“Those who are capable of tyranny are capable of perjury to sustain it.” –

- Ad USA Berkey Water Filters - Start Drinking Purified Water Today!#1 Trusted Gravity Water Purification System! Start Drinking Purified Water now with a Berkey water filtration system. Find systems, replacement filters, parts and more here.

- Ad Civil Defense ManualClick Here --> The Civil Defense Manual... The A to Z of survival. Looks what's in it... https://civildefensemanual.com/whats-in-the-civil-defense-manual/

Preparedness Notes for Thursday — June 10, 2021

On June 10, 1967, the Six-Day War ended as Israel and Syria agreed to observe a United Nations-mediated cease-fire.

—

SurvivalBlog Writing Contest

Today we present another entry for Round 95 of the SurvivalBlog non-fiction writing contest. The prizes for this round include:

First Prize:

- The photovoltaic power specialists at Quantum Harvest LLC are providing a store-wide 10% off coupon. Depending on the model chosen, this could be worth more than $2000.

- A Gunsite Academy Three Day Course Certificate. This can be used for any of their one, two, or three-day course (a $1,095 value),

- A course certificate from onPoint Tactical for the prize winner’s choice of three-day civilian courses, excluding those restricted for military or government teams. Three-day onPoint courses normally cost $795,

- DRD Tactical is providing a 5.56 NATO QD Billet upper. These have hammer forged, chrome-lined barrels and a hard case, to go with your own AR lower. It will allow any standard AR-type rifle to have a quick change barrel. This can be assembled in less than one minute without the use of any tools. It also provides a compact carry capability in a hard case or in 3-day pack (a $1,100 value),

- Two cases of Mountain House freeze-dried assorted entrees in #10 cans, courtesy of Ready Made Resources (a $350 value),

- A $250 gift certificate good for any product from Sunflower Ammo,

- American Gunsmithing Institute (AGI) is providing a $300 certificate good towards any of their DVD training courses.

Second Prize:

- A Front Sight Lifetime Diamond Membership, providing lifetime free training at any Front Sight Nevada course, with no limit on repeating classes. This prize is courtesy of a SurvivalBlog reader who prefers to be anonymous.

- A Glock form factor SIRT laser training pistol and a SIRT AR-15/M4 Laser Training Bolt, courtesy of Next Level Training, that have a combined retail value of $589,

- Two 1,000-foot spools of full mil-spec U.S.-made 750 paracord (in-stock colors only) from www.TOUGHGRID.com (a $240 value).

- An Israeli CBRN Gas Mask with Hydration Straw and two Extra 40mm NATO Filter s – Manufactured in 2020 (a $229.99 value), courtesy of McGuire Army-Navy.

- Naturally Cozy is donating a “Prepper Pack” Menstrual Kit. This kit contains 18 pads and it comes vacuum-sealed for long term storage or slips easily into a bugout bag. The value of this kit is $220.

- An assortment of products along with a one-hour consultation on health and wellness from Pruitt’s Tree Resin (a $265 value).

Third Prize:

- Three sets each of made-in-USA regular and wide-mouth reusable canning lids. (This is a total of 300 lids and 600 gaskets.) This prize is courtesy of Harvest Guard (a $270 value)

- A Royal Berkey water filter, courtesy of Directive 21 (a $275 value),

- Siege Stoves is generously donating a SIEGE® STOVE kit, including a Titanium Gen 3 Flat-Pack Stove with titanium Cross-Members and a variety of bonus items including a Large Folding Grill, a pair of Side Toasters, a Compact Fire Poker, and an extra set of stainless steel universal Cross-Members. (In all, a $200 value.)

- Two Super Survival Pack seed collections, a $150 value, courtesy of Seed for Security, LLC,

- A transferable $150 purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun. There is no paperwork required for delivery of pre-1899 guns into most states, making them the last bastion of firearms purchasing privacy!

Round 95 ends on July 31st, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging.

- Ad LifeSaver 20K JerryCan Water PurifierThe best water jerrycan you can buy on the market! Mention Survivalblog for a Free Filter ($130 Value)

- Ad Trekker Water Station 1Gal Per MinuteCall us if you have Questions 800-627-3809

The Citroen 2CV as a Prepper Vehicle, by Steve W.

