Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at the stock market rebound–most likely a bull trap rally. (See the Equities section.)

Precious Metals:

Gold bid/offer spreads blow out to $100 in loco London market. JWR’s Comment: Things are definitely askew when the “paper” gold market says that gold is trash while simultaneously the physical gold market says that gold is treasure.

o o o

Gold Price Tells Us Nothing About Gold

Economy & Finance:

I’ve concluded that America has been visited by its long-feared Black Swan. Tragically, the gub-mint’s chosen response was to start limitless and ceaseless bailouts in an attempt reinflate The Everything Bubble. But this will likely wreck our economy, shrink the Middle Class, and destroy the Dollar as a currency unit. – JWR

o o o

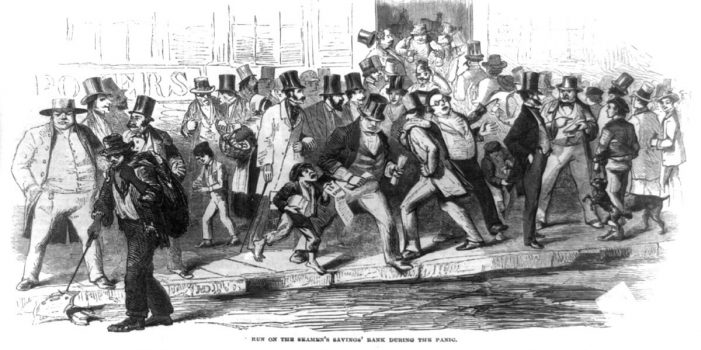

Reader ST85 spotted this troubling news at the Federal Reserve web site:

“As announced on March 15, 2020, the Board reduced reserve requirement ratios to zero percent effective March 26, 2020. This action eliminated reserve requirements for all depository institutions.”

ST85 warns: “I expect bank runs.”

o o o

CNBC: Negative rates come to the US: 1-month and 3-month Treasury bill yields are now below zero

o o o

The check is in the mail (“real soon”): Coronavirus stimulus checks will come within three weeks, Mnuchin says. JWR’s Comment: This is Robinhood-ism, plain and simple! Do you make more than $75,000? Well, then, “No check for you.” Uncle Sam will instead tap your wallet, and hand it to Mr. Democrat Voter. Worst of all, the Everything Bailout (with plenty of corporate welfare) will triple the Federal Budget Deficit for the year–an extra $2 Trillion for us taxpayers to gradually re-pay, plus interest!

At Wolf Street: Four Mortgage REITs Collapse After Chaos Hit Markets for Residential & Commercial Mortgage-Backed Securities

o o o

An interview with a market trader that covers a lot of ground at Real Vision Daily Briefing: Roger Hirst: There’s No Quick Fix For The Fed