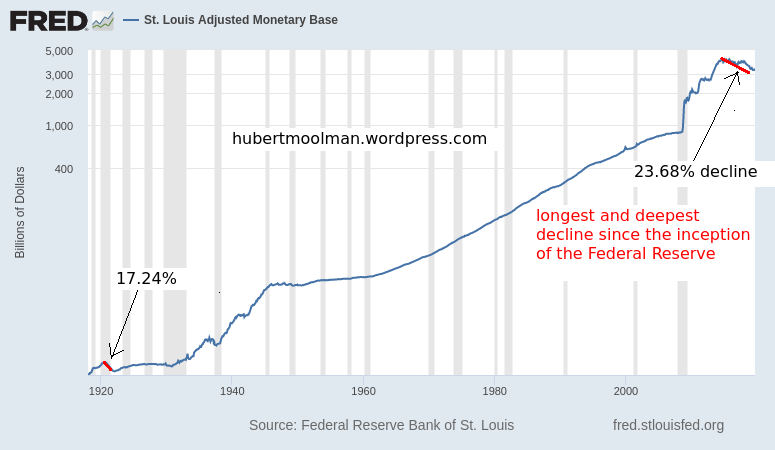

Since 2016, the US Monetary Base has declined by about 23.68%. This is the deepest and longest decline since the Federal Reserve was formed. This should not be ignored.

The last time there was a decline close to this magnitude,there was a sharp deflationary recession. That was the one that occurred from 1920 to 1921.

Below, is a long-term chart of the Monetary base that goes back to 1918:

During the 1920-1921 recession the decline in the monetary base eventually made it into the broader money supply and this caused a significant drop in price levels (between 13% and 18%) during the recession, with wholesale prices dropping as much as 36%.

The current decline in the monetary base has not evolved into a decline of the money supply yet, but it will likely soon do so. Especially if the economy goes into a recession and the stock market collapses.

The monetary base is the foundation part of the money supply, and represents the most liquid part of it. It basically acts like gold in a 100% funded gold standard: it represents the final settlement of a transaction.

If the monetary base is declining then less means to service debt is available and could trigger mass defaults. Cash becomes scarce and suddenly you have a situation where the Fed has to intervene in the repo market like it has been over the last couple of weeks, just to keep the system going.

This problem is not just going to go away without a major crisis and some severe consequences. By my estimation the banking system is broken and is unable to continue creating new credit in its current form, just like a bank is unable to increase its gold holdings under a gold standard when there is distrust of the banking system or that particular bank.

Believe it or not, the reserve banks do not control all the elements in the system: they are not all powerful and unstoppable. The appetite or ability to take on new credit is just not there anymore.

In my opinion, their intervention is not about making the crisis go away (because it won’t), but to protect their interest during the crisis.

This is likely the beginnings of the expected monetary event I have pointed out before:

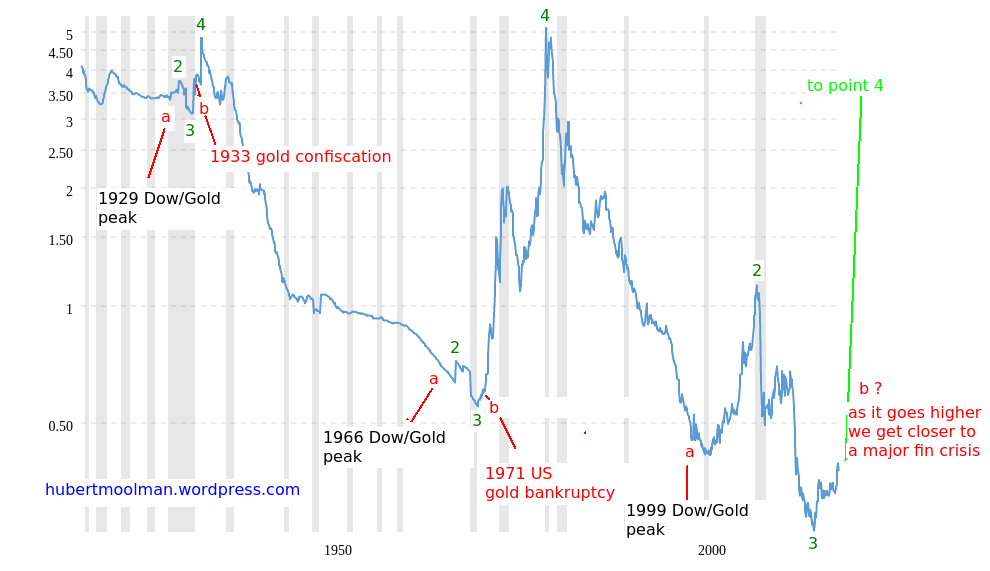

The chart shows the ratio of the gold price to the St. Louis Adjusted Monetary Base back to 1918. That is the gold price in US dollars divided by the St. Louis Adjusted Monetary Base in billions of US dollars.(from macrotrends.com)

More details about the chart and original commentary here.

The bottom at point 3 is now virtually confirmed and we could soon have an event similar to the 1933 gold confiscation (bankruptcy) and the 1971 announcement where the US ended the dollar convertibility to gold (at a fixed rate).

Although both of the historic events were significant, they did not occur during a stock market crash or during a recession. There is a huge potential that the coming event could happen during a major stock market crash and recession.

