Since I’m traveling today en route to a memorial service and have scant time for column writing, with permission, I’m posting a guest article by Arkadiusz Sieroń that was originally posted by Sunshine Profits:

Will the Surge in Spending on Goods Include Gold?, by Arkadiusz Sieroń

Consumers’ expenses on goods soared amid the pandemic crisis. Will gold benefit from this spending spree?

“We need lower [consumer demand] growth to give the supply chain time to catch up, or differently spread out growth”, said Morten Engelstoft, chief executive of Maersk-owned APM Terminals, in September. Even though I’m fully aware of the supply-chain crisis, Engelstoft’s remarks struck me. Companies usually complain about soft consumers’ appetite, not about strong demand, and they don’t call for a reduction in expenditures!

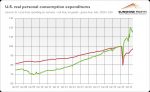

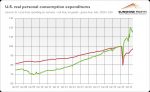

Something strange is happening here, indeed. So, I decided to dig into this issue a bit deeper, and I was even more struck by the data I found. Please take a look at the chart below, which shows the US real personal consumption expenditures on services (red line) and on goods (green line). As you can see in the chart below, people’s spending on goods has increased about 15% since February 2020.

Let’s repeat it, adding some context: we experienced the deepest recession since the Great Depression, but the personal expenditures on goods are not lower, but higher! And they are substantially higher, as 15% is a giant disturbance to the production system, which is very difficult to be accommodated in such a short time.

Why is it so important? Well, it’s a unique development. As the chart above shows, after the global financial crisis in 2007-2009, consumer spending on goods has returned to the pre-crisis level only in 2012. This difference is caused by two things. The first is enormous fiscal stimulus passed in response to the epidemic. As a result, the demand for goods, especially durables, surged, boosting inflation.Continue reading“Economics & Investing For Preppers”