrictive state. Choose from a wide range of top brands made compliant for your state.

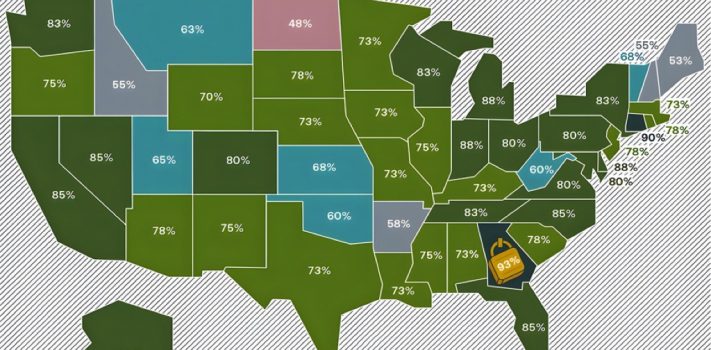

SurvivalBlog Graphic of the Week

Today’s graphic: Percentage Of Americans Who Always Lock Their Doors. (Graphic courtesy of Reddit.)

The thumbnail below is click-expandable.

—

Please send your graphics or graphics links to JWR. (Either via e-mail or via our Contact form.) Any graphics that you send must either be your own creation or uncopyrighted.

- Ad USA Berkey Water Filters - Start Drinking Purified Water Today!#1 Trusted Gravity Water Purification System! Start Drinking Purified Water now with a Berkey water filtration system. Find systems, replacement filters, parts and more here.

- Ad Survival RealtyFind your secure and sustainable home. The leading marketplace for rural, remote, and off-grid properties worldwide. Affordable ads. No commissions are charged!

The Editors’ Quote of the Day:

- Ad STRATEGIC RELOCATION REALTYFOR SALE: Self-sustaining Rural Property situated meticulously in serene locales distant from densely populated sanctuary cities. Remember…HISTORY Favors the PREPARED!

- Add Your Link Here

Preparedness Notes for Sunday — April 27, 2025

The Battle of Carbisdale was fought on April 27, 1650: The Royalist army under Marquess of Montrose invaded mainland Scotland from Orkney Island. They were defeated by a Covenanter army.

—

On April 27, 1773, the British Parliament passed the Tea Act.

—

And on April 27, 1805, US Marines attacked the shores of Tripoli.

—

Today’s feature article was too short for inclusion in the judging in the SurvivalBlog non-fiction writing contest. More than $950,000 worth of prizes have been awarded since we started running this contest. Round 118 ends on May 31st, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging. In 2023, we polled blog readers, asking for suggested article topics. Please refer to that poll if you haven’t yet chosen an article topic.

A Covid Experience: Three Years Later, by Tom In Alaska

It was October 31, 2021. I was living in Arizona with a full season of cool weather hiking on the calendar. The first (and last) walk of the season was delightful. The temperatures were on the warm side and a steady breeze was kicking up the omnipresent Arizona dust.

Waking on November 1st with a 102 F fever was an omen. The next day I immediately drove to the local Urgent Care and was diagnosed with Covid. My thought was, okay, I’ll be sick for a while but the vitamins, zinc, healthy diet, and penchant for walking would allow for an easy recovery. Wrong!

I remember leaving the Urgent Care facility, entering my vehicle, and then nothing more than that until several days after being removed from a ventilator.