Many would consider the Citroen 2CV an unlikely vehicle for preparedness plans. But based on 40 years of personal experience with the car, I am suggesting that you consider the Citroen 2CV as a backup vehicle for your preparedness plans. While not a fancy car, my many kilometers and miles driving a 2CV in across Europe and North America have been easily the least costly road miles that I have logged, and they were a lot of fun.

25 years ago, I wrote:

“A 2CV is the past, days spent going vineyard to vineyard, New Year’s Eve in Guernica Spain for three days straight, crazy descending down “Burg Wachenburg” Weinheim an der Bergstrasse, Germany with the 2CV’s motor turned off, days spent watching geysers while drinking local champagne. A 2CV is max speed on city streets (and sidewalks), is having your paperwork review at machinegun point in Victoria, is briefly claiming that center lane in Luxemburg to pass whatever was a little bit slower. A 2CV is seats out and car loaded full of cases of wine, is cooking out and camping in the mountains, is paying the local beach lads to dive for a better looking and hopefully better tasting fish for your lunch while on the Mediterranean Sea.

A 2CV is today, an oddity in the great north woods of the upper Midwest, it is always finding business cards and notes under the wipers asking to buy my car, is making Milwaukee and return on just a fiver. A 2CV is never being able to sneak in anywhere, because of the small crowd it attracts and the questions. A 2CV is filling the car completely with wrapped Christmas gifts.

A 2CV is tomorrow, a minimalistic, self-repairable 21st century transport. A 2CV is 400 miles in a spare jerry can. A 2CV is a no-computer, EMP resistant survivor. A 2CV is history in action.

All in all, a 2CV is clean good fun!”

I am not going to try to paraphrase the massively inclusive write-up of the history of the 2CV series which you can find at InfoGlactic. (Please note the 2CV Series is part of Citroen’s “A-series” which include van, jeep-like, and other car variants.)

These cars are not physically super small, but they are not big, either. They use a simple opposed (boxer type) 2-cylinder air-cooled engine, four-speed manual transmission, and front wheel drive. Their long-travel suspension handles rough roads or no roads rather well.Continue reading“The Citroen 2CV as a Prepper Vehicle, by Steve W.”

- Ad California Legal Rifles & Pistols!WBT makes all popular rifles compliant for your restrictive state. Choose from a wide range of top brands made compliant for your state.

- Ad Click Here --> Civil Defense ManualNOW BACK IN STOCK How to protect, you, your family, friends and neighborhood in coming times of civil unrest… and much more!

The Survivalist’s Odds ‘n Sods

SurvivalBlog presents another edition of The Survivalist’s Odds ‘n Sods— a collection of news bits and pieces that are relevant to the modern survivalist and prepper from “JWR”. Our goal is to educate our readers, to help them to recognize emerging threats, and to be better prepared for both disasters and negative societal trends. You can’t mitigate a risk if you haven’t first identified a risk. Today, we look at some new revelations about the origin of the Wuhan Flu virus.

MSM, Governments Suffer Fastly CDN Internet Outage

H.L. mentioned this news, summarized over at Kit Knightly’s Off-Guardian: MSM experiences global internet outage. Be sure to read the comments. The problem appears to be with the Fastly content delivery network (CDN). The key question: Was it just a glitch, or was it a cyber attack?

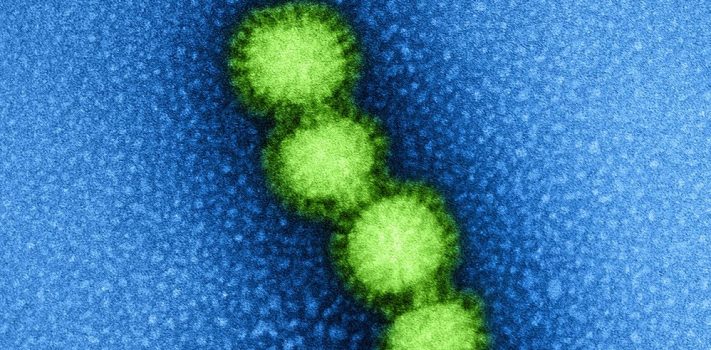

Evidence Suggesting COVID-19 was Engineered by Wuhan Lab

Linked over at the Whatfinger.com news aggregation site: Two experts show damning fact in genome blueprint suggesting COVID-19 was engineered in Wuhan lab.

