Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at global inflation concerns.

Precious Metals:

It’s just zeros and ones at the end of the day’ – David Garofalo on why gold is better than bitcoin

o o o

Price pressure on gold and silver as bond yields on the rise

Economy & Finance:

Flexport: Trans-Pacific deteriorating, brace for shipping ‘tsunami’

o o o

At Zero Hedge: Why Global Inflation Is About To Go Into Overdrive

o o o

Over at American Thinker: Jerome Powell and the Coming Inflation. This article begins:

“Usually, the Federal Reserve acts as a counterweight when Congress and U.S. presidents follow inflationary policies. We haven’t had an incompetent Federal Reserve chairman since Arthur Burns and G. William Miller produced simultaneous inflation and recession, an economic malady known as “stagflation.” Federal Reserve Chairman Jerome Powell may not be as bad as Burns and Miller, but he does seem to be making one economic mistake after another.

Like Miller, Powell is that rare exception: a Fed chair without a background in economics. Being an American today is a bit like riding on a bus driven by someone who lacks a CDL. It might work out okay, but some white knuckles on the curves are well justified.”

o o o

At Wolf Street: Forget 2% Inflation. With Margins Forcefully Squeezed, Big Companies Raise Prices, Point at Massive Inflation Overshoot

o o o

Euro Area Inflation March 2021

Commodities:

GM President Reuss says chip shortage is ‘worst’ auto supply issue ever as sale prices rise

o o o

H.L. spotted this: What’s Behind Skyrocketing Lumber Prices?

o o o

Metal Boom: Copper Hits 10-Year High Amid Supply Constraints And Infrastructure Plans

o o o

Oh, and speaking of copper, reader C.B. sent us this: A more efficient, safer alternative to sourcing copper via bacteria

Derivatives:

SEC to Examine Fund Disclosure Rules After Archegos Blowup

o o o

Wall Street’s losses on Archegos just topped $10 billion

o o o

How many funds are a margin call away from failing like Archegos?

Forex & Cryptos:

Is Hyperinflation Around The Corner?! (Dave Ramsey)

o o o

Ruble Trouble? Full Percentage Point Interest Rate Hike by Georgia’s Central Bank

o o o

US Dollar Price Action Set Up for FOMC: EUR/USD, AUD/USD Levels

o o o

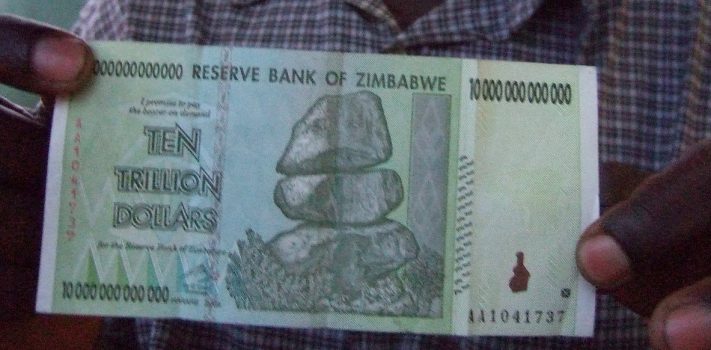

Zimbabwe April inflation lowest in nearly two years. JWR’s Comment: Wow! Now only 194.1% inflation.

o o o

Jameson Lopp: Custodial Bitcoin Interest Service Reviews

o o o

Turkey arrests four in new digital currency platform probe

Tangibles Investing:

Pat Cascio sent us this news: Fenix Ammo: 100,000 rounds of 9mm sold out in 2 minutes 34 seconds. Pat’s Comment: This is evidence that Great Ammo Drought will continue all through the Biden-Harris years.

o o o

Reader Tim J. sent this at Fox News: Used pickup prices are skyrocketing amid new vehicle shortage.

o o o

By way of Mcalvany.com’s Daily G2 e-newsletter: Even The ‘Cheapest’ Homes In America Are Rising At 4x The Fed’s Inflation Target

o o o

And lastly, Fred sent us this Zillow real estate listing that illustrates the absurd real estate bubble in the vicinity of San Jose, California. 580 Sunnymount Avenue, Sunnyvale, California, with an asking price of $1,799,000. The listing notes that this 1949-vintage house has been abandoned since 2013. Fred’s Comment: The termites are holding hands to keep it together. Realistically, this is just a .183 acre lot, with established utilities. So the buyer has to plan on another $20,000+ for full demolition of the house and debris hauling, just to get started. The scary thing about the current market is that they will probably get their $1.8 million asking price!

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. And it need not be only about commodities and precious metals. Thanks!