The analysis of two similar economic cycles over the last century reveals some interesting facts about silver and how it relates to the coming monetary system collapse and reset

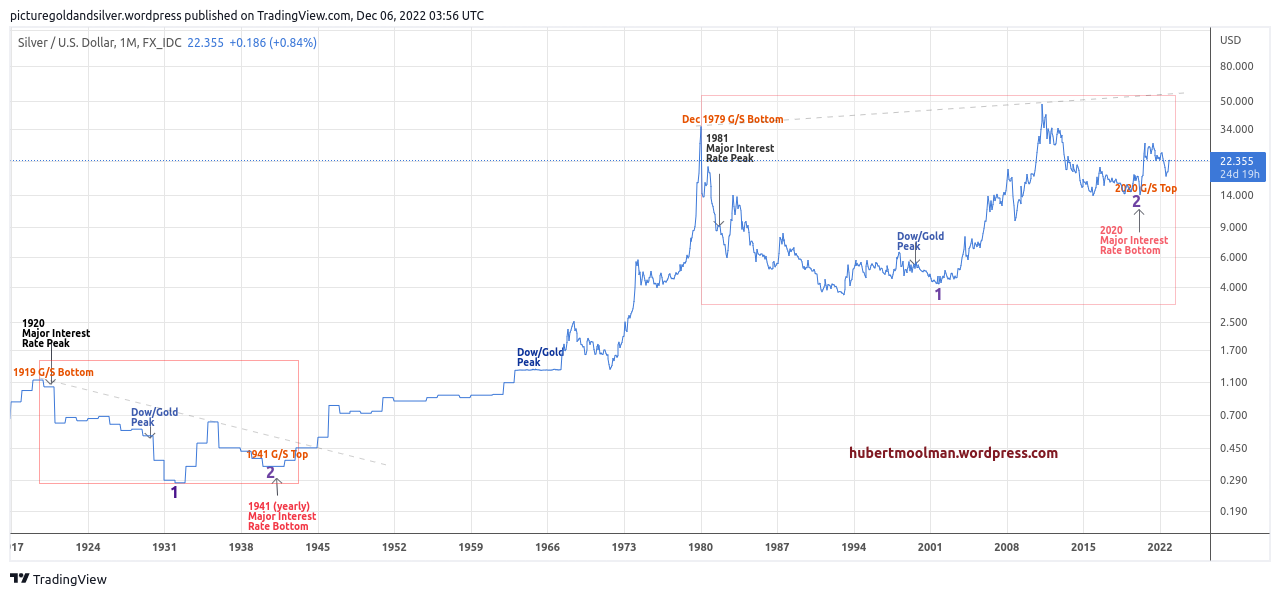

Below, is a long-term silver chart showing how silver performed in these similar and specific cycles:

Both cycles start at major gold/silver ratio bottoms in 1919 and 1979 respectively. Very early in the cycles, there was a major interest rate peak (1920 and 1981). The major interest rate peak signals or confirms that conditions are likely to be favourable to debt-based assets for a long time, and unfavourable to gold and silver.

Towards the middle of the cycle the Dow/gold ratio peaked, and this signalled that the downtrend for real assets (like gold and silver) is soon coming to an end, and a long-term uptrend can be expected in real and nominal terms.

In both cases silver made an extreme bottom at point 1 (1932 and 2001), after the Dow/gold ratio peaked.

From this silver bottom in 1932, silver had a long major bull market that ended in early 1980. In the same way we are now in a long major silver bull market that started in 2001, and that could end around a major interest rate peak.

Currently in this cycle, we are just a few years past the important point, which is the major interest rate bottom that came in March of 2020. The similar point in the previous cycle came approximately in 1941, when yearly interest rates on US Treasuries bottomed.

This is the critical point in the cycle. From this point debt and debt-based assets get destroyed while silver prices see some real stellar increases. This point cannot be stressed enough, since debt or credit is what this current world is built on.

The importance of this turning point will be highlighted and confirmed when the collapse and reset of the world monetary system occur. I have recently written about this at my Monetary Reset blog.

Due to the massive debts, the world monetary system is in a very vulnerable state. In order to prepare for what could soon come over the world it is important to understand the critical themes at play.

Below, is a chart that I discuss in detail at the Monetary Reset blog:

—

Editor’s Closing Note: Hubert Moolman is an economist and precious metals investing specialist who lives in South Africa. He has written several guest articles that have been posted in SurvivalBlog since 2019. He publishes a Premium Service newsletter as well as a Silver Long-term Fractal Analysis Report that provides more insight regarding the gold and silver markets.