Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on Palladium (See the Precious Metals section.)

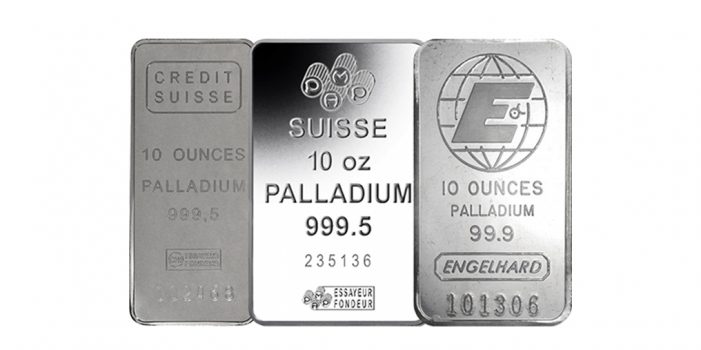

Precious Metals (Palladium):

The spot price of palladium is still looking strong. But if you see the global economy start to turn downward, it would probably be a good time to cash in and take your profit on palladium.

o o o

But all is not well for all of the platinum metals group. Platinum itself–which has a price more closely tied to general industrial production and passenger automobile sales– is just now crawling up out of the dumpster. But it is bound to bounce back, so I consider it presently bargain priced.

o o o

And then there is Ruthenium, which I recommended to my consulting clients, back in 2016 and 2107. The spot price of Ruthenium has more than doubled in the past year. I really doubt that it is headed to another 2007-style price spike, but time will tell. Ruthenium has always been very volatile and difficult to predict.

o o o

Lastly, I should mention Rhodium, which I recommended publicly in late February of 2016. It was then spot priced at just $670 per Troy ounce, and at around $850 in coin form. The Spot Rhodium price is now around $2,200, and the scarce Baird Rhodium coins now sell for as much as a $340 per ounce premium over spot! Just as with palladium, if you see the global economy start to turn downward, it would probably be a good time to take your profit on Rhodium.

Economy & Finance:

Where stocks and bonds are heading this coming week is anyone’s guess. I’m generally expecting more of a rollercoaster ride. Buckle up! Reduce most of your long positions, re-assess your stop-loss orders, and do a serious re-evaluation of your portfolio. Look at each and ask: Is this stock or ETF recession proof? If not, then dump them. Where to put those proceeds? Tangibles. And if you are at or near retirement age, then lean toward the more liquid tangibles. If you’ve been reading this column regularly, then I shouldn’t have to list them. As an aside: I’m not presently much of a believer in cryptocurrencies. They’ve dropped around 75% in the past year. And with more regulation surely coming in many countries, the cryptos look dubious, at best.

o o o

Here is a well-reasoned perspective: S&P 500 Weekly Update: The Stock Market At A Crossroads

o o o

Despite rising interest rates, national economic statistics are looking solid.

o o o

The number of people gainfully employed in the United States just reached an all-time high of 156,562,000. I don’t think we can thank Former President Obama for that, despite his recent bragging.

Forex & Cryptos:

Forex Market Outlook For The Week November 5 – 9, 2018. Here is a quote: “Last week was a turbulent period for the U.S. dollar amid the jobs report, stock price movement, and the heightened possibility of a trade deal between China and the U.S. becoming real.”

o o o

‘Ruff’ Month? Dogecoin’s Price Slid 36 Percent in October

o o o

Bitcoin Cash Continues to Skyrocket 15% to $535, Volume Quintuples

Tangibles Investing:

They’re calling it the depression in the price of Depression Glass. One thing that eBay has surely done is created a genuine global market for collectibles. One unintended consequence is that this broadening has made some formerly “scarce” items like Depression Era glassware all too common, and prices have therefore suffered. I’m a big believer in free market economics–where supply meets demand and a fair price is established. But it saddens me to see that some folks who invested in collectibles back in the early to mid-1990s had a rude awakening when the marketplace went global. Now the world truly knows what is “scarce” and what isn’t. We are living is the 21st Century. This is era of both American Pickers, and eBay. Except in remote areas, the information treasure trove of the Internet is at everyone’s fingertips, via laptops and smartphones. Be frugal and wise. Do lots of research before you buy.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often get the scoop on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!

I have know idea what is mined substantially or only in South Africa. I’m not a geopolitical trader or investor but an opportunity may be on the horizon in South Africa. I would think, that tangibles mined exclusively or substantially in South Africa might go up in value as commies start to commie down there driving supply shortages. It’s just a thought and maybe you’ve considered it in your rundown of several of the metals in this post. Geopolitical investing is hard and I ain’t no Soros that’s for sure.

I find it difficult to believe that palladium, ruthenium, or rhodium would be useful investments after TEOTWAWKI. Most of the population have never heard of them, but everyone understands the value of gold and silver.

In a major depression, sure. But not after a global catastrophe.

Investing in tangibles has always included buying and keeping what I like.

We have glass, guns, and wood items that have been in the family for generations. These kind of things used to be priceless.

A 19th century Sears Roebucks rocker purchased for 18.00 by great grandpa. Bowls and figurines brought back from Europe and Japan were treasured by grandma. A Remington 511 that my Wife’s stepdad used to reduce the squirrel population when he was a teen. These “things” bring a smile to my face and are not for sale or trade.

I believe that holding onto some if this history adds texture and substance to our present day lives.

Ebay and craigslist have made it easier for people to liquidate family heirlooms. The market being flooded with collectables may be another consequence of our family values being diluted.

My opinion, liquidating an estate to pay bills, settle debt is justified and painful. Selling off heirlooms years later to get the latest iPhone does not make sense to me.

I pick up silver when I see something I like, such as the 2018 Silver Krugerrand, and some gold here and there, but most of my investments are in guns and ammo. I’ve preached to many folks, now is the golden time to get what you want, and lots of it. We all remember what it was like after Sandy Hook; it took years to recover from that. You won’t regret it.

When Trump won, it felt like people eased on stockpiling ammunition and firearms. Price of ammo tended to not go up as it previously did under obama. I think people should not let down their guard as the left does not waiver their war against the Second Amendment. Now is not the time slow your investment in firearms and ammo but continue to stockpile for your family’s sake.

Tangibles Investing:

Ebay is not the reason depression glass or other collectibles have fallen in price. Better information and numerous reproductions did not help, but changing tastes did it. Ebay makes it easier to move marginal stuff as you have a larger audience.

Serious collectors are better informed and their tastes are not their grandparents. They are looking for real rarity, uniqueness and quality. The collectors are there and the money is there, but you have to have things they want!

When is the last time you seen a pile of depression glass? When is the last time you seen a metal toy robot or Halloween piece from the same time period? When is the last time you seen a wood plain from the 1890’s? When is the last time you seen a fancy cast iron level from the same time period?

Ebay is a wonderful guide to rarity! If there is more than one listed – it may not be all that rare.