2020: Dropping All Pretenses

Reserve requirements were gradually reduced from 1913 to 2019. The reserve ratio is the percentage of reserves that a bank is required to hold against deposits. As of 1917, the reserve requirements for three types of banks under the Federal Reserve were set at 13%, 10%, and 7%. A decrease in the reserve ratio allows the bank to lend more, thus increasing the money supply. And of course an increase in the reserve ratio decreases the money supply. Reducing reserve requirements allowed the multiplier effect to be amplified, creating more and more FRN Dollars. Generally, reserve requirements have declined, but there have been times when they’ve been raised, to decrease the money supply.

As announced on March 15, 2020, the Federal Reserve Board reduced reserve requirement ratios to zero percent effective March 26, 2020. This action eliminated any reserve requirements for all Federally-insured depository institutions. That change, along with “COVID Relief” money handouts explains what we see in this money creation chart, published by the St. Louis Federal Reserve.

As you can see from that chart, The Fed’s Funny Money Machine is now running in overdrive. So it is no wonder that consumer price inflation is now rampant. More FRNs in circulation are chasing fewer goods and services. And now, with no reserve requirement, banks can lend out close to 100% of their deposits. Thus, the purchasing power of each FRN diminishes.

Please dismiss the current talk about “raising interest rates to fight inflation”. That is absolutely laughable. Congress, the U.S. Treasury Department, and the Federal Reserve private banking cartel have again unleashed the inflation djinni. This will not end well. Welcome to Weimar, folks.

The Rise of the Fed Banking Cartel and The Income Tax

Most Americans believe that the Federal Reserve is a government agency. It is not! Again, it is a private banking cartel that was unconstitutionally authorized by congress to create money. The empowerment of the Federal Reserve allowed the gradual destruction of the U.S. Dollar, the growth of Big Government, a huge military (focused on foreign wars rather than defending our territories) to back up an expansive U.S. foreign policy — making the United States “The World’s Policeman.”

Here are some key points in the chain of events, starting in 1909:

The 16th Amendment was offered by Congress in 1909 in response to the 1895 Pollock v. Farmers’ Loan & Trust Co. Supreme Court case. The Sixteenth Amendment was fraudulently ratified — supposedly by the requisite number of states — on February 3, 1913. But it was not actually properly ratified. (For details on that false ratification, see the scarce 1985 book: The Law that Never Was: The Fraud of the 16th Amendment and Personal income Tax.)

The Revenue Act of 1913, signed into law on October 3, 1913 by Woodrow Wilson, established a one percent tax on income above $3,000 per year. This new income tax affected only about 3 percent of the population. Tax withholding for individuals in that category was introduced in 1913 but that was repealed in 1916.

President Woodrow Wilson signed the Federal Reserve Act in December, 1913 making the private banking cartel the de facto monetary authority and central bank for the United States.

1922-23: Saddled by war reparations, the Weimar government of Germany hyperinflates the national currency.

1929: Calvin Coolidge was the last President to oversee any decrease in the National Debt.

October, 1929: Stock markets crash and a global deflationary depression ensues. A national banking crisis eventually followed.

1933: Franklin Delano Roosevelt becomes President. He proposes The New Deal expansion of government. Most of the New Deal legislation was enacted by Congress within the next 90 days. (March 9–June 16, 1933.) The cornerstone of The New Deal was the National Recovery Act, passed on June 16, 1933. The original group of Alphabet Soup Agencies, such as the Works Progress Administration (WPA) and the Civilian Conservation Corps (CCC), and the Tennessee Valley Authority (TVA) were established. The National Debt is $258,682,187,409 at his death, ending his third term in office.

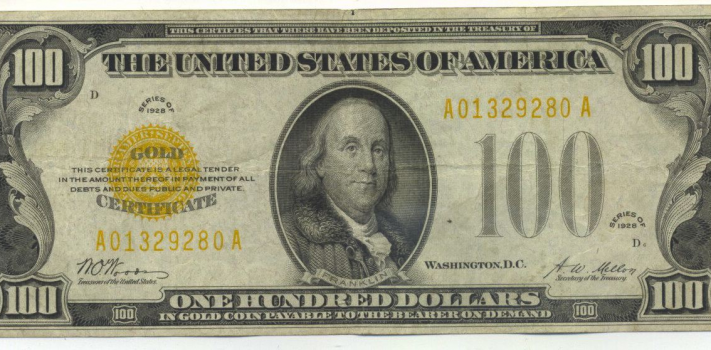

April 5, 1933: FDR signs Executive Order 6102 “…forbidding the hoarding of gold coin, gold bullion, and gold certificates within the continental United States.” All non-numismatic gold coins and bullion bars were ordered to be surrendered, and the owners reimbursed in paper dollars, effectively at the rate of $20.67 per Troy ounce. Although the government continued to buy gold from miners, this order ended the domestic gold standard.

January 20, 1934, FDR signs the Gold Reserve Act of 1934. This Act transferred ownership of all monetary gold in the United States to the US Treasury and prohibited the Treasury and financial institutions from redeeming dollars for gold. The act also Included a revaluation of gold to $35 per Troy ounce. (What a great scam: Seize everyone’s gold, and then re-set its value, for a tidy profit.)

June 26, 1934: The unconstitutional National Firearms Act (NFA) was passed by congress and signed into law by FDR. This instituted a $200 transfer tax on machineguns, suppressors, short-barreled rifles, and short-barreled shotguns.

1935: Social Security Act was passed by congress and signed into law by FDR.

1943: Income Tax Payroll Withholding is reinstituted.

1944: Bretton Woods Agreement. Per Wikpedia: The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold (or 0.88867 gram fine gold per dollar).