COVID Origins Report From LLNL’s Z Division: Lab Leak ‘Plausible’

COVID Origins Report From Lawrence Livermore “Z Division” Concluded In May 2020 Lab Leak ‘Plausible’.

Karl Denninger on the Wuhan Flu Genetic Resequencing

Karl Denninger on the Wuhan Genetic Resequencing: Ok, Now We’re Done. here is a key quote:

“A Chinese Communist Party military scientist who got funding from the National Institutes of Health filed a patent for a COVID-19 vaccine in February last year — raising fears the shot was being studied even before the pandemic became public, according to a new report.

Zhou Yusen, a decorated military scientist for the People’s Liberation Army (PLA) who worked alongside the Wuhan Institute of Virology as well as US scientists, filed a patent on Feb. 24 2020, according to documents obtained by The Australian.”

- Ad USA Berkey Water Filters - Start Drinking Purified Water Today!#1 Trusted Gravity Water Purification System! Start Drinking Purified Water now with a Berkey water filtration system. Find systems, replacement filters, parts and more here.

- Ad Survival RealtyFind your secure and sustainable home. The leading marketplace for rural, remote, and off-grid properties worldwide. Affordable ads. No commissions are charged!

The Editors’ Quote of the Day:

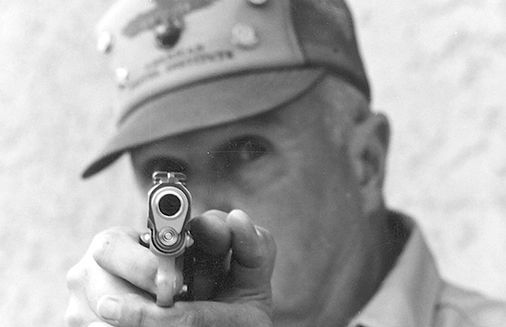

“The rifle itself has no moral stature, since it has no will of its own. Naturally, it may be used by evil men for evil purposes, but there are more good men than evil, and while the latter cannot be persuaded to the path of righteousness by propaganda, they can certainly be corrected by good men with rifles.” – Col. Jeff Cooper

- Ad Ready Made Resources, Trijicon Hunter Mk2$2000 off MSRP, Brand New in the case

- Ad STRATEGIC RELOCATION REALTYFOR SALE: Self-sustaining Rural Property situated meticulously in serene locales distant from densely populated sanctuary cities. Remember…HISTORY Favors the PREPARED!

Preparedness Notes for Wednesday — June 9, 2021

Today is the birthday of Jean Alexandre Francois LeMat (1824–1883), best known for the percussion cap-fired LeMat revolver. It was a clever design, with a nine-shot .42 caliber cylinder revolving around a 20-gauge shotgun barrel. The LeMat was considered a fairly obscure footnote in firearms history up until some nice replicas (in .44) were manufactured by Pietta, and then it got a lot of screen time in Holywood movies, most notably in Twelve Monkeys and Cold Mountain.

On June 9, 1940 Norway surrendered to the invading German army, during World War II. The citizenry was then quickly disarmed by the Nazis, so resistance was limited. (The invaders had access to the Norwegian police gun registration lists.) To limit reprisals by the Germans, King Hakkon the 7th also ordered that only Norwegian troops operating from offshore should overtly resist the Nazis.

—

SurvivalBlog Writing Contest

Today we present another entry for Round 95 of the SurvivalBlog non-fiction writing contest. The prizes for this round include:

First Prize:

- The photovoltaic power specialists at Quantum Harvest LLC are providing a store-wide 10% off coupon. Depending on the model chosen, this could be worth more than $2000.

- A Gunsite Academy Three Day Course Certificate. This can be used for any of their one, two, or three-day course (a $1,095 value),

- A course certificate from onPoint Tactical for the prize winner’s choice of three-day civilian courses, excluding those restricted for military or government teams. Three-day onPoint courses normally cost $795,

- DRD Tactical is providing a 5.56 NATO QD Billet upper. These have hammer forged, chrome-lined barrels and a hard case, to go with your own AR lower. It will allow any standard AR-type rifle to have a quick change barrel. This can be assembled in less than one minute without the use of any tools. It also provides a compact carry capability in a hard case or in 3-day pack (a $1,100 value),

- Two cases of Mountain House freeze-dried assorted entrees in #10 cans, courtesy of Ready Made Resources (a $350 value),

- A $250 gift certificate good for any product from Sunflower Ammo,

- American Gunsmithing Institute (AGI) is providing a $300 certificate good towards any of their DVD training courses.

