Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we discuss investing in limited production and vintage motorcycles. (See the Tangibles Investing section.)

Precious Metals:

Silver price 2022: Here’s how silver can outperform gold as it plays catch-up next year.

o o o

Asian Metals Market Update: Physical Gold And Silver Remain Long-Term Safe Havens.

Economy & Finance:

A few weeks ago, I mentioned the collapse of China’s Evergrande and Kaisa real estate development giants. At that time, I suggested that there could be a contagion. Yes, there still can, and most likely it will come in March or April of 2022. As more and more real estate developers in China are forced into bankruptcy, the price of land, houses, and apartments will collapse. Developers will be desperate to sell off their holdings at a loss. This will create a downward spiral that will spill over into other sectors of the Chinese economy, and then the Asian economy, and then possibly the global economy. Brace yourself, folks. This will make the 1989 Tokyo real estate crash (and the corresponding Nikkei stock market crash) look tiny, by comparison. The first effects to be felt in North America will likely be crashes in Vancouver, B.C. real estate and Bay Area California real estate, since it was Chinese buyers that were in part driving those real estate bubbles. Next will be a commodities crash, and then possibly a global credit crisis. You’ve been warned. – JWR

o o o

From reader H.L.: Get ready for a larger-than-expected interest rate spike in 2022.

o o o

Andre sent us this: Greyerz – The World Has Now Entered The First Of Four Major Phases Of Chaos And Financial Destruction.

o o o

California Rewards Deadbeats Once Again With $80K Cash Giveaway To Delinquent Homeowners.

o o o

At Zero Hedge: “Potential For Extreme Havoc”: $50 Trillion Question Is What If Yields Spike Higher.

Commodities:

Terry sent us this: Goldman Says $100 Oil Possible as Record Demand Outpaces Supply.

o o o

OilPrice News reports: Coal On Track To Break Records Despite Efforts To Curb Production.

o o o

CNOOC To Take First LNG Cargo From U.S. Exporter.

Inflation Watch:

U.S. Inflation-Adjusted Spending Stagnates as Prices Surge.

o o o

Real Inflation is 9%… and the Fed Thinks It Can Stop By Raising Rates to 2%.

o o o

At MarketWatch: Why inflation and the U.S. policy response will be key for markets in 2022.

Forex & Cryptos:

At Currency Thoughts: Revised U.S. and British GDP Figures, Record High PPI Reports, and a Big Czech Central Bank Rate Hike.

o o o

H.L. spotted this news, over at Zero Hedge: Turkey Halts All Stock Trading As Currency Disintegrates, Central Bank Powerless To Halt Collapse. This article begins:

“Another day, another collapse in the Turkish lira, only this time there was a twist: as the hyperinflating currency implodes, Erdogan has finally had enough of the relentless pummeling, and is starting to shut down Turkey’s markets.

But first, let’s back up: heading into Friday, the lira accelerated its historic descent, weakening past the 16 per-dollar mark for the first time ever, as the central bank’s pledge to end a four-month cycle of interest rate cuts on Thursday failed to convince investors that inflation can be brought to heel. That was just the start however, and the currency plunge only accelerated crashing as low as 17.14 just hours later, bringing declines this week to 17%. YTD the currency has lost more than half of its value!

As a reminder, the central bank yesterday cut its benchmark one-week repo rate by a further 100 basis points to 14%, its fourth reduction since September spurred by demands from President Recep Tayyip Erdogan to lower borrowing costs in the face of surging consumer prices as part of his batshit insane monetary policy Erdoganomics whose only possible outcome is the collapse of Turkey’s economy and hyperinflation. The resulting sell-off accelerated a 54% plunge in the currency so far this year as real rates fall further below zero with inflation now standing at an annual 21.3%.”

o o o

In Zimbabwe: Forex Cheats Spark Chaos.

o o o

Video from Naomi Brockwell: You can live ENTIRELY off crypto in THESE places! (Our thanks to Tim J. for the link.)

o o o

BTC/USD Forex Signal: Climb to 50,000 Likely.

Tangibles Investing:

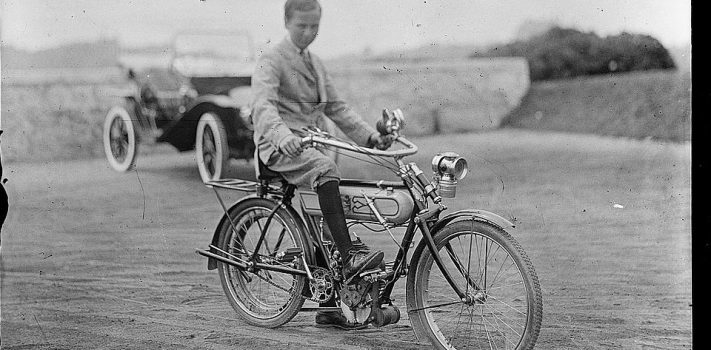

Investing in limited production and vintage motorcycles has become trendy — and not for just Keanu Reeves and Ewan MacGregor.

o o o

This was published in 2018 by Hot Cars: 20 Motorcycles Every Collector Needs Right Now (Before Their Value Skyrockets)

o o o

Top 10 types of bike that could make you money. An excerpt:

“Bear in mind that, as an investment, bikes have got significant problems. They need maintaining, servicing and insuring, and there’s always the risk that the used value will plummet. But then again, values on some have risen incredibly over the last few years – anyone who bought a decent RG500 or RC30 a decade ago will be basking in that warm knowledge that it’s now worth much more than it cost.”

o o o

Published in England, in 2019: Top five classic bikes to buy now before they increase in value.

o o o

o o o

I was recently a guest on the GoldSilverBitcoin podcast, where we discussed several topics, including tangibles investing. Here is a link to the archived show, on YouTube.

o o o

Perhaps there are some lessons here, for folks who hold tangibles as a hedge on inflation: As Lira Implodes, Turkey Proposes Huge Fines For “Hoarding”.

o o o

Over at Breitbart: Report: Real Estate Records Set in Coronavirus Era: High Prices, Quick Sales, One Third of Americans Moved.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. And it need not be only about commodities and precious metals. Thanks!