Therefore, the coming monetary event could be the cause (or at the center) of the coming crisis, whereas with the previous two they were as a result of an ongoing crisis, and came towards the end to “correct” the situation.

Note that a sharp move from point 3 to point 4 on the chart is akin to a bank run on gold holding banks in a gold standard. With the decline in the monetary base and a rising gold price this is exactly what is happening.

Editor’s Closing Note: This article first appeared at Hub Moolman’s web site. It is re-posted with permission. By subscription, he also has a premium service.

My stable of experts may have different perspectives, yet if they all generally agree, that a severe financial crisis is near at hand and is inescapable, then the odds that it will actually occur are greater.

By “stable of experts”, do you mean the internet prophets of doom that have been predicting financial collapse for more than a decade?

Meanwhile, in the real world:

Dow up 309% from March 9 2009

Nasdaq up 538% from March 9 2009

S&P 500 up 341% from March 9 2009

There is another name for being ten years early for anything: it’s called being wrong.

It’s good that you are happy with the major stock indexes.You sleep well at night not being concerned with the economic factors that are signs of the coming storm.

Global and national debt are at all time highs with no possibility ever paying it down.Ever!

Oh wait! We’ll just print more and more worthless fiat currency.That is sure to help and make you feel better.

Manufacturing,transportation,retail sales,real estate(residential and commercial) are all tanking.

Consumers in general are tapped out.A consumer driven economy will fail.Have you seen

Many new KMART stores opening lately?Exactly!

The high stock prices that so many people worship are in a large part the product of corporate buy backs.

Normalcy Bias in your “real world” can be dangerous.

If you are just one day late you and your family will not like the outcome.

We all get caught up debating/argueing our points of view and theories.

I sincerely hope that this all turns out well for you.

Bravo! Timing is everything, yet few have that golden touch of timing that makes them millions, or saves them millions. Some of that success is dumb luck. And it is not just about when to bail out of a market. Those who bail early tend to remain solvent to return again. Those who claim that the doom and gloom is unjustified, simply do not understand the essences of the problem, or the reasons why it has not collapsed much sooner. Nor do they appreciate the mindset, time and resources needed to be truly prepared.

Perhaps had I stayed in the game all these years I would be better off financially. Perhaps had my health been better I could have done this or that. However, I would not be near as well prepared as I am today, because I never lost sight of the threat, remained vigilant, and made it a life style. What is ahead requires years of preparation, that does not require money, but time and practice. There is much more to life than money. Been there, done that.

No, much the wealthy will become poor and commit suicide as this blows up. My guess is markets, including real estate, will tank hard as we go into a depression , and the bond market goes pop as well, and Trump over sees the first reset and bankruptcy. That is if he lives to be reelected. And then we gotta deal with the revolutionary commies, the minions of the Globalists, and the Globalist themselves, who perhaps caused the collapse to help destroy Trump, if he refuses to leave. Yet who really knows… It’s definitely going to get dynamic and kinetic. I’ll be continuing to stack it high, and barter yet again, for more lead today.

First sentence: ” Since 2016, the US Monetary Base has declined by about 23.68% ”

Wednesday, Jan 6th 3,649,906

This weeks reading 3,251,308

That’s an 11% change

Maybe if you go back to Sept of 2015 you can get closer to the stated number, but that’s not what the author wrote. An audience, especially one in regards to financial matters require accuracy.

Also be very leery of being told a specific number 23.68% and including the weasel words “by about”. Why give such a detailed figure and throw in verbiage to make it inaccurate or less accurate?

Fudging / fudge isn’t always about chocolate.

I read this site because I’m trying to learn how to protect the money I have saved. It’s all in fiat dollars that can and is as I write this being inflated away by the policies of the Federal Reserve. From what I have read and heard over the last fifteen years it seems that the only way to protect ones wealth is to buy PM’s. I realize they do not pay interest but getting any kind of interest income off ones savings these days is non-existent. I am concerned with the recent activities of the Fed and am wanting to make the jump to gold as a store of value for my savings but I would like to understand the whole transaction better. When I go to a gold dealer and buy gold do I have to fill out a Federal form like I do when I buy a gun? Or does the law require the gold dealer to have to fill out a Federal form to report my sale of gold when I cash it in after the crisis? That brings up another point I never hear discussed and that is that we are ‘herd animals’ in a way meaning that there will be a lot of us trying to cash out our gold holdings after the crisis is past and that will in my reasoning drive the price we get down and I think this is something most people don’t realize. Can anyone out there tell me from their experience just what happens when they buy and sell gold?

Jim, I know you say you don’t publish our email addresses but are you sure that the government does not have a back door into your server to find this information? I don’t trust the government and believe they have software that can scan a letter under a highly illuminated source and can reconstruct the letter even though it’s folded. Just my two cents.

James

The monetary base represents the money in cash and coins. I admit I have not done any of the book work on this, but I strongly suspect that the decrease reported represents the rise of “electronic money” in the economy. Instead of “Cash is King”, the refrain today should be “Cashless is King”. In a tangential aside, it has gotten increasingly difficult to get anyone besides a bank to accept or break a $100 bill. Many places around me display signs that they will not accept or break them.

Is it the same for a 50 Dollar bill?