Second Prize:

- A Front Sight Lifetime Diamond Membership, providing lifetime free training at any Front Sight Nevada course, with no limit on repeating classes. This prize is courtesy of a SurvivalBlog reader who prefers to be anonymous.

- A Glock form factor SIRT laser training pistol and a SIRT AR-15/M4 Laser Training Bolt, courtesy of Next Level Training, that have a combined retail value of $589,

- Two 1,000-foot spools of full mil-spec U.S.-made 750 paracord (in-stock colors only) from www.TOUGHGRID.com (a $240 value).

- An Israeli CBRN Gas Mask with Hydration Straw and two Extra 40mm NATO Filter s – Manufactured in 2020 (a $229.99 value), courtesy of McGuire Army-Navy.

- Naturally Cozy is donating a “Prepper Pack” Menstrual Kit. This kit contains 18 pads and it comes vacuum-sealed for long term storage or slips easily into a bugout bag. The value of this kit is $220.

- An assortment of products along with a one-hour consultation on health and wellness from Pruitt’s Tree Resin (a $265 value).

Third Prize:

- Three sets each of made-in-USA regular and wide-mouth reusable canning lids. (This is a total of 300 lids and 600 gaskets.) This prize is courtesy of Harvest Guard (a $270 value)

- A Royal Berkey water filter, courtesy of Directive 21 (a $275 value),

- Siege Stoves is generously donating a SIEGE® STOVE kit, including a Titanium Gen 3 Flat-Pack Stove with titanium Cross-Members and a variety of bonus items including a Large Folding Grill, a pair of Side Toasters, a Compact Fire Poker, and an extra set of stainless steel universal Cross-Members. (In all, a $200 value.)

- Two Super Survival Pack seed collections, a $150 value, courtesy of Seed for Security, LLC,

- A transferable $150 purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun. There is no paperwork required for delivery of pre-1899 guns into most states, making them the last bastion of firearms purchasing privacy!

Round 95 ends on July 31st, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging.

- Ad SIEGE belt: the original unmatched action belt. Proven in many unexpected situations on wearers' daily routines & travels. Engineered for extreme durability, performance, comfort & stunning looks. The only effective EDC you can take anywhere.SIEGE STOVES: prep for adventure/crisis with the ultimate ultra-compact survival stove. SIEGE BELTS: prized by those in the know. Blazing fast. Stunning appearance. USA-made.

- Add Your Link Here

Chainsaw Fuels for Long Term Storage, by Tunnel Rabbit

Even if I do not have time to lay out all that I know about long-term storage of various fuels and the various types of engines that might consume that fuel, perhaps I can pass along some helpful information.

As a rule of thumb, I figure I’ll need one gallon of chainsaw gas for every one cord of wood that I cut, and I’ll need half that volume in bar oil. If we can keep a chainsaw running, then that fuel could be of adequate quality to run anything else. Gasoline is much more difficult to store than diesel, and if we can successfully store gas that meets the higher standard needed to run a modern chainsaw, then we can run anything else with that gas. However, we could also go electric and run a diesel generator to charge an electric chainsaw, but I simply do not have the excessive wealth for that option at this time. Another way is to have a large enough PV array to charge an electric chainsaw. If I could, my first choice in an electric saw would be a Makita, yet as it is, my best choice is an old school, slow and heavy 35 year old saw that I believe is a better choice as it can run on lower octane fuel and a variety of 2 cycle engine oils, even 30 weight motor oil in the fuel in a pinch. But then most already have a modern chainsaw, and so do I, so we’ll need fuel for these.

