Today, in lieu of my usual bi-weekly Economics & Investing column, I will describe some ongoing shifts in the global credit and currency spheres. The driving forces behind the present-day monetary and fiscal trends date back to the year 1909, as I will explain. This is not just an academic exercise. Take heed that there are some serious preparedness implications for you and your family, in all of this — especially in light of the latest round of currency inflation. – JWR

The Robbery of Our Genuine Dollars

Most Americans are essentially clueless about what constitutes a “Dollar”, and how Dollars come into existence. The word Dollar is Spanish (and Thaler is the German equivalent), and in fact, the first functional currency in the American colonies was in the form of Spanish milled Dollars.

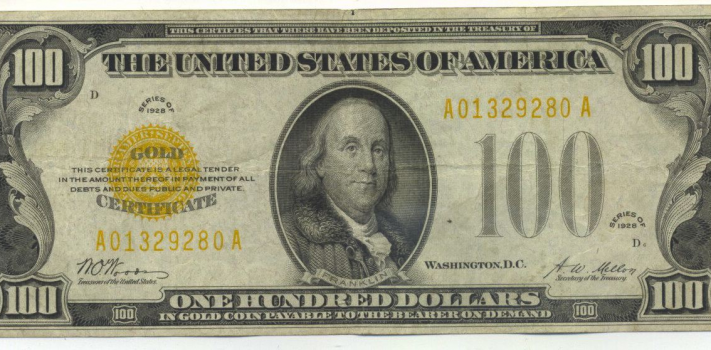

Up until 1913, U.S. Dollars were minted by the U.S. Mint, under the U.S. Treasury’s bi-metallic currency system. Dollars were either gold ($5, $10, and $20 gold pieces), or silver (dimes, quarters, half-dollars, and dollars.) Most people carried money that jingled in their pockets. And the limited supply of Treasury-issued paper Dollars were redeemable, on demand, in gold or silver. But starting in late 1913, millions and then billions of credit-based Federal Reserve Note (FRN) paper “Dollars” were created out of thin air. This new funny money issuance stemmed from a congressionally-authorized fractional reserve banking system that employs a money multiplier effect. This violated Article I, Section 8, Clause 2 of the Constitution. Let me explain this multiplier effect, briefly:

By law, starting in 1913, for each Dollar on deposit in a Federal Reserve-affiliated bank, those banks kept just a fractional reserve and then could lend out the remaining 90% of those dollars as credit–primarily home loans, industrial loans, and farm loans. But as they were spent, most of those loaned-out FRN Dollars eventually ended up back in banks, where they were loaned out again. Thus, over the years, each credit-based “Dollar” was loaned out over and over– effectively multiplied, greatly benefitting bankers. This change in our currency was a gross violation of Article I, section 10, clause 1 of the U.S. Constitution.

Genuine Dollars and the U.S. Constitution

To back up even further: The terms “dollar” and “money” are used in seven places in the U.S Constitution:

- “Congress shall have power to borrow money on the credit of the United States”: Article I, Section 8, Clause 2.

- “Congress shall have power to coin money, regulate the Value thereof, and of foreign coin, and fix the standard of weights and measures”: Article I, Section 8, Clause 5.

- “Congress shall have power to provide for the punishment of counterfeiting the securities and current coin of the United States”: Article I, Section 8, Clause 6.

- “No money shall be drawn from the Treasury, but in consequence of appropriations made by law”: Article I, Section 9, Clause 7.

- “The migration or importation of such persons as any of the states now existing shall think proper to admit, shall not be prohibited by the Congress prior to the year one thousand eight hundred and eight, but a tax or duty may be imposed on such importation, not exceeding ten dollars for each person”: Article I, Section 9, Clause 1.

- “No state shall coin money, emit bills of credit, or make any thing but gold and silver coin a tender in payment of debts”: Article I, Section 10, Clause 1.

- “In suits at common law, where the value in controversy shall exceed twenty dollars, the right of trial by jury shall be preserved”: Amendment VII.