Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at global inflation concerns.

Precious Metals:

It’s just zeros and ones at the end of the day’ – David Garofalo on why gold is better than bitcoin

o o o

Price pressure on gold and silver as bond yields on the rise

Economy & Finance:

Flexport: Trans-Pacific deteriorating, brace for shipping ‘tsunami’

o o o

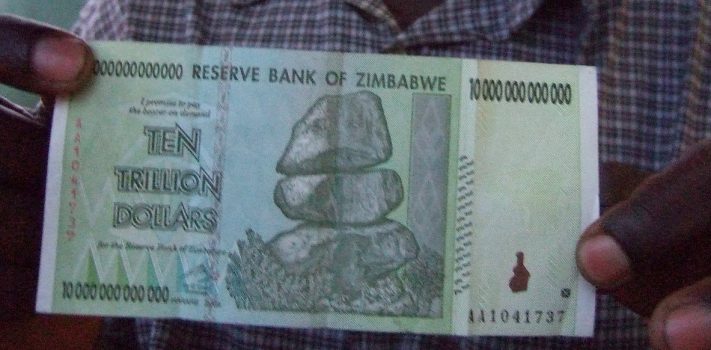

At Zero Hedge: Why Global Inflation Is About To Go Into Overdrive

o o o

Over at American Thinker: Jerome Powell and the Coming Inflation. This article begins:

“Usually, the Federal Reserve acts as a counterweight when Congress and U.S. presidents follow inflationary policies. We haven’t had an incompetent Federal Reserve chairman since Arthur Burns and G. William Miller produced simultaneous inflation and recession, an economic malady known as “stagflation.” Federal Reserve Chairman Jerome Powell may not be as bad as Burns and Miller, but he does seem to be making one economic mistake after another.

Like Miller, Powell is that rare exception: a Fed chair without a background in economics. Being an American today is a bit like riding on a bus driven by someone who lacks a CDL. It might work out okay, but some white knuckles on the curves are well justified.”

o o o

At Wolf Street: Forget 2% Inflation. With Margins Forcefully Squeezed, Big Companies Raise Prices, Point at Massive Inflation Overshoot

o o o