Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at a new tangibles investing niche: used oxygen concentrators. (See the Tangibles Investing section.)

Precious Metals:

Gold price muted as Bank of Canada follows Fed with 50-basis-point cut

o o o

Steven Cochran (our Precious Metals Correspondent) sent this: Listen to how precious-metals sellers psychologically manipulate elderly conservatives

o o o

Charts for Gold, Silver and Platinum and Palladium, Mar. 4. JWR’s Comments: Note that spot silver has dropped below its 200-day moving average. So this is a good juncture to buy silver!

Economy, Finance & Equities:

NPR: Wall Street’s Brutal Week Slashed Nearly 3,600 Points From Dow

o o o

Gary Christenson: The Care and Feeding of Bubbles

o o o

At Zero Hedge:“It Smells Like Panic”: This Is Not What Powell Had In Mind…

o o o

Fed Repo Injections Hit Record Level: Global Contagion Negatively Impacting Financial Markets

o o o

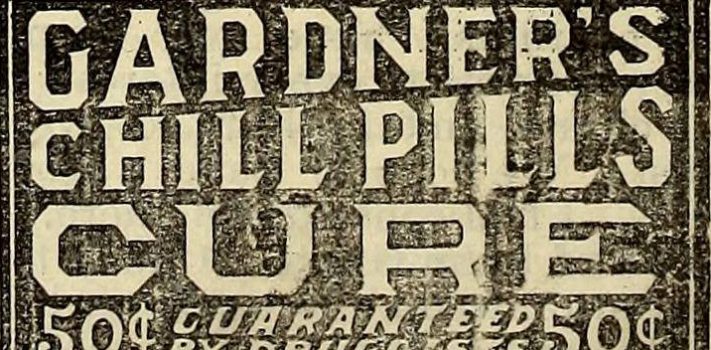

Stocks Sag as Fed Cures Coronavirus by Cutting Rates ½ Percentage Point. JWR’s Comment: When equities prices go down immediately after an interest rate cut, then it is clear that you’ve entered uncharted territory! Granted, there was a substantial (1,200+ point) bounce back on Wednesday, but then a 969 point drop on Thursday. This is that wild roller coaster ride that I warned you about, folks.

o o o

Also at Wolf Street: Yield Curve Gets Ugly, 10-Year Treasury Yield Falls Below 1% for First Time Ever, 30-Year at Record Low, on Rising Inflation

o o o

And over at Seeking Alpha: Markets tank following Fed’s emergency cut