Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. This column emphasizes JWR’s “tangibles heavy” investing strategy and contrarian perspective. Today, we look at the global debt crisis in general and the U.S. National Debt, in particular.

Precious Metals:

With both world war tensions and a global debt crisis brewing, the precious metals bull market is picking up speed. I took note that spot gold stood at $3,393.60 USD per Troy ounce on Thursday morning. It seems likely that Mr. Bull may be taking another run at $3,500, soon. The last time that happened was on April 22nd. Meanwhile, spot silver jumped 3.74% to a quite respectable $36.03 per Troy ounce. I expect the silver-to-gold ratio to continue to narrow, throughout the rest of 2025. Ditto for the platinum-to-gold ratio. – JWR

o o o

Bank of America Eyeballs $4,000 Gold and $40 Silver.

o o o

‘Gold As Collateral For Internationalized Yuan’ Is Agenda For BRICS 2025 Summit.

Economy & Finance:

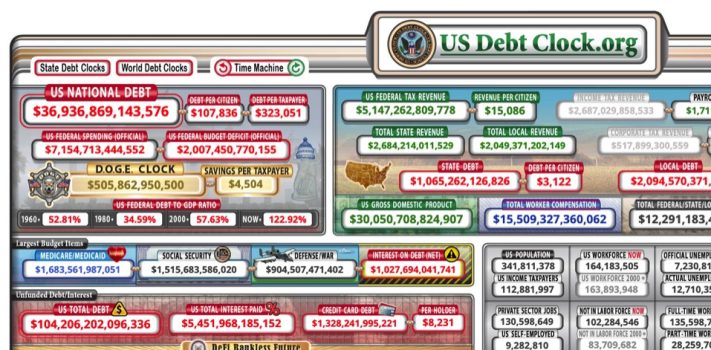

A very informative video, from Jeff Snider of EuroDollar University: This Is What An Economic Collapse Actually Looks Like. JWR’s Comments: I concur with Snider, generally. A global recession is waiting in the wings and there is a likelihood of deflation in Europe in China. But meanwhile, inflation will re-emerge in the United States. If interest rates spike in the U.S., there could be a debt crisis for the U.S Treasury — and the Federal Reserve banking cartel will not be able to stop it. Plan accordingly. (Especially vis-à-vis your precious metals and crypto portfolios.)

o o o

Brookings: What are the risks of a rising federal debt?

o o o

o o o

Billionaire Ray Dalio warns of ‘economic heart attack’ as debt crisis escalates.

o o o

OECD: Global Debt Report. Here is an excerpt from the report’s opening summary:

“Sovereign bond issuance in OECD countries is projected to reach a record USD 17 trillion in 2025, up from USD 14 trillion in 2023. Emerging markets and developing economies’ (EMDE) borrowing from debt markets has also grown significantly, from around USD 1 trillion in 2007 to over USD 3 trillion in 2024. The outstanding global stock of corporate bond debt reached USD 35 trillion at the end of 2024, resuming a long-term trend of over two decades of consecutive increases in indebtedness that came to a temporary halt in 2022.”