Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we focus on the predictions of economist Marc Faber.

Precious Metals:

Gary Christenson: Self-Destruction: Cheerleading The Process

o o o

Worldwide Major Central Banks are Accumulating Their Gold Holdings

Economy & Finance:

Jon C. was the first of several readers to send us this news: Shopko announces closure of all stores

o o o

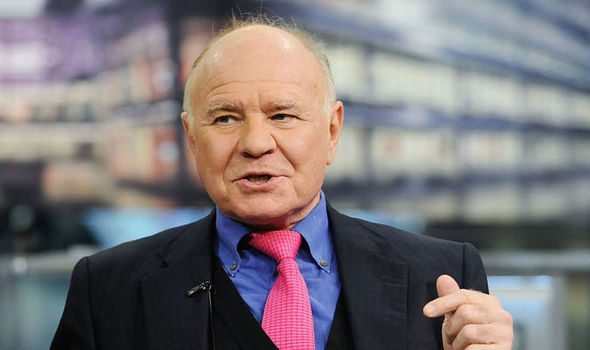

Marc Faber: Huge Asset Bubble Will be Deflated, Recession Started Last Year – Money Printing Coming. Here is a quote from the video interview:

“When I started to work in 1970 on Wall Street, the stock market capitalization of the U.S. as a percentage of GDP . . . was between 25% and 30%. Now, the stock market capitalization alone is 150% of GDP, and when you add the bonds to it, we are at 300%. It’s a huge asset bubble compared to the real economy. I think no matter what they do, this asset bubble will be deflated, and it will be very painful. The asset holders are the powerful ones here, and they don’t want it deflated. . . . The question is would it have been better economically to go into the hospital in 2008/2009 and clean up the system rather than to essentially inject the sick patient with more opioids to keep him alive? It’s going to get much worse the next time it happens.”

And, in describing the asset bubble re-inflation following the 2008 debacle, Faber said:

“You can print money for a long time, but it doesn’t end well.”

o o o