Here are the latest items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on Rare Coins. (See the Tangibles Investing section.)

Forex and Precious Metals:

Robert Shapiro: Dollar/Yuan And US Treasuries/Gold

o o o

“Tyler Durden” at Zero Hedge: Russia Buys Over 800,000 Ounces Of Gold In July After Dumping US Treasuries

o o o

Turkey lira crisis to trigger RECESSION: Germany may PROP UP Erdogan amid Europe concerns

Stocks:

Tesla gets hit again — shares fall 2% in volatile trading to below $300. JWR’s Comments: Investing should always be done dispassionately. Never buy stock in a company that has never turned a profit and that has poor prospects of ever being profitable! (Tesla isn’t turning a profit even with government subsidies, paid for by taxpayers!) Tesla shares are about as detached from reality as you will ever find in American investing history.

o o o

Next, at Zero Hedge: The Market’s Record Bull Run In Five Charts. JWR’s Comment: It is a amazing what artificially low interest rates can accomplish. And seeing what happens when interest rates inevitably rise will come as a shock, to many.

o o o

BofA’s “Emerging Market Crisis” Indicator Was Just Triggered

Economy & Finance:

Wolf Street: Average Age of Cars & Trucks by Household Income and Vehicle Type over Time

o o o

Neal Irwin, writing in The New York Times: What Will Cause the Next Recession? A Look at the 3 Most Likely Possibilities

Tangibles Investing (Rare Coins):

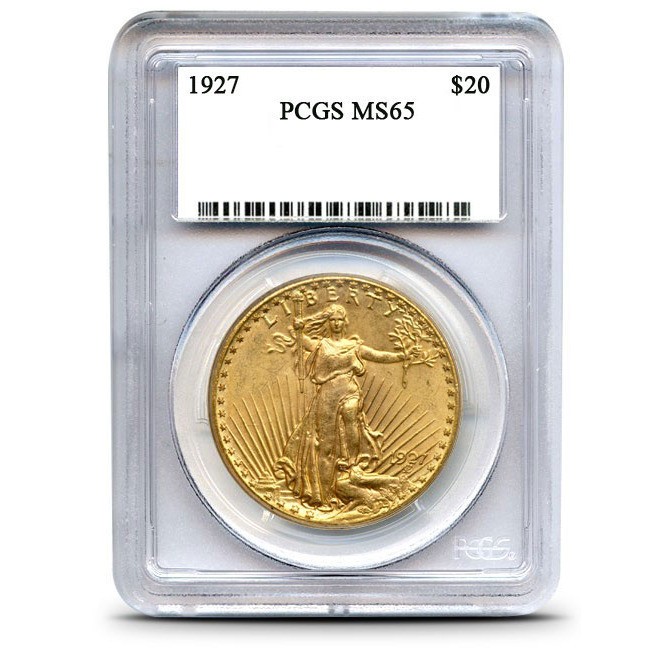

It is often said that the best time to buy rare coins is when the price of bullion coins is low. That is because the two markets mirror each other. When spot prices jump, rare coin prices jump too–usually even more dramatically. Since spot gold and silver are firmly in their summer doldrums, this could be a good opportunity to diversify into some low grade numismatic coins. Unless you are an expert on coin grading, I recommend that you buy only PCGS or NGC slabbed coins. These are coins that have been professionally graded and encapsulated. The grades to look for range from AU55 to MS62. Ask for “common dates.” Common date coins in the lower grades sell at fairly low premiums over their melt value. As a prepper, I always like to consider the “worst case” in a disaster situation. There, you might only get the equivalent of just melt value in a trade for a coin. So for most preppers it doesn’t make sense to buy high grade numismatic rare coins. (And by high grade, I’m referring to MS64 or higher, on the Sheldon scale.)

o o o

If you are a beginner, then I recommend this book: Coin Collecting – Newbie Guide To Coin Collecting: The ABC’s Of Collecting – Including Gold, Silver and Rare Coins: What Every Investor Must Know

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often get the scoop on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!

“Tesla shares are about as detached from reality as you will ever find in American investing history.”

Although I only own Tesla shares indirectly as part of a fund(s), and I’m actually way more interested in going to Mars than “green” cars that run on coal, I would hope that Musk’s focus would be entirely on Mars.

The other side of the argument is this; In the days of computer driven investment with AI, more accurately called Machine Learning, there is no data point that can’t be known about a company. This leaves us with only so called intangibles and CEOs and Management Teams are the biggest intangible. My point is that ‘everybody’ knows the readily available information about the company. The pros are investing in only one thing, Elon Musk.

Lot’s and lot’s of money has been made by investing solely in Bezos, or Ford, or zuckerface, or Jobs. But way more companies have failed. So investing in a man means hedging and diversifying which the pros are doing with Musk. It’s the same thing they do in the show Shark Tank. Make small bets on the people with the most potential.