HJL,

I was going to leave a short comment but this deserves wider exposure.

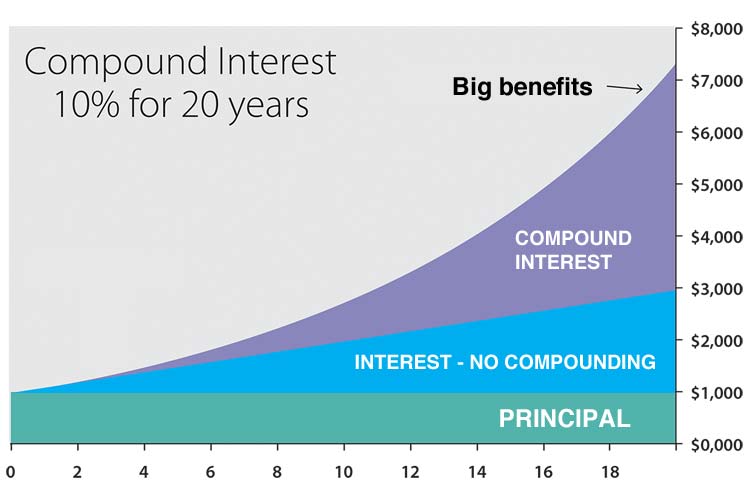

Amen to all that about debt in the Zero Hedge article. Compound interest is not your friend if you are paying it. I bought into leverage for asset acquisition. Robert Kawasaki (intentionally incorrect) has a special place in my heart or is that some place much lower… It is a serious mistake not to take the income sheltered by depreciation and put it toward loan principal reduction. When you hit 50 and want to be out of debt the cold reality hits that profit and income must be earned and taxed to reduce principal. Practically speaking, you have to earn 140% of the principal in order to pay it off because you have run out of depreciation and you are in your prime earning years and therefore in a higher tax bracket.

The creepy part is to be personal guarantee element. Even if you have just one asset still financed you are vulnerable when SHTF. After every economic disaster there is a wave of lawyers and opportunists that buy up delinquent financial instruments for pennies, add legal fees to the tune of 300% of the original debt and then go to court to get judgments in Federal court. Understand that the retainer for a defense lawyer in Federal court is $10,000. At that point they just take assets that are paid off.