The old, slow, and heavy saws have their virtues. The most noteworthy is that in a long-term collapse scenario, it can run on low octane fuel that might harm a modern saw. Unfortunately, it would be difficult for the average person to locate or repair an old school saw, so they must contend with the fuel requirement of modern lightweight, and high-performance saws. The problem for modern saws is its requirement for high octane gasoline. Without that, the engine can overheat and become damaged. If you run a modern StIhl saw on low octane gas, or even with fresh premium fuel with too much 2 cycle oil in it, the octane rating is too low. When run hard and hot, one might hear pre-detonation (knocking) in the cylinder that can burn a hole in the piston over time, or immediately. These are high-performance machines, akin to a Formula One race car. There is little tolerance to less than ideal fuels and lubricants. My old school saw is more like a tractor in comparison. It is harder to use, but keeps on plowing through wood, decade after decade with whatever I put into it. The brand and model of my old saw is not important, it is the technology that is used in these saws that is important. Currently, I am running 2-year-old untreated (not stabilized) premium non-ethanol fuel it with a 32 to 1 ratio mix of TW3 rated 2 cycle oil that is not recommended for modern chainsaws. This fuel would not work well, and would probably damage a modern saw and certainly degrade it’s performance. Old school saws are much less ‘picky’ in other ways as well. I have gallons of TW3 type 2 cycle oil intended for water-cooled 2 cycle engines that I got for free. It is higher grade lubricant than was available when the old saw was made.

A modern saw should use a 50 to 1, or a 40 to 1 mixture with a synthetic lubricant for best performance and longevity. Stihl requires 50 to 1 and premium fuel. It is also important to use non ethanol premium grade with an octane rating of 91. Because the ethanol is hydrophillic, and water can be absorbed into fuel during storage. Water suspended in the fuel by the ethanol does not mix well with 2 cycle lubricating oils, and damage can be done to the engine. Water can also accumulated in any fuel tank or container. When filling the saw fuel, always leave about an inch of fuel on the bottom of the gas can to avoid putting water that is at the bottom of the fuel into the saw. Any water in the fuel could quickly damage the piston and cylinder wall. Benzine, not the ethanol can do damage by shortening the life span of the diaphragm in chain saw carburetors. Have several replacement complete carburetors. Gasoline from the 1960s and 1970s was closer to pure gasoline. Old school gasoline did not have near the list of additives, such as olifins that gum up works, and other additives. As time progress, more additives were added for various reasons. The diaphragm is the fuel pump for the saw. Using gas that does not harm the diaphragm, or plug up the very fine orifice inside these tiny carburetors improves reliability and performance. Also octane rating becomes lower as the stored fuel degrades in general. Oxygen is the primary enemy of gasoline. If the can breathes, or is permeable to oxygen, as are plastic storage containers, the rate of degradation increases. Swings in temperatures cause not only condensation, but more import, unacceptably high internal pressures that may cause essential light violate gases to escape containment.Continue reading“Chainsaw Fuels for Long Term Storage, by Tunnel Rabbit”

SurvivalBlog Readers’ & Editors’ Snippets

This weekly column is a collection of short snippets: practical self-sufficiency items, how-tos, lessons learned, tips and tricks, and news items — both from readers and from SurvivalBlog’s editors. We may select some long e-mails for posting as separate letters.

Firstly, and most importantly, there is this encouraging news: Federal Judge Overturns California’s Assault Weapons Ban. The full text of the decision can be seen here. JWR’s Comments: Be advised that the automatic stay leaves the door open for a very likely appeal, anytime in the next 25 days. So we can expect this to advance to a Ninth Circuit three-judge panel, and then if they overturn Judge Benitez’s ruling, eventually to the U.S. Supreme Court. That appeals process could take several years.

o o o

Reader Tim J. sent this news from Florida: Nikki Fried Amends Financial Disclosure Ahead of Campaign Announcement.

“Nikki Fried’s amendment of her financial disclosure forms three days before she announced her gubernatorial candidacy made state and national news.

The report revealed Fried failed to report approximately $280,000 in income from a marijuana company she lobbied for in 2018.”

o o o

Drug cartels attack enemies and spread terror with weaponized drones in US, Mexico.

o o o

Reader H.L. sent this: If California is Facing a Rare Mega-Drought, Why is the State Releasing Water from Reservoirs?

The Editors’ Quote of the Day:

“The Framers of the Bill of Rights did not purport to ‘create’ rights. Rather, they designed the Bill of Rights to prohibit our Government from infringing rights and liberties presumed to be preexisting.” – Justice William J. Brennan

Preparedness Notes for Tuesday — June 8, 2021

On June 8, 1867, Frank Lloyd Wright was born in Richland Center, Wisconsin.

—

On June 8, 1937, Carl Orff’s Carmina Burana is premiered. The symphony’s cantata, featuring Orff’s dramatic chorale of the medieval poem O Fortuna, has been used in umpteen movie soundtracks. It is also a de facto choice for the makers of movie trailers for new films that have not yet been scored.

