Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we again look at investing in military surplus (“mil-surp”) rifles. (See the Tangibles Investing section.)

Precious Metals:

Friday’s news: Why did gold price drop 2% today? More downside coming? Gareth Soloway on metals, stocks, Bitcoin. JWR’s Comments: I expect the futures and spot prices of gold and silver to recover, certainly by this fall. If the $1.2 Trillion “Infrastructure” legislation passes, (and that’s likely) then we can expect renewed currency inflation. That, in turn, will trigger higher prices for precious metals. Presently, it is a good time to buy silver. As an aside: I’ve just dropped the silver to Federal Reserve Note (FRN) price multiplier on my antique guns to 20.1 times face value, at Elk Creek Company. (Thus, a gun priced at $20 in pre-1965 silver coinage would be priced at $402 in FRNs.)

o o o

The Fed Goes Full Dove: Rocket Fuel For Gold, Silver and Mining Stocks.

Economy & Finance:

o o o

At Zero Hedge: The “Real” Real Yield Is -4.15%… And We Are Stuck With It Forever.

o o o

Reader V.L. suggested this piece by Charles Hugh Smith: How Breakdown Cascades Into Collapse.

o o o

At Wolf Street: Weird Phenomenon of “Labor Shortages” as Millions of People Still Aren’t Working: Employers Hired 2.5 Million in 3 Months.

o o o

Study show Biden’s Capital Gain Tax Plan would cost hundreds of thousands of jobs, year after year.

Commodities:

H.L. sent us this: Infrastructure Bill Will ‘Study’ Job Losses from Canceling Keystone XL, Without Restoring It.

o o o

OilPrice News reports: Oil Prices On Track For Worst Weekly Loss Since March.

o o o

At Global Trade: Here’s How to Turn the Trials of Commodity Shortages into Positives for your 3PL.

Inflation Watch:

At Fox News: Car part prices are heading higher.

o o o

Inflation Expectations Hit 13 Year High As Democrats Drive Sentiment Slump In July.

o o o

Nationwide Chlorine Shortage Forces Prices to Rise, Pools to Close.

o o o

Forex & Cryptos:

Over at the far left Democracy Now: Lebanon Faces Dire Crisis After the Elite Plundered the State for Decades, Exacerbating Inequality.

o o o

US Dollar Technical Analysis: DXY Index’s False Breakout; USD/JPY Follows US Yields Lower.

o o o

Just as I warned you, folks: Bipartisan plan to raise revenues from cryptocurrencies faces implementation obstacles.

o o o

Here is another perspective: “Not A Drill”: Infrastructure Bill Could Sink American Crypto Industry.

Tangibles Investing:

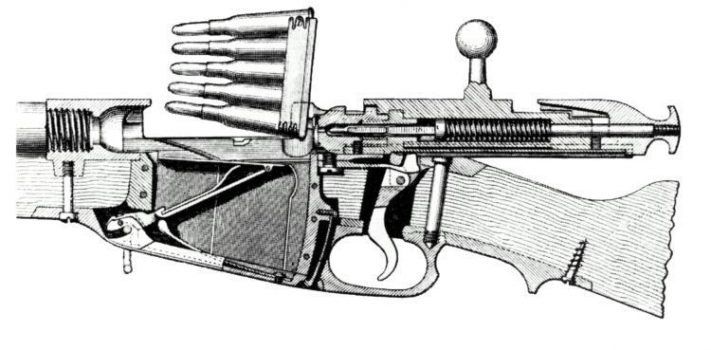

Video from IV8888: Top 5 Antique Rifles.

o o o

6 Affordable Surplus Firearms In 2021.

o o o

The Housing Boom Is Officially Over – Home Sales Drop To New Low.

o o o

o o o

Wolf Richter: Used-Vehicle Madness Unwinds Teeny-Weenie Bit, Second Month.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. And it need not be only about commodities and precious metals. Thanks!