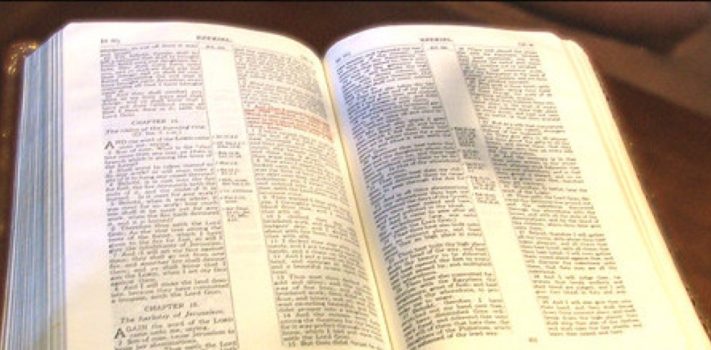

There are now just 20 days to the November U.S. presidential election. The next three weeks should be a time of concerted prayer — personally, and with your family and fellow church congregants.

Blog reader L.B. suggested this prayer list published by Turning Point Academy:

“Seek the Lord while he may be found; call upon him while he is near.” – Isaiah 55:6

Pray our nation will seek God in Repentance, Humility, and Prayer.

Consecrate a fast; call a solemn assembly. Gather the elders and all the inhabitants of the land to the house of the LORD your God, and cry out to the LORD. (Joel 1:14)

“Yet even now,” declares the LORD, “return to me with all your heart, with fasting, with weeping, and with mourning; and rend your hearts and not your garments.” Return to the LORD. (Joel 2:12-13a)Continue reading“Please Pray For Our Nation”