Since I’m traveling today en route to a memorial service and have scant time for column writing, with permission, I’m posting a guest article by Arkadiusz Sieroń that was originally posted by Sunshine Profits:

Will the Surge in Spending on Goods Include Gold?, by Arkadiusz Sieroń

Consumers’ expenses on goods soared amid the pandemic crisis. Will gold benefit from this spending spree?

“We need lower [consumer demand] growth to give the supply chain time to catch up, or differently spread out growth”, said Morten Engelstoft, chief executive of Maersk-owned APM Terminals, in September. Even though I’m fully aware of the supply-chain crisis, Engelstoft’s remarks struck me. Companies usually complain about soft consumers’ appetite, not about strong demand, and they don’t call for a reduction in expenditures!

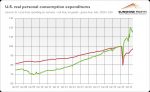

Something strange is happening here, indeed. So, I decided to dig into this issue a bit deeper, and I was even more struck by the data I found. Please take a look at the chart below, which shows the US real personal consumption expenditures on services (red line) and on goods (green line). As you can see in the chart below, people’s spending on goods has increased about 15% since February 2020.

Let’s repeat it, adding some context: we experienced the deepest recession since the Great Depression, but the personal expenditures on goods are not lower, but higher! And they are substantially higher, as 15% is a giant disturbance to the production system, which is very difficult to be accommodated in such a short time.

Why is it so important? Well, it’s a unique development. As the chart above shows, after the global financial crisis in 2007-2009, consumer spending on goods has returned to the pre-crisis level only in 2012. This difference is caused by two things. The first is enormous fiscal stimulus passed in response to the epidemic. As a result, the demand for goods, especially durables, surged, boosting inflation.

The second is the fact that the Covid-19 crisis wasn’t a crisis of aggregate demand, but it was a structural crisis, i.e., it was characterized by the substantial shift in the structure of spending. As you can see in the chart above, the personal consumption expenditures on services haven’t yet returned to the pre-pandemic level. In other words, because of the Great Lockdown, people couldn’t leave their money in restaurants, hotels, movie theatres, etc., so they started to buy more stuff. However, the government and central banks acted as if the problem was aggregate demand, so they boosted the money supply and fiscal deficits, contributing to the rising prices of goods.

What does it all mean for the gold market? The first implication is that the current expansion is and will be, as I warned shortly after the economic crisis, more inflationary than the recovery from the Great Recession. Inflation is already high, and it may increase even further, or at least stay at the elevated level for a while, given the scale of supply-side challenges.

According to Brian Sondey, chief executive of Triton International, the world’s largest container leasing company, “consensus in the industry is we’re unlikely to see a cleaning up of the situation until deep into next year”. This means that inflation could be more lasting than the Fed claims. Gold should benefit from higher inflation and lower real interest rates, but only if Powell and his colleagues don’t become more hawkish in response to persistent price pressure and interest rates don’t rise significantly. Luckily for gold, the FOMC seems to be focused on employment much more than inflation.

The second implication is that the current expansion may prove to be unsustainable; the economy could slowly revert to the structure and trends from before the pandemic. In this scenario, the demand for services would rise, but the demand for goods would fall. If the demand for goods declines, companies could reduce their investments. Then, the supply-chain disruptions could become aggravated, while the economy could enter a new recession. What’s important, in this case, a recession could be accompanied by relatively elevated inflation. In such a stagflationary environment, gold might shine.

Of course, this is just a scenario, and it might turn out that the structure of demand for goods and services won’t return to the pre-pandemic level and the economy will enter a new, steeper path of growth. In this more optimistic scenario, gold would struggle. The coming months will be crucial for the future of the economy and the precious metals market.

One thing is certain, however. We are not yet on a nice, riskless post-pandemic path and important structural shifts are still ahead of us. Last year, the shifts in consumer spending and mammoth monetary and fiscal stimulus perhaps helped to avoid a more serious recession, but at the expense of higher inflation. We can still enter a recession though — at this time, with stronger price pressure. Nonetheless, given all the risks ahead of us, gold should still be of interest to investors.

Arkadiusz Sieron, PhD

Note: Sunshine Profits publishes an excellent gold newsletter, with free subscriptions.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. And it need not be only about commodities and precious metals. Thanks!