Here are the latest items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on future collector cars–that is, current production models that are likely to become collectible. (See the Tangibles Investing section.)

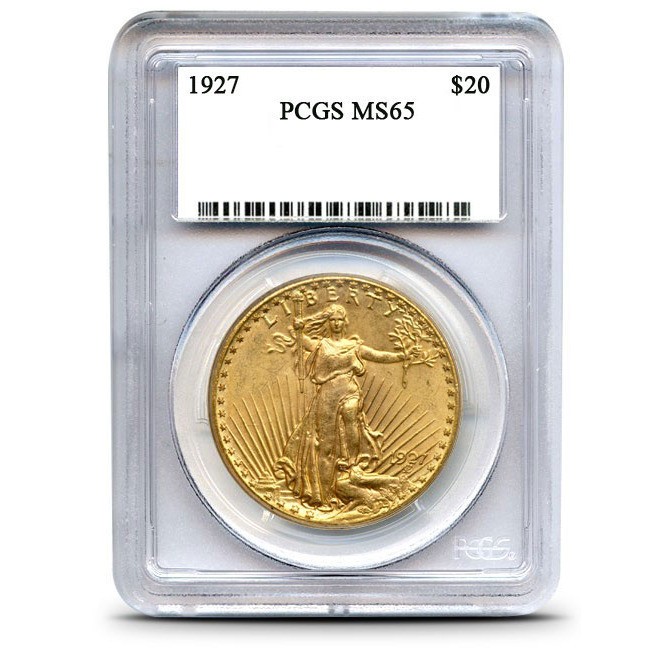

Precious Metals:

Video: Gold Speculators Are Least Bullish In Years

o o o

Over at Kitco: First Digital Gold, Now Silver To Be Added To Blockchain Platform

Stocks:

The New York Stock Exchange (NYSE) just set a record for the longest bull market in its history. Just short of 10 years with no reversals of more than 20%. The MSNBC Cheering Section will tell you “it is a great time to buy”, but pleas e be objective, folks. There are now a lot of stocks that are overbought. P/E ratios haven’t been this out of whack since just before the 2008 debacle. And similar P/E ratios were seen just before the 2000 crash. So this is probably a good time to do some profit taking and diversify your holdings.

o o o

Speaking of P/E ratios, let’s discuss a company that doesn’t have one. It has never turned a profit. When I last checked, Tesla Motors (TSLA)–which trades on the NASDAQ–was down again, to $321.23 per share. It is hard to believe that Wallet Investor’s long range forecast presently shows the stock at $589.53 in five years. I’m not much on stock predictions, but my gut is telling me that it will be priced under $50 a share, by then. I can foresee that much more lean small companies will steal most of their market share. And a lot of Tesla’s high valuation and hype was built on government subsidies. Time will tell…