February 4-11, 1945: Yalta Conference. FDR annotates a map with Stalin, carving up Europe, setting the stage for the Cold War.

1948 Marshall Plan — officially called the European Recovery Program (ERP). The ERP was enacted in 1948 to provide foreign aid to Western Europe The U.S. Government gifted or loaned over $13 billion (the equivalent of about $120 billion in 2022 dollars) to rebuild the European economy, with borrowed money. With the ERP, the U.S. effectively instituted Dollar hegemony, as the U.S. Dollar supplanted the British Pound as the world’s dominant reserve currency. Henceforth, most international debts would be re-payed in U.S. Dollars.

The ERP also indirectly created two new categories of “Dollars”: Euro Dollars: U.S. Dollars on deposit in Europe, and Petrodollars: Oil contracts that are settled in U.S. Dollars, requiring Dollar deposits abroad.

1958: French President Charles de Gaulle orders the Banque de France to increase the rate at which it converts new Dollar reserves into bullion.

June 4, 1963: JFK issues Executive Order 11110, authorizing the U.S. Treasury to issue a new round of U.S. Treasury Note Silver Certificates to circulate alongside FRNs.

November 22, 1963: JFK is assassinated. That same day, Vice President Lyndon Baines Johnson (LBJ) becomes President. The National Debt is $353,720,253,841 when LBJ leaves office.

March 1964, Secretary of the Treasury C. Douglas Dillon halted the redemption of silver certificates for silver dollars. They could still be exchanged for silver dimes or quarters, but only at Federal Reserve banks.

July 23, 1965: LBJ signs the Coinage Act, and lies through his teeth. (“Our present silver coins won’t disappear and they won’t even become rarities.”) This law permanently debased our formerly silver coinage. The last silver dimes and quarters (90% silver) were minted in 1964. The last silver half dollars (debased to 40% silver) were minted in 1970.

1965: The international “Run On Fort Knox” begins. French President Charles de Gaulle orders French naval ships to New York to pick up $150-million worth of gold bullion — redeemed from French “Dollar” deposits.

1967: With France demanding increasing numbers of Dollars repatriated in gold, the proportion of French national reserves held in the form of gold bullion rises from 71.4% to 91.9%.

1968: The silver content of circulating Canadian silver coins reduced from 80% to 50%. (And eventually, zero.)

1968 Richard Milhouse Nixon (RMN) becomes President. The National Debt is $475,059,815,731 when he leaves office.

June, 24, 1968: Silver certificates become only redeemable in Federal Reserve Notes. Thus, FRN Funny Money becomes our only circulating money.

1970: Silver coinage has completely disappeared from circulation in the United States.

Aug. 13, 1971: Nixon closes the gold window, ending both the international gold standard and the Bretton Woods system. Wage and price controls are implemented. With now free-floating Dollars, all fiscal and monetary restraint is abandoned.

1974: Gerald Ford becomes President. The National Debt is $698,840,000,000 when he leaves office.

1974: President Gerald Ford signs legislation that permits Americans to once again legally own gold bullion and non-numismatic gold coins. Smuggled Krugerrands come out of hiding.

1977: James Earl Carter (JEC) becomes President: The National Debt is $997,855,000,000 when he leaves office.

1978-1981 The Carter-Era Stagflation era. In an attempt to staunch inflation, the Federal Reserve ratchets up interest rates. Mortgage interest rates exceed 20%.

1981: Ronald Wilson Reagan (RWR) becomes President. Federal spending explodes. The National Debt exceeds $1 Trillion for the first time. The National Debt is $2,857,430,960,187 when he leaves office.

1981: The top income tax rate fell from 70 percent to 50 percent, and eventually to 37 percent.

Dec 17, 1985: President Reagan signed into law the Gold Bullion Coin Act which allowed the US Mint to produce gold coins from “newly mined domestic sources”.

1989: George H. W. Bush (GHB) becomes President. The National Debt is $4,411,488,883,139 when he leaves office.

1993: William Jefferson Clinton (WJC) becomes President: The National Debt is $5,807,463,412,200 when he leaves office.

2001: George W. Bush (GWB) becomes President. The National Debt is $11,909,829,003,511 when he leaves office.

2009: Barack Hussein Obama (BHO) becomes President. The National Debt is $20,244,900,016,053 when he leaves office. With compounding interest, this debt is mathematically impossible to repay without a period of hyperinflation.

2017: Donald J. Trump (DJT) becomes President: The National Debt is $27,052,190,118,519 when he leaves office.

2020: It is estimated that 97 percent of the purchasing power of a 1913 US dollar has been lost to inflation.

2021: Joseph R. Biden (JRB) becomes President and Bidenflation begins.

2022: The National Debt exceeds $30 Trillion for the first time.

The preceding is just a thumbnail history. I left out the succession of U.S. military campaigns overseas that often followed “upstart” countries having the temerity to introduce, or even talk about introducing gold-backed currencies.

Conclusion

If you look at the monetary history of The United States from the long view, you’ll see:

- We had no Federal income tax until 1913.

- We had genuine money backed by specie, until 1913.

- We were robbed of our gold money in 1933.

- Then we were robbed of our silver money in 1965.

- Our “money” today has no tangible basis. It is Funny Money, available in nearly unlimited amounts. The only coins left in circulation with any value near their face value are pre-1981 copper pennies and nickels (all years).

- We’ve also been gradually robbed by inflation — a hidden form of taxation — starting from the founding of our nation.

It has been said that history doesn’t repeat, but it often rhymes. Be prepared for an extended era of stagflation, quite similar to what we experienced in the Jimmy Carter era.