—

On June 8th, 1776, Canadian Governor Sir Guy Carleton defeated American Patriot forces under John Sullivan. After taking heavy losses and the loss of General Richard Montgomery at Quebec, the Patriots were pursued by Governor Carleton. Halfway between Quebec and Montreal, at the Trois-Rivieres, the Patriots turned to fight. The Redcoats and German mercenaries killed 25, wounded 140, and captured 236, but Carleton allowed the rest of the 2,500-man force to complete their retreat. This battle changed the priorities of the Patriots, and Colonel Benedict Arnold wrote, “Let us quit and secure our own country before it is too late.”

—

The BATF just released their “Proposed Rulemaking” on pistol arm braces that was dictated by the Biden-Harris administration: “Factoring Criteria for Firearms with Attached ‘Stabilizing Braces.'” This 71-page document is as clear as mud and is an incredibly subjective, vague, discretionary, and arbitrary bureaucratic minefield. Many of the “standards” proposed do not take into account body shapes, body height, or variations in the diameter of people’s forearms. The new rules will ban dozens of arm brace designs that were formerly “ATF-Approved” and thereby transform millions of law-abiding citizens into instant felons. Worse, the identical brace that is deemed legal on some pistols would be illegal on other pistols that weigh too much, or too little. And even worse, they will penalize pistol owners for installing hand stops designed to keep them from accidentally shooting off their fingers! MrGunsngear has already posted a preliminary video, analyzing this bureaucratic monstrosity. Once the BATF opens up comments on these proposed rules and their farcically subjective “worksheet”, please voice your opposition! And please also contact your U.S. senators and congressman. This bureaucratic “re-definition” over-reach must be stopped!

SurvivalBlog Writing Contest

Today we present another entry for Round 95 of the SurvivalBlog non-fiction writing contest. The prizes for this round include:

First Prize:

- The photovoltaic power specialists at Quantum Harvest LLC are providing a store-wide 10% off coupon. Depending on the model chosen, this could be worth more than $2000.

- A Gunsite Academy Three Day Course Certificate. This can be used for any of their one, two, or three-day course (a $1,095 value),

- A course certificate from onPoint Tactical for the prize winner’s choice of three-day civilian courses, excluding those restricted for military or government teams. Three-day onPoint courses normally cost $795,

- DRD Tactical is providing a 5.56 NATO QD Billet upper. These have hammer forged, chrome-lined barrels and a hard case, to go with your own AR lower. It will allow any standard AR-type rifle to have a quick change barrel. This can be assembled in less than one minute without the use of any tools. It also provides a compact carry capability in a hard case or in 3-day pack (a $1,100 value),

- Two cases of Mountain House freeze-dried assorted entrees in #10 cans, courtesy of Ready Made Resources (a $350 value),

- A $250 gift certificate good for any product from Sunflower Ammo,

- American Gunsmithing Institute (AGI) is providing a $300 certificate good towards any of their DVD training courses.

Second Prize:

- A Front Sight Lifetime Diamond Membership, providing lifetime free training at any Front Sight Nevada course, with no limit on repeating classes. This prize is courtesy of a SurvivalBlog reader who prefers to be anonymous.

- A Glock form factor SIRT laser training pistol and a SIRT AR-15/M4 Laser Training Bolt, courtesy of Next Level Training, that have a combined retail value of $589,

- Two 1,000-foot spools of full mil-spec U.S.-made 750 paracord (in-stock colors only) from www.TOUGHGRID.com (a $240 value).

- An Israeli CBRN Gas Mask with Hydration Straw and two Extra 40mm NATO Filter s – Manufactured in 2020 (a $229.99 value), courtesy of McGuire Army-Navy.

- Naturally Cozy is donating a “Prepper Pack” Menstrual Kit. This kit contains 18 pads and it comes vacuum-sealed for long term storage or slips easily into a bugout bag. The value of this kit is $220.

- An assortment of products along with a one-hour consultation on health and wellness from Pruitt’s Tree Resin (a $265 value).

Third Prize:

- Three sets each of made-in-USA regular and wide-mouth reusable canning lids. (This is a total of 300 lids and 600 gaskets.) This prize is courtesy of Harvest Guard (a $270 value)

- A Royal Berkey water filter, courtesy of Directive 21 (a $275 value),

- Siege Stoves is generously donating a SIEGE® STOVE kit, including a Titanium Gen 3 Flat-Pack Stove with titanium Cross-Members and a variety of bonus items including a Large Folding Grill, a pair of Side Toasters, a Compact Fire Poker, and an extra set of stainless steel universal Cross-Members. (In all, a $200 value.)

