The rolling average 3-month rate of inflation in the United States has now reached 10.7%. This is an important number as it represents the first time that we have a full three months of inflation data – March, April, and May – that include the economic impact of the Ukraine War and the related sanctions.

What is being lost in the political and economic talking points is that we have three underlying sources of inflation. As we will graphically develop in this analysis, these three sources can be broken apart, and the stepping up of inflation as the second and then third sources merge with the first source becomes boldly obvious. This is a particular issue because the Federal Reserve’s interest rate increases are not addressing any of the three root causes of the inflation.

This analysis is part of a series of related analyses, which support a book that is in the process of being written. Some key chapters from the book and an overview of the series are linked here.

The First Source Of Inflation

History seems to be going through a period of acceleration in the early 2020s, and this makes it easy to lose track of what was the fantastic and unprecedented just a year or two ago.

In the early stages of the COVID pandemic, the government shut down much of the country while flooding the nation with stimulus checks.

In the single calendar year of 2020, and even after adjusting for inflation, the U.S. Treasury ran a bigger deficit than it did in its first 208 years in existence. The government ran fantastic deficits in order to flood the nation with cash – that it wanted consumers to spend – to a historically unprecedented extent.

If we look at fiscal years, the government spent $6.6 trillion and $6.8 trillion in 2020 and 2021. These represented a level of spending that was about 80% higher than the $3.7 trillion average for the previous twelve years between 2008 and 2019 – which themselves included the record government spending and deficits in the wake of the Financial Crisis of 2008 and the resulting Great Recession.

The government has somewhat dropped its spending – but is in no way going back to normal, not even to the post-2008 standards, let alone the $1.5 to $2 trillion in total government spending that had been the norm in prior years. The Office of Management Budget estimate for the 2022 fiscal year is the government will spend about $5.9 trillion, which is about is still about 60% higher than the 2008 to 2019 average.

Another way of phrasing this is that when the government goes from the fantastic level of annually spending 80% more than it previously had, down to “only” spending 60% more than it previously had – it isn’t really going back to normality or responsible government spending, but rather we are seeing the attempted normalization of the fantastic at only a slightly lower level (but without our getting the stimulus checks in exchange).

This can also be seen in the deficit numbers. On a fiscal year basis, the government ran deficits of $3.2 trillion in 2020 and $2.8 trillion in 2021, with each being multiples of the previous records. The current projection for the 2022 fiscal year is $1.415 trillion – which is the third-largest in U.S. history.

It should be noted that the largest source for that deficit spending was the U.S. government borrowing the money from the Federal Reserve. What is far less known, but as is explored in my book “The Stealthy Raid On Our Bank Accounts” (chapter one link here), the Fed’s primary source of money came from tapping into the spending power of our bank accounts. The government is spending our money, our savings, and because they are making poor choices in how they do so, they are also creating the inflation that is destroying the value of our money.

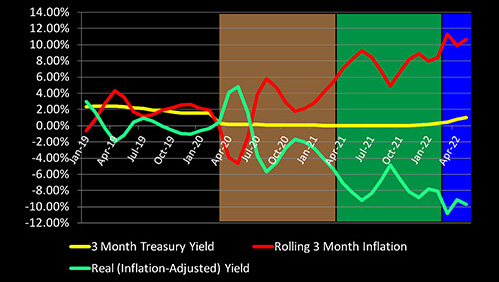

This first source of inflation is shown with the brown background above and it is a classic – governments running up huge debts to freely throw money at favored political groups and sections of society. History shows that the end result is high rates of inflation, both because of the excess spending and because that is how heavily indebted governments manage their national debts.

We saw the largest and most irresponsible deficit spending in history. After experiencing a brief bout of deflation in the first three months of the shutdowns, the red line of inflation bounced back to a substantially higher level. Between July of 2020 and March of 2021, the rolling 3 month rate of inflation rose to an average of 3.7%. This was – by itself – 2.3 times as high as the reported average 1.6% rate of inflation between 2009 and 2019.

