Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at the economic storm clouds on the horizon.

Precious Metals:

Gold Prices Struggle To Hold $1,300 As U.S. ISM Manufacturing Rises In March

o o o

And for those in the chartist camp: Gold Cycles Down Into Late-Spring, Up Into Summer

Economy & Finance:

Erik Conley, at Seeking Alpha: Why An Inverted Yield Curve Is Important

o o o

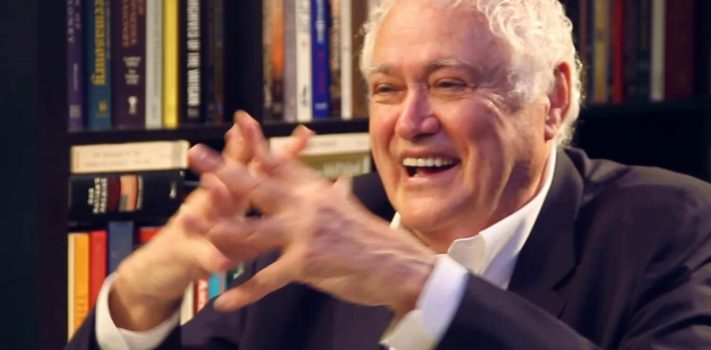

Martin W. Armstrong: The Financial Panic of 2019? Armstrong notes:

“There is a major liquidity crisis brewing that could pop in May 2019. European Banks have loaded their portfolios with real estate loans thanks to quantitative easing and negative interest rates, and emerging market debt. Spanish banks are especially invested in Turkish debt where they hoped to get the highest yields expecting that the IMF would never let Turkey default. On top of this, banks have been lending to each other to also avoid parking money at the European Central Bank where they would be charged with a negative interest rate.

Currencies from South Africa’s rand to Brazil’s real are witnessing a spike in their expected volatility, signaling concern they may weaken the most along with the Turkish lira going into May. The price swings have evoked sudden deep-rooted fears that there may be an emerging market crash before the end of the year.”

o o o