- Two Super Survival Pack seed collections, a $150 value, courtesy of Seed for Security, LLC,

- A transferable $150 purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun. There is no paperwork required for delivery of pre-1899 guns into most states, making them the last bastion of firearms purchasing privacy!

Round 95 ends on July 31st, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging.

You Can Shoot — But Can You Fight?, by B.D.C.

Many of you, like myself, have stored firearms and ammunition for events likely to come. Many of you train to become proficient in the use of firearms. But do you know how to fight? Knowing how to effectively deliver an accurate shot to a target from a static position is not knowing how to fight. It is knowing how to shoot.

This article is not going to be a how-to. Its purpose is to educate you in the skills you need to effectively fight with a firearm under adverse conditions. Do you train under adverse conditions?

To illustrate what I am talking about here are a few questions you may want to ask yourself:

1. Can I deliver accurate fire while moving? If you are shooting you’d best be moving.

2. Can I shoot under pressure while trying to discriminate targets?

3. Can I shoot bad guys without flagging good guys?

4. Does my gun follow my eyes, or do my eyes follow my gun?

5. Can I shoot, move and communicate as a team? Is your spouse trained to shoot as a team?

6. If I have to leave my car under duress, do I know how do do so and get my family out safely?

7. Do I know the difference between cover and concealment?

8. Do I know how to properly use cover?

9. Do I know how to properly use a weapon-mounted light without flagging good guys?

10. How do I protect my family in an active shooter situation?

11. How many shots should I take into a bad guy?

12. How do I break tunnel vision?

13. What is getting off the “X”?

14. Can I think under pressure? Do I have a system to do so?

15. Do I know the three ways to stop a threat?

16. Can I reload if my shooting arm is hit?

17. Have I trained to shoot with my support hand?

18. Do I know how to reload without taking my eyes off of the threat?

19. Do I know the proper procedure if my weapon fails to fire or jams? What would be my “immediate action”?

20. Do I know how to properly draw from a holster?

21. What do I do if I am hit by gunfire?

22. Do I know how to stop the bleed?

23. Do I know how to deal with multiple threats?

24. Do I have a plan for a home invasion?

25. Can I shoot accurately from various positions?

26. Can I transition from a rifle to a handgun?

27. Is my firearm choice appropriate for my living environment and conditions? Will it over- penetrate?

28. Can I hit a moving target?

I consider the foregoing questions to be basic knowledge for anyone preparing to defend with a firearm.

Continue reading“You Can Shoot — But Can You Fight?, by B.D.C.”

SurvivalBlog’s News From The American Redoubt

This weekly column features news stories and event announcements from around the American Redoubt region. (Idaho, Montana, eastern Oregon, eastern Washington, and Wyoming.) Much of the region is also more commonly known as The Inland Northwest. We also mention companies of interest to preppers and survivalists that are located in the American Redoubt region. Today, we focus on another plan to move the Washington state line. (See the Central & Eastern Washington section.)

Idaho

Draper Couple Survives Small Plane Crash in Idaho

o o o

Fiery head-on car crash in Idaho kills 4, including 3 sisters

o o o

Cheerleader dies after suffering allergic reaction to dessert, family says

Continue reading“SurvivalBlog’s News From The American Redoubt”

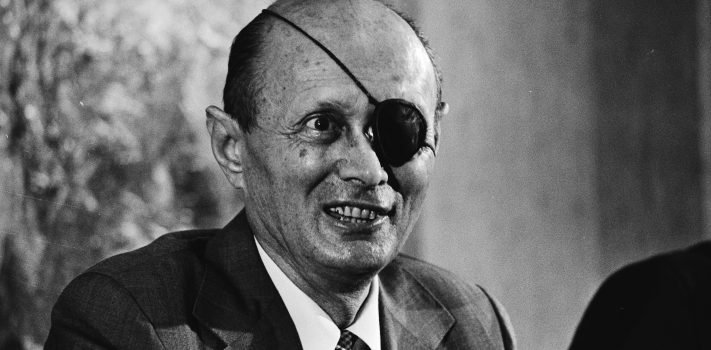

The Editors’ Quote of the Day:

“Freedom is the oxygen of the soul. ” – Moshe Dayan

Preparedness Notes for Monday — June 7, 2021

On June 7th, 1776, Richard Henry Lee of Virginia (pictured) proposed to the Continental Congress a resolution calling for a Declaration of Independence.