Crucially – no efforts are being made to stop or reduce this fundamental source of inflation. Instead, the current economy absolutely depends on it. If we reduced government spending down to even 30% more than what it had been before the pandemic – let alone what it had been before 2008 – then the economy would likely go straight into recession. Instead of having “the healthiest economy ever”, we arguably still have one of the sickest economies, as it is still so dependent on fantastic levels of government spending and deficits – which also means it is fundamentally inflationary on an ongoing basis.

The Second Source Of Inflation

The second fundamental source of inflation is that of supply chain shortfalls, and it interacted and combined with the first source of inflation. As a result of the global shutdowns, supply chain difficulties emerged in multiple areas, with shortages of energy, food, computer chips, new and used autos, as well as many other items.

The first source led to too many dollars in the system chasing too few goods – which is a classic prescription for creating inflation. This supply-side inflation is a particularly difficult type of inflation for central banks such as the Federal Reserve. They can’t increase the physical supplies, so they can’t deal with the fundamental source of inflation, and all they can do is to indirectly mitigate the damage.

This was a process that occurred over time, but the critical month was April of 2021, as I identified in real-time in my May of 2021 analysis “The Current & Future Supply Side Inflation Shocks” (link here), which came out about a week after the release of the April CPI.

As explored in that analysis – and in complete opposition to the statements of the Federal Reserve and most analysts at that time – this was not transitory inflation, nor did it result from money creation, but rather it was the result of a supply-side shock meeting an ample money supply in the hands of consumers, created by federal deficit spending. As seen in the Consumer Price Index for April of 2021, this created the highest annual rate of inflation in 13 years, and a single month rate of inflation that when annualized resulted in a rate of inflation in excess of 10%.

As explored in that analysis, there was no reason to expect the inflation to abate so long as supply chain issues were combining with “unprecedented government spending”, creating a multiplication of inflationary pressures.

(Chart repeated, for continuity)

This merger of the two fundamental sources of inflation can be seen in the green background area above, starting in April of 2021 (the graphic is repeated for ease of scrolling). Government spending remained elevated far above historical norms, that extra spending was running into shortages of goods in some crucial categories, and the inflation proved to be very persistent indeed, even as rates of inflation increased from 13 year highs to 40 year highs.

Using 3 month rolling averages (annualized), the average rate of inflation from April of 2021 to February of 2022 (the green area above) increased to 7.7%. Adding the second source of inflation more than doubled the prior rate of inflation from a single source, the 3.7% average between July of 2020 and March of 2021. Having two inflation sources multiplicatively combining increased the inflation rate by 4.8 times – almost five times – compared to the 1.6% rate that had been the average between 2009 and 2019.

This inflation is not being dealt with. There is no major effort to reduce government spending. There are no major proactive attempts, or national emergency interventions being used to end the supply chain shortfalls. Instead, there is just a hope that the supply chain issues will work themselves through as quickly as possible.

Please also note that the Federal Reserve increasing interest rates does not directly deal with either of these primary sources of inflation. As long as they both exist and continue to combine, then too many dollars chasing too few goods can be expected to continue to create persistent and high inflation.

Now some would argue that if the Fed’s interest rate increases lead to a recession, then that will reduce demand, and thereby alleviate the supply chain shortfalls. Perhaps. But first – we would now have a recession on top of high inflation, so that is not a particularly desirable path. Second, we know from the 1970s that high rates of inflation can coexist with repeated recessions, recessions do not necessarily reduce inflation. And third, the government would likely respond to recession by massively increasing deficit spending to increase consumer and business spending – which could then actually increase the first source of inflation.

The Third Source Of Inflation

It is very difficult to fix supply-side inflation without increasing supplies. However, there is a highly effective way to make that kind of inflation much worse – take actions that will further decrease supplies, particularly if this is done in such vital areas as energy and food.

This taking an already bad situation and making it much worse is exactly what is happening as a result of the Ukraine War, and the political decisions to cripple much of the global energy and food markets in the name of sanctions.

(Chart repeated, for continuity)

The Russian invasion of Ukraine began near the end of February, which means that we now have three months of inflation data that include all three primary sources of inflation: March, April, and May of 2022. The blue background area in the graphic above (repeated again for ease of scrolling) shows the immediate results, which are to push prices still higher.

