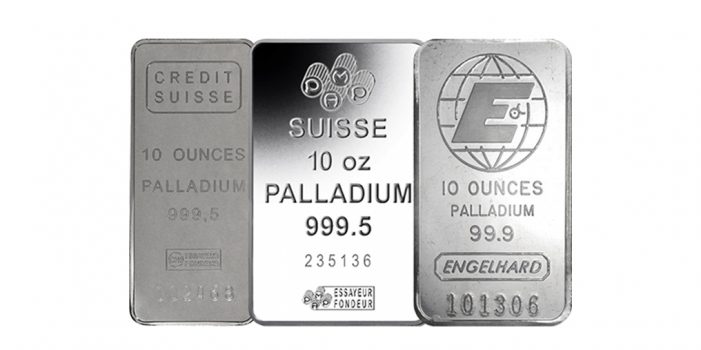

Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on Palladium (See the Precious Metals section.)

Precious Metals (Palladium):

The spot price of palladium is still looking strong. But if you see the global economy start to turn downward, it would probably be a good time to cash in and take your profit on palladium.

o o o

But all is not well for all of the platinum metals group. Platinum itself–which has a price more closely tied to general industrial production and passenger automobile sales– is just now crawling up out of the dumpster. But it is bound to bounce back, so I consider it presently bargain priced.

o o o

And then there is Ruthenium, which I recommended to my consulting clients, back in 2016 and 2107. The spot price of Ruthenium has more than doubled in the past year. I really doubt that it is headed to another 2007-style price spike, but time will tell. Ruthenium has always been very volatile and difficult to predict.

o o o

Lastly, I should mention Rhodium, which I recommended publicly in late February of 2016. It was then spot priced at just $670 per Troy ounce, and at around $850 in coin form. The Spot Rhodium price is now around $2,200, and the scarce Baird Rhodium coins now sell for as much as a $340 per ounce premium over spot! Just as with palladium, if you see the global economy start to turn downward, it would probably be a good time to take your profit on Rhodium.