Continue reading“A Covid Experience: Three Years Later, by Tom In Alaska “

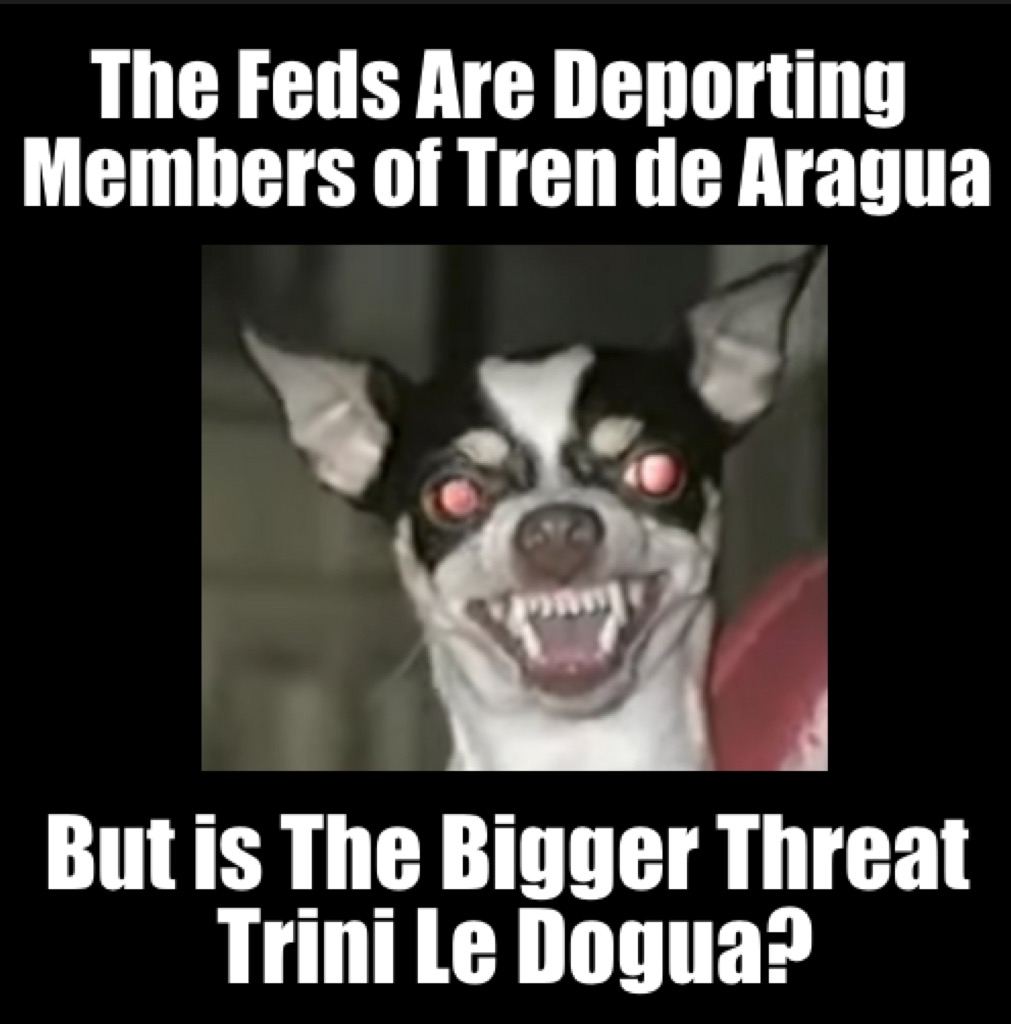

JWR’s Meme Of The Week:

The latest meme created by JWR:

Meme Text:

The Feds Are Deporting Members of Tren de Aragua

But is The Bigger Threat Trini Le Dogua?

Relevant Links:

- Exclusive: DOJ memo offers blueprint to Tren de Aragua deportation plan.

- Drummond defends Trump’s efforts to deport violent Tren De Aragua gang.

- More than 40 people possibly linked with Venezuelan gang taken into custody in Hays County.

- Wikipedia: Tren de Aragua

Notes From JWR: Do you have a meme idea? Just e-mail me the concept, and I’ll try to assemble it. And if it is posted then I’ll give you credit. Thanks!

Permission to repost memes that I’ve created is granted, provided that credit to SurvivalBlog.com is included.

The Editors’ Quote of the Day:

“And when he had called unto him his twelve disciples, he gave them power against unclean spirits, to cast them out, and to heal all manner of sickness and all manner of disease.

Now the names of the twelve apostles are these; The first, Simon, who is called Peter, and Andrew his brother; James the son of Zebedee, and John his brother;

Philip, and Bartholomew; Thomas, and Matthew the publican; James the son of Alphaeus, and Lebbaeus, whose surname was Thaddaeus;

Simon the Canaanite, and Judas Iscariot, who also betrayed him.

These twelve Jesus sent forth, and commanded them, saying, Go not into the way of the Gentiles, and into any city of the Samaritans enter ye not:

But go rather to the lost sheep of the house of Israel.

And as ye go, preach, saying, The kingdom of heaven is at hand.

Heal the sick, cleanse the lepers, raise the dead, cast out devils: freely ye have received, freely give.

Provide neither gold, nor silver, nor brass in your purses,

Nor scrip for your journey, neither two coats, neither shoes, nor yet staves: for the workman is worthy of his meat.

And into whatsoever city or town ye shall enter, enquire who in it is worthy; and there abide till ye go thence.

And when ye come into an house, salute it.

And if the house be worthy, let your peace come upon it: but if it be not worthy, let your peace return to you.

And whosoever shall not receive you, nor hear your words, when ye depart out of that house or city, shake off the dust of your feet.

Verily I say unto you, It shall be more tolerable for the land of Sodom and Gomorrha in the day of judgment, than for that city.

Behold, I send you forth as sheep in the midst of wolves: be ye therefore wise as serpents, and harmless as doves.

But beware of men: for they will deliver you up to the councils, and they will scourge you in their synagogues;

And ye shall be brought before governors and kings for my sake, for a testimony against them and the Gentiles.

But when they deliver you up, take no thought how or what ye shall speak: for it shall be given you in that same hour what ye shall speak.