June 7th, 1967 is also the day of Jerusalem’s redemption from foreign governments in the Six-Day War, placing it back under Israeli sovereign control after having been occupied for over 2,500 years. This was in accord with the UN General Assembly’s vote in 1948.

—

We are running short of articles for the SurvivalBlog Nonfiction Writing Contest. We’d greatly appreciate it if you’d share your knowledge. And you’ll be in the running to win some valuable prizes!

—

Today, we present a review by our loyal Field Gear Editor, Pat Cascio.

Rock Island Armory 1911 Government Model, by Pat Cascio

There are more 1911 pistols made in the Philippines than in any other country in the world – and that’s a fact. It wasn’t all that many years ago, when it was a real hit or miss, on 1911s from this country. And, as I understand it, there are three major companies that produce 1911s over there. Doesn’t matter what name is stamped on the gun – odds are real good that your Philippine-made 1911 came from one of those three makers. In the past, about the only thing you could get from the Philippines, was a bare bones, military-style 1911 – nothing more. All of that has changed in the past 10-12 years, though. Now you can get just about any kind of 1911 you want, and best of all, prices are more than “right” even during this latest gun/ammo drought.

My local FFL had just one 1911 for sale some time ago, and I took it, sight unseen – well, they sent me a picture of the gun, and I got it. It is a full-sized Government Model 1911 in .45 ACP. It has an all-steel frame and slide. The frame has a brushed nickel coating on it – very tough stuff. The steel slide, hammer, grip safety, trigger, slide release, and magazine release were all finished in Cerakote – gradated black to red, with a very attractive look. Those colors very nicely match the red and black coloration of the pistol’s checkered Cocobolo grips. I referenced the Rock Island Armory web site, and saw that this particular model variant wasn’t listed. So, I’m guessing that either it was a discontinued variant edition or that someone had the work done locally on the slide. The gun came to me out of pawn. (Whomever previously owned it, never paid off the pawn ticket, so the gun was put up for sale.)

My local FFL had just one 1911 for sale some time ago, and I took it, sight unseen – well, they sent me a picture of the gun, and I got it. It is a full-sized Government Model 1911 in .45 ACP. It has an all-steel frame and slide. The frame has a brushed nickel coating on it – very tough stuff. The steel slide, hammer, grip safety, trigger, slide release, and magazine release were all finished in Cerakote – gradated black to red, with a very attractive look. Those colors very nicely match the red and black coloration of the pistol’s checkered Cocobolo grips. I referenced the Rock Island Armory web site, and saw that this particular model variant wasn’t listed. So, I’m guessing that either it was a discontinued variant edition or that someone had the work done locally on the slide. The gun came to me out of pawn. (Whomever previously owned it, never paid off the pawn ticket, so the gun was put up for sale.)

The sights – the front is all-black, and the rear has two white dots and is a “combat-style” very nice indeed. I painted the front sight with some blaze orange nail polish – I may replace both sights with night sights – still thinking on that one. There is no Series 80-style firing pin safety – an I prefer that simplicity. The slide is lowered and chamfered for reliable ejection of loaded and empty brass. The barrel is all-black, and take-down is of the Government-style – no extended recoil spring guide to deal with.

The sights – the front is all-black, and the rear has two white dots and is a “combat-style” very nice indeed. I painted the front sight with some blaze orange nail polish – I may replace both sights with night sights – still thinking on that one. There is no Series 80-style firing pin safety – an I prefer that simplicity. The slide is lowered and chamfered for reliable ejection of loaded and empty brass. The barrel is all-black, and take-down is of the Government-style – no extended recoil spring guide to deal with.

The barrel/slide/frame fit is impeccable – just a hint of movement between those parts, so I knew the gun would be a real good shooter. The barrel’s chamber ramp is flared, so it will feed any kind of .45 ACP ammo you care to feed this gun. The feed ramp on the slide has been opened and polished – once again, to help the gun feed anything you want to stoke it with.Continue reading“Rock Island Armory 1911 Government Model, by Pat Cascio”