Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we focus on the predictions of economist Marc Faber.

Precious Metals:

Gary Christenson: Self-Destruction: Cheerleading The Process

o o o

Worldwide Major Central Banks are Accumulating Their Gold Holdings

Economy & Finance:

Jon C. was the first of several readers to send us this news: Shopko announces closure of all stores

o o o

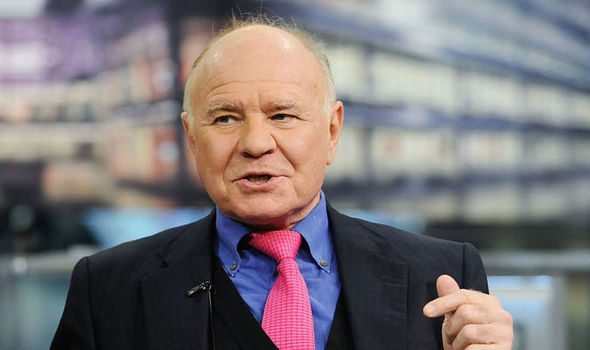

Marc Faber: Huge Asset Bubble Will be Deflated, Recession Started Last Year – Money Printing Coming. Here is a quote from the video interview:

“When I started to work in 1970 on Wall Street, the stock market capitalization of the U.S. as a percentage of GDP . . . was between 25% and 30%. Now, the stock market capitalization alone is 150% of GDP, and when you add the bonds to it, we are at 300%. It’s a huge asset bubble compared to the real economy. I think no matter what they do, this asset bubble will be deflated, and it will be very painful. The asset holders are the powerful ones here, and they don’t want it deflated. . . . The question is would it have been better economically to go into the hospital in 2008/2009 and clean up the system rather than to essentially inject the sick patient with more opioids to keep him alive? It’s going to get much worse the next time it happens.”

And, in describing the asset bubble re-inflation following the 2008 debacle, Faber said:

“You can print money for a long time, but it doesn’t end well.”

o o o

Views of “Current Economic Conditions” in Germany Drop to Euro Debt-Crisis Level. Here is a passage from the end of the article:

“The ZEW indicators are a reflection of what these insiders see happening currently, and what they expect, or hope, might happen over the next six months.

It is interesting to note that this situation is happening despite the ECB’s negative-interest-rate policy and years of scorched-earth QE, which have pushed down long-term interest rates and therefore the costs of borrowing to ludicrously low levels, even for risky corporate borrowers, with the average euro-denominated junk-bond yield currently at 3.5%.

With this sort of heavy-handed stimulus, along with stimulus in other parts of the world, the German economy should be swimming in nirvana. The fact that all this stimulus isn’t helping, and maybe hurting the real economy is of course something that would never occur to the ECB.”

Stocks:

Watching for a warning flare? Here it is, folks: Yield curve inverts for first time since 2007 on global growth worries

o o o

An Old Recession Boogeyman—the Inverted Yield Curve—Returns, and It’s Spooking Some Investors

Derivatives:

News from India: Physical settlement may squeeze short-sellers. (Until recently, India’s equity derivatives market settled all its trades in cash.)

o o o

More from India: Nifty March futures at premium.

Forex & Cryptos:

Bitcoin Struggles to Pass Key Price Resistance Over $4K

o o o

At CoinDesk: Bitcoin’s Share of Total Crypto Market Slips Back Toward 50%. A quote:

“Bitcoin’s dominance rate, or its share of the total cryptocurrency market, is on the verge of falling below 50 percent for the first time in over seven months.

At press time, the world’s largest cryptocurrency accounts for 50.9 percent of the total capitalization of the entire market and fell as low as 50.54 on March 17, according to data from CoinMarketCap.

Before 2017, bitcoin’s dominance rate was perpetually in excess of 70 percent, but it began to deflate as new cryptocurrencies were created and sold to investors in initial coin offerings (ICOs), causing bitcoin’s dominance rate to drop to a low of 32.48 percent on Jan. 13, 2018.”

o o o

At Wolf Street: That Didn’t Last Long: CBOE Bails on Bitcoin Futures Trading

Tangibles Investing:

A lot of my readers and consulting clients have been asking for suggestions on stocking up on ARs. Here are a couple of relevant pieces:

Over at Guns & Ammo: The SIG Sauer M400 Tread. The article begins:

“There has never been a better time to be in the market for an AR-15. The current political administration is friendly to gun owners, and there has never been a wider selection of well-priced rifles.

Among all those beautiful AR-15s exists a demographic of “economy” rifles selling for less than $1,000. Standing out in this crowd is no easy chore, but no AR that sells for less than $1,000 has anywhere near the performance or value of SIG Sauer’s new M400 Tread.”

o o o

Top Two 80 Lower Jigs of 2019. A snippet:

“With tax season upon us, it’s time. Yes, it is time to anger the spouses and start that 80% lower AR-15 project! We’re excited you could join us – but what 80% Lower Jig should you opt for? With so many available (and so many calibers to pick from), it can be tough deciding”

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often get the scoop on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!

If we have asset collapse like in 07/08, I assume silver and gold will go up similarly?

Yes, that is most likely. But the new debt bubble is even bigger than the last one. So the effects will be even more pronounced.

I completely agree with JWR. He says: So the effects will be even more pronounced.

Many people will be in a world of hurt.

Carry on.

A few things to consider- and I am not a financial expert, I am just an average Joe who pays attention to the news.

>In 2009, the M2 money supply was approximately $8.3 Billion. Today it is $14.5 Billion, diluting the currency by about 43%. https:fred.stlouisfed.org/series/M2

>Federal Debt to Gross Domestic Product ratio in 2009 77.3% 2019 105%

https://www.macrotrends.net/1381/debt-to-gdp-ratio-historical-chart

(conventional wisdom says anything over 90% is too much debt to EVER be repaid without default or a drastic devaluation/hyperinflation event.)

These numbers are not confined to the US. alone. China added approximately $1Trillion to it’s money supply IN JANUARY ALONE to stimulate its economy !

>The velocity of money in 2013 was about 5.4, bottomed out at about 2.5 in January 2017, and is now a little above 3 .

https://blog.commonwealth.com/independent-market-observer/the-velocity-of-money-2019-edition

>As noted by Mr.Rawles, the yield curve is again inverted, signalling a coming recession, as are the recent announcements of retail store closings and layoffs.

>Derivatives have not gone away. They are likely a ticking time bomb, as I understand them.

>Much of the repatriated money that U.S. corporations brought back from overseas was used, despite Trump’s warnings, for stock buybacks. Now many of those companies are having trouble meeting their debt obligations on loans and their bonds that are coming due.

>A record 7 million Americans are 90 or more days behind on their auto loan payments, according to a study from the Federal Reserve Bank of New York. That number is a million higher than the total at the end of 2010, a time when unemployment rates hit 10% and “delinquency rates were at their worst” notes the Fed. http://fortune.com/2019/02/12/americans-late-on-car-payments/

>Recent floods in the midwest have destroyed crops, killed livestock, prevented farmers from planting their crops, and destroyed much of the grain that was being stored from last year’s crop. I know this first hand. Expect higher food prices.

GET OUT OF DEBT, STOCK UP ON SUPPLIES, AND GET RIGHT WITH GOD.