For it is not ye that speak, but the Spirit of your Father which speaketh in you.

And the brother shall deliver up the brother to death, and the father the child: and the children shall rise up against their parents, and cause them to be put to death.

And ye shall be hated of all men for my name’s sake: but he that endureth to the end shall be saved.” – Matthew 10:1-22 (KJV)

Preparedness Notes for Saturday — April 26, 2025

On April 26, 1949, Transjordan was officially renamed the Hashemite Kingdom of Jordan.

—

On April 26, 1991, 23 people were killed in Kansas and Oklahoma by tornadoes.

—

SurvivalBlog Writing Contest

Today we present another entry for Round 118 of the SurvivalBlog non-fiction writing contest. The prizes for this round include:

First Prize:

- The photovoltaic power specialists at Quantum Harvest LLC are providing a store-wide 10% off coupon. Depending on the model chosen, this could be worth more than $2000.

- A Gunsite Academy Three Day Course Certificate. This can be used for any of their one, two, or three-day course (a $1,095 value),

- A Peak Refuel “Wasatch Pack” variety of 60 servings of premium freeze-dried breakfasts and dinners in individual meal pouches — a whopping 21,970 calories, all made and packaged in the USA — courtesy of Ready Made Resources (a $350 value),

- American Gunsmithing Institute (AGI) is providing a $300 certificate good towards any of their DVD training courses. Their course catalog now includes their latest Survival Gunsmithing course.

- HSM Ammunition in Montana is providing a $250 gift certificate. The certificate can be used for any of their products.

Second Prize:

- A SIRT STIC AR-15/M4 Laser Training Package, courtesy of Next Level Training, that has a combined retail value of $679

- Two 1,000-foot spools of full mil-spec U.S.-made 750 paracord (in-stock colors only) from TOUGHGRID.com (a $287 value).

- Two sets of The Civil Defense Manual, (in two volumes) — a $193 value — kindly donated by the author, Jack Lawson.

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun. There is no paperwork required for delivery of pre-1899 guns into most states, making them the last bastion of gun purchasing privacy!

Third Prize:

- A Berkey Light water filter, courtesy of USA Berkey Filters (a $305 value),

- 3Vgear.com is providing an ultimate bug-out bag bundle that includes their 3-day Paratus Bag, a Posse EDC Sling Pack, and a Velox II Tactical Backpack. This prize package has a $289 retail value.

- A $200 credit from Military Surplus LLC that can be applied to purchase and/or shipping costs for any of their in-stock merchandise, including full mil-spec ammo cans, Rothco clothing and field gear, backpacks, optics, compact solar panels, first aid kits, and more.

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun.

—

More than $950,000 worth of prizes have been awarded since we started running this contest. Round 118 ends on May 31st, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging. In 2023, we polled blog readers, asking for suggested article topics. Please refer to that poll if you haven’t yet chosen an article topic.

Europe’s Anti-American Shift, by Brandon Smith

Nationalism is villainous and globalists are the heroes? It’s a propaganda message that has been building since the end of World War II and the creation of globalist institutions like the UN, the IMF, World Bank, etc. By the 1970s there was a concerted and dangerous agenda to acclimate the western world to interdependency; not just dependency on imports and exports, but dependency of currency trading, treasury purchases and interbank wealth transfer systems like SWIFT.

This was the era when corporations began outsourcing western manufacturing to third world countries. This is when the dollar was fully decoupled from gold. When the IMF introduced the SDR basket system. When the decade-long stagflationary crisis began.Continue reading“Europe’s Anti-American Shift, by Brandon Smith”

Editors’ Prepping Progress

To be prepared for a crisis, every Prepper must establish goals and make both long-term and short-term plans. In this column, the SurvivalBlog editors review their week’s prep activities and planned prep activities for the coming week. These range from healthcare and gear purchases to gardening, ranch improvements, bug-out bag fine-tuning, and food storage. This is something akin to our Retreat Owner Profiles, but written incrementally and in detail, throughout the year. We always welcome you to share your own successes and wisdom in your e-mailed letters. We post many of those — or excerpts thereof — in the Odds ‘n Sods Column or in the Snippets column. Let’s keep busy and be ready!

Jim Reports:

I had a very busy week of firewood cutting. I cut and hauled nearly two cords. More than half of it is in 6-foot-long sections so it still needs to be gang cut. I stacked all of those logs with the butt ends all neatly aligned. It looks a bit OCD to do so, but that works for me.

I had phone and Zoom meetings with my literary agent and one of my publishers.

On Thursday, we hired some tractor time, with our neighbor. He helped me fill in a low spot with rock and then gravel, He also moved several tons of 1- to 3-year-old composted manure. The neighbor is a retired gentleman, and a godly Christian. And he loves running his tractor. We are happy to pay him for his time and his diesel fuel. If I were to accomplish the same that he did in 4 hours with the tractor, it would have taken me weeks with a shovel and wheelbarrow.

