(Continued from Part 1. This concludes the article.)

No matter what third-party players do on the international stage (China, Russia, Iran – in that order), this country may be on the road to a slow-rolling collapse over the next eighteen months. All the things that currently get news coverage are like the opening act before Garth Brooks takes the concert stage. Ukraine – So what? Taiwan – Well, it had to happen. Faltering economy – All Trump’s fault. West Texas crude oil above $120 per barrel – Just park your truck. And any of these things could result in higher prices for energy and bigger supply chain problems for electronics and medical supplies plus an additional spurt to inflation which will have already spread to the rest of the global economy.

As long as the electrical grid, internet, and financial processing networks continue to work at some level, relatively limited urban violence but rapidly rising crime rates seem likely and will be hell for the merchants and local residents experiencing it. Peaceful protests complete with torched police cars and burning buildings will most likely be concentrated in the inner-city areas of major metro areas. Los Angeles, Houston, Portland, Milwaukee, Detroit, Newark, San Francisco, Seattle, Chicago, and New Yok City. These conspicuously blue cities have already experienced peaceful protesters and sympathetic prosecutors as their own warmup gigs. The new protests may be triggered before November on relatively trivial fake news.

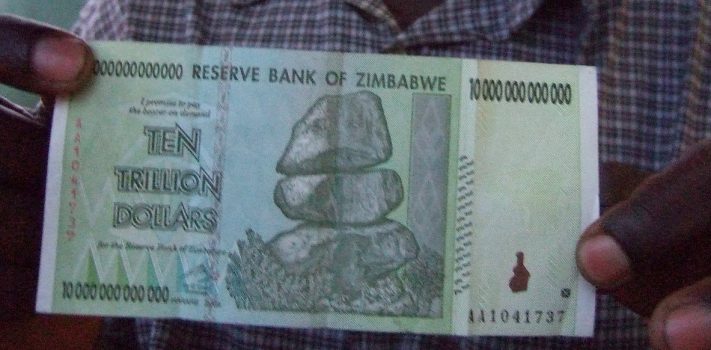

All bets are off if there are major terrorist attacks on refineries, the power grid, or the telecom networks including cell and internet. If that happens, kiss normal “Goodbye” – in a rush. Meantime, life won’t be exactly normal in either small cities or suburbia or even fly-over country. One of the many consequence of sustained inflation is government budget over-runs, and this will hit municipal and state governments as soon as real inflation goes beyond 10% or perhaps earlier. What will happen next and is already starting to occur is that municipal bond underwriters will not be able to place the massive amount of city and state bond funding that will be needed just to finance daily operations and locked-in pension payments.Continue reading“Inflation: How Bad Could it Get? – Part 2, by Banker Bob”