Email a copy of 'Economics & Investing For Preppers' to a friend

6 Comments

- Ad California Legal Rifles & Pistols!Get the firepower necessary to survive in restrictive states! WBT offers California & other state compliant rifles from any brand you want.

- Ad Suburban Defense: non-fiction by author Don ShiftA cop's how-to guide to protecting your home and neighborhood during riots, civil war, or SHTF.

I have know idea what is mined substantially or only in South Africa. I’m not a geopolitical trader or investor but an opportunity may be on the horizon in South Africa. I would think, that tangibles mined exclusively or substantially in South Africa might go up in value as commies start to commie down there driving supply shortages. It’s just a thought and maybe you’ve considered it in your rundown of several of the metals in this post. Geopolitical investing is hard and I ain’t no Soros that’s for sure.

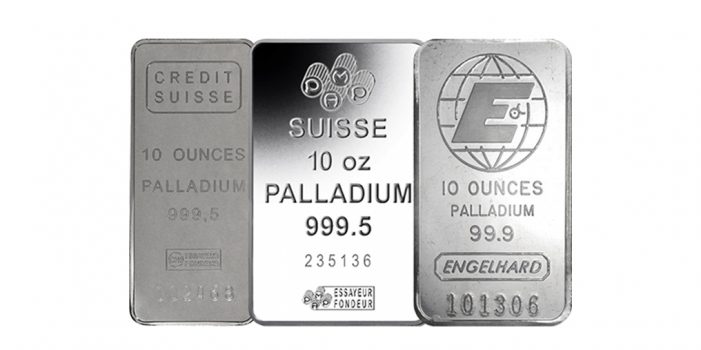

I find it difficult to believe that palladium, ruthenium, or rhodium would be useful investments after TEOTWAWKI. Most of the population have never heard of them, but everyone understands the value of gold and silver.

In a major depression, sure. But not after a global catastrophe.

Investing in tangibles has always included buying and keeping what I like.

We have glass, guns, and wood items that have been in the family for generations. These kind of things used to be priceless.

A 19th century Sears Roebucks rocker purchased for 18.00 by great grandpa. Bowls and figurines brought back from Europe and Japan were treasured by grandma. A Remington 511 that my Wife’s stepdad used to reduce the squirrel population when he was a teen. These “things” bring a smile to my face and are not for sale or trade.

I believe that holding onto some if this history adds texture and substance to our present day lives.

Ebay and craigslist have made it easier for people to liquidate family heirlooms. The market being flooded with collectables may be another consequence of our family values being diluted.

My opinion, liquidating an estate to pay bills, settle debt is justified and painful. Selling off heirlooms years later to get the latest iPhone does not make sense to me.

I pick up silver when I see something I like, such as the 2018 Silver Krugerrand, and some gold here and there, but most of my investments are in guns and ammo. I’ve preached to many folks, now is the golden time to get what you want, and lots of it. We all remember what it was like after Sandy Hook; it took years to recover from that. You won’t regret it.

When Trump won, it felt like people eased on stockpiling ammunition and firearms. Price of ammo tended to not go up as it previously did under obama. I think people should not let down their guard as the left does not waiver their war against the Second Amendment. Now is not the time slow your investment in firearms and ammo but continue to stockpile for your family’s sake.

Tangibles Investing:

Ebay is not the reason depression glass or other collectibles have fallen in price. Better information and numerous reproductions did not help, but changing tastes did it. Ebay makes it easier to move marginal stuff as you have a larger audience.

Serious collectors are better informed and their tastes are not their grandparents. They are looking for real rarity, uniqueness and quality. The collectors are there and the money is there, but you have to have things they want!

When is the last time you seen a pile of depression glass? When is the last time you seen a metal toy robot or Halloween piece from the same time period? When is the last time you seen a wood plain from the 1890’s? When is the last time you seen a fancy cast iron level from the same time period?

Ebay is a wonderful guide to rarity! If there is more than one listed – it may not be all that rare.