Since we’ve started tapping birch water from our trees and boiling down birch syrup, I did some research. I found a useful summary at Healthline. It included this:

“One 10.2-ounce (300-ml) bottle [of birch water] contains:

- Calories: 9

- Carbs: 3 grams

- Sugar: 3 grams

- Calcium: 2% of the Daily Value (DV)

- Magnesium: 95% of the DV

- Manganese: 130% of the DV

- Zinc: 3% of the DV

Studies also reveal varying amounts of phosphorus, potassium, folic acid, vitamin C, and copper. Additionally, birch water provides small amounts of amino acids and large amounts of polyphenol antioxidants, which help fight oxidative stress in your body.”

Now, Lily’s part of the report…

The Editors’ Quote of the Day:

“Again the word of the Lord of hosts came to me, saying,

Thus saith the Lord of hosts; I was jealous for Zion with great jealousy, and I was jealous for her with great fury.

Thus saith the Lord; I am returned unto Zion, and will dwell in the midst of Jerusalem: and Jerusalem shall be called a city of truth; and the mountain of the Lord of hosts the holy mountain.

Thus saith the Lord of hosts; There shall yet old men and old women dwell in the streets of Jerusalem, and every man with his staff in his hand for very age.

And the streets of the city shall be full of boys and girls playing in the streets thereof.

Thus saith the Lord of hosts; If it be marvellous in the eyes of the remnant of this people in these days, should it also be marvellous in mine eyes? saith the Lord of hosts.

Thus saith the Lord of hosts; Behold, I will save my people from the east country, and from the west country;

And I will bring them, and they shall dwell in the midst of Jerusalem: and they shall be my people, and I will be their God, in truth and in righteousness.

Thus saith the Lord of hosts; Let your hands be strong, ye that hear in these days these words by the mouth of the prophets, which were in the day that the foundation of the house of the Lord of hosts was laid, that the temple might be built.” – Zechariah 8:1-9 (KJV)

Preparedness Notes for Friday — April 25, 2025

On April 25, 1719, novelist Daniel Defoe published “Robinson Crusoe”. It is regarded as the first English novel.

—

Today is the birthday of physicist, inventor, and entrepreneur Guglielmo Marconi (1874–1937). He was known for his pioneering work on long-distance radio transmission as well as for the development of Marconi’s law and a radio telegraph system. He is often considered the inventor of radio.

—

SurvivalBlog Writing Contest

Today we present another entry for Round 118 of the SurvivalBlog non-fiction writing contest. The prizes for this round include:

First Prize:

- The photovoltaic power specialists at Quantum Harvest LLC are providing a store-wide 10% off coupon. Depending on the model chosen, this could be worth more than $2000.

- A Gunsite Academy Three Day Course Certificate. This can be used for any of their one, two, or three-day course (a $1,095 value),

- A Peak Refuel “Wasatch Pack” variety of 60 servings of premium freeze-dried breakfasts and dinners in individual meal pouches — a whopping 21,970 calories, all made and packaged in the USA — courtesy of Ready Made Resources (a $350 value),

- American Gunsmithing Institute (AGI) is providing a $300 certificate good towards any of their DVD training courses. Their course catalog now includes their latest Survival Gunsmithing course.

- HSM Ammunition in Montana is providing a $250 gift certificate. The certificate can be used for any of their products.

Second Prize:

- A SIRT STIC AR-15/M4 Laser Training Package, courtesy of Next Level Training, that has a combined retail value of $679

- Two 1,000-foot spools of full mil-spec U.S.-made 750 paracord (in-stock colors only) from TOUGHGRID.com (a $287 value).

- Two sets of The Civil Defense Manual, (in two volumes) — a $193 value — kindly donated by the author, Jack Lawson.

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun. There is no paperwork required for delivery of pre-1899 guns into most states, making them the last bastion of gun purchasing privacy!

Third Prize:

- A Berkey Light water filter, courtesy of USA Berkey Filters (a $305 value),

- 3Vgear.com is providing an ultimate bug-out bag bundle that includes their 3-day Paratus Bag, a Posse EDC Sling Pack, and a Velox II Tactical Backpack. This prize package has a $289 retail value.

- A $200 credit from Military Surplus LLC that can be applied to purchase and/or shipping costs for any of their in-stock merchandise, including full mil-spec ammo cans, Rothco clothing and field gear, backpacks, optics, compact solar panels, first aid kits, and more.

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun.

—

More than $950,000 worth of prizes have been awarded since we started running this contest. Round 118 ends on May 31st, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging. In 2023, we polled blog readers, asking for suggested article topics. Please refer to that poll if you haven’t yet chosen an article topic.