Here are the latest items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on Bitcoin Market Manipulation. (See the Cryptos section.)

Precious Metals:

First up, at Zero Hedge: Russia Buys 300,000 Ounces Of Gold In March – Nears 2,000 Tons In Reserves

o o o

Silver Short Squeeze Unable to Ignite the Gold Sector…Yet

o o o

Michael Ballanger: Whither Silver From Here?

Stocks and Bonds:

I warned readers that rising interest rates would cause some big market drops. Well, here they come: Dow drops over 500 points after 10-year Treasury yield touches 3%

Cryptos (Bitcoin Market Manipulation):

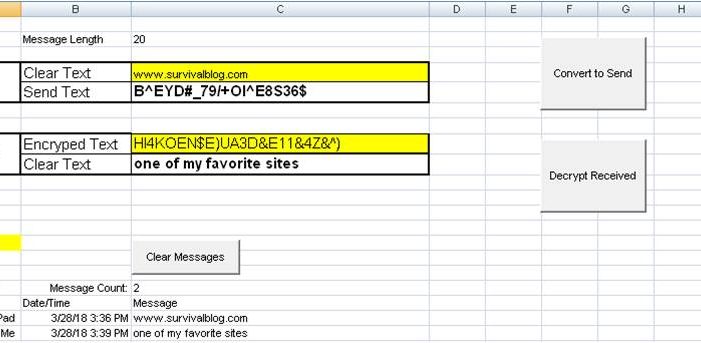

It is noteworthy that the U.S. Dollar trade value of Bitcoin (BTC) has been bouncing around $9,300 but then it regularly gets pushed back down below $8,850. This definitely smacks of automated sell orders that are in place. As I’ve mentioned before, only 50 individuals and entities hold more than half of all of the Bitcoin now in existence. One of those entities is the U.S. Government. It does so, because the Justice Department made a few high-profile seizures of Bitcoin. Most notorious was their “tackle in the public library” seizure of more than 144,000 BTC from Silk Road manager Ross Ulbricht (aka The Dread Pirate Roberts or DPR) in 2013. At the time, that chunk of BTC (then worth $130 per BTC) was valued at just $28.5 million. But at $9,000 USD each, that 144,000 BTC equates to nearly $1.3 Billion USD!Continue reading“Economics & Investing For Preppers”