We now have gas prices that are on average over $5 a gallon, and diesel prices that average over $6 a gallon. Fertilizer is much more expensive, and it costs much more to drive tractors and other farm equipment because of higher fuel prices, so the domestic cost of producing the food we eat is sharply shooting up. There are international shortages of energy and fuel, that are also acting to pull up domestic prices.

When these increases are combined with what are becoming every broader inflation increases in multiple categories, the 3-month rolling rate of inflation reached 11.3% in March, 9.9% in April, and 10.7% in May. All three of those rates were higher than any previous months, as the adding in the third source of inflation, the supply shortages resulting from the Ukraine War sanctions, took the combined inflation to a still higher level.

We are still early, with only three months of data, and there is every reason to expect the rates of inflation resulting from the third source to get higher still, as the rates of inflation also steadily grew with the first two sources. However, even at this early stage, we had a 10.6% rate of inflation during the first three months of data for the Ukraine War period, and that is a full 6.6X the average rate between 2009 and 2019.

We now have three distinct primary sources of inflation that are merging – and playing off each other. The first source, too much money being injected via massive government spending increased the rate of inflation by 2.3 times. Adding the second source of supply shortfalls increased inflation by a new total of 4.8 times. And even in the early stages of the Ukraine War, the energy, fertilizer, and food price increases that are the result of sanctions were enough to increase prices by a total of 6.6 times.

There are hopes – but there are no cures in sight for any of those three sources of inflation. No material efforts are being made to deal with the underlying problems. And merely increasing interest rates does not cure the three underlying inflation sources of too much government deficit spending, or supply chain shortfalls, or the new actual supply shortfalls when it comes to energy and food.

The Building Fourth Source Of Inflation

There is a building fourth source of inflation that may become the most powerful and persistent of all. The inflation of the 1970s and early 1980s had its primary sources as well, such as the inflation caused by the deficit spending used to pay for the Vietnam War, and how that merged with the energy supply shortfall that was caused by the oil embargo, combining to form a still more powerful inflation. While the specifics differ, it is interesting to note that nearly half a century later, we have the same basic troika of war, soaring deficit spending, and energy shortfalls, together creating the highest inflation rates seen since that time. That was a potent combination for destroying the value of the dollar then, and it is a potent combination now.

However, the highest rates of inflation of that era did not occur until the late 1970s and early 1980s, long after the primary sources of inflation were gone. Once inflation gets established, then it can sustain itself via the wage/price cycle, long after the primary sources of the original inflation are gone.

The prices for diesel have exploded upwards. This means that everything in this country that is transported by truck has now become more expensive to deliver. This means that the prices for everything that is transported by truck must go up as well.

Our current situation is one of impoverishment for the average low-income or middle-class household. Some estimates are that the average annual cost of living has gone up by $5,200 – so far. This represents about a month of the median annual household income – gone.

So, there are two choices – accept permanent impoverishment for the average person, the great majority of the country, or raise wages. If wages go up, then prices must go up for everything that is created by paying people income. This then creates another round of prices going up, which must be compensated for by raising wages, that then creates another round of increasing prices.

It should also be noted that the economic well-being of much more of the nation is now dependent on transfer payments from the government than it was a half-century ago. Many of these low-income households and retiree households were in pretty marginal economic circumstances to begin with. When the government creates inflation, these economically vulnerable households face a very real poverty unless their checks from the government go up. For the checks from the governments to go up, then deficit spending must climb as well, which further feeds and strengthens the primary underlying source of inflation.

The most effective way to deal with these hazards – is to keep that inflation from getting going in the first place. Yet, we have a government that seems almost indifferent to the predictable results of its decisions, as keeping the policies in place that are creating the inflation seems to be judged to be more politically important than the resulting impoverishment of tens of millions of households. This process of economic destruction is not just a threat but is now well underway, with no substantive efforts to deal with the underlying sources of inflation, the potential recession-inducing rapid interest rate increases notwithstanding. – Daniel Amerman, CFA

—

Disclaimer: This analysis contains the ideas and opinions of the author. It is a conceptual and educational exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. While the sources of information and the calculations are believed to be accurate, this is not guaranteed to be true. This educational overview is not intended to be used for trading purposes, those making investment decisions should do their own research and come to their own independent conclusions. This analysis does not constitute specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of the information contained in the analysis, either directly or indirectly, are expressly disclaimed by the author.