(Continued from Part 1. This concludes the article.)

No matter what third-party players do on the international stage (China, Russia, Iran – in that order), this country may be on the road to a slow-rolling collapse over the next eighteen months. All the things that currently get news coverage are like the opening act before Garth Brooks takes the concert stage. Ukraine – So what? Taiwan – Well, it had to happen. Faltering economy – All Trump’s fault. West Texas crude oil above $120 per barrel – Just park your truck. And any of these things could result in higher prices for energy and bigger supply chain problems for electronics and medical supplies plus an additional spurt to inflation which will have already spread to the rest of the global economy.

As long as the electrical grid, internet, and financial processing networks continue to work at some level, relatively limited urban violence but rapidly rising crime rates seem likely and will be hell for the merchants and local residents experiencing it. Peaceful protests complete with torched police cars and burning buildings will most likely be concentrated in the inner-city areas of major metro areas. Los Angeles, Houston, Portland, Milwaukee, Detroit, Newark, San Francisco, Seattle, Chicago, and New Yok City. These conspicuously blue cities have already experienced peaceful protesters and sympathetic prosecutors as their own warmup gigs. The new protests may be triggered before November on relatively trivial fake news.

All bets are off if there are major terrorist attacks on refineries, the power grid, or the telecom networks including cell and internet. If that happens, kiss normal “Goodbye” – in a rush. Meantime, life won’t be exactly normal in either small cities or suburbia or even fly-over country. One of the many consequence of sustained inflation is government budget over-runs, and this will hit municipal and state governments as soon as real inflation goes beyond 10% or perhaps earlier. What will happen next and is already starting to occur is that municipal bond underwriters will not be able to place the massive amount of city and state bond funding that will be needed just to finance daily operations and locked-in pension payments.

Within the next six to twelve months, the financial press and then the MSM may have to report difficulties with municipal bond financings and a general credit squeeze from commercial banks even if the Federal Reserve takes only the predicted modest, token steps. As government budgets come under severe pressure, at least two spending line items will be spared at the outset. The first priority will be making retirement payments for underfunded government pension plans out of current cash flow, but right behind will be providing broad support for the homeless and all the uneducated and unskilled illegal immigrants pouring in at a rate of 2 million per year and then bussed and flown at federal expense all over the country.

Eventually, reality will set in, and personnel cuts will be the only remaining option for city and state bureaucracies. Defund the police is coming even where it was not voted in. The trade-off that comes next is between diversity administrators and their friendly, efficient, and loyal support staff versus essential workers in such mundane jobs as street maintenance, garbage collection, sewage processing, and city water systems. There will be a very thin blue line, and municipal services may not be a lot better than Caracas or other Third World cities.

Hospitals, health care providers, and health insurers have had to deal firsthand with all the COVID issues, directives, and mandates and provide services to illegal immigrants on a priority basis. Hospitals will suffer the most as operating costs climb and inflation-related wage pressures make personnel shortages worse. For consumers, insurance rates will jump along with co-pays while coverages will drop. How long before this is a critical problem? Sometime in the next twelve to eighteen months – depending on the actual rise in personnel costs and overall inflation rates.

Supply chain logistics will continue to be a mess even without inflationary disruptions. Between unemployment for people who lost jobs that got eliminated, and employers unable to hire workers at wages that keep pace with inflation, both large and small businesses will face staffing problems and an unrelenting attack on profit margins. How long can businesses of any size continue to operate? A year? Part way into the second half of 2023? All the way to November 2024?

Even if the GOP takes control of one or both the Senate and the House beginning in 2023, there will likely be little or no financial relief coming out of Washington and no new bi-partisan spending or financial support bills for the last two years of the Biden administration regardless who sits in the Oval Office. Expanded unemployment coverage for those folks that employers are forced to lay off will not happen unless Biden or his successor wields the mighty pen and signs an Executive Order releasing unauthorized funding. In the meantime, Biden’s most recent stay on student loans ends May 1 and is causing concerns about whether the stay will be postponed until after the primaries or maybe the November elections so as not to sour the Millennials. Political name-calling and personal hostility will increase dramatically especially if there is an upset in the existing power balance from the midterm elections. Net result: Little or no political compromise or cooperation even in a time of dire need.

At some point in this timeline, festering problems in the economies of China, Russia, and Western Europe may come to a head. China’s entire economy is based on exports. A big drop in buying power abroad means politically unpopular domestic actions. Russia’s main source of income is energy. Any sustained threat to that cash flow will have a huge impact. Europe is already on the ropes as a result of COVID policies exacerbated by former Chancellor Merkel’s successful efforts to aid an invasion of refugees from the Middle East. Expect to see draconian efforts to regulate the European economies which will only make the cumulative problems worse. And, any of these economies may implode at any time.

NO GOOD SOLUTIONS

No good news on the domestic front either. More dependence on imported energy with crude oil back over $100 per barrel and climbing. Guns and ammo in short supply with Biden’s existing embargo on Russian ammunition cutting imports and driving prices up. Total dependence on China, Taiwan, and Korea for chips for many consumer goods but especially for the rolling computers known as gas-guzzling trucks and the rest of the auto industry. The DOJ, FBI, and NSA all concerned more with angry parents than cyber warfare. Teachers’ unions fighting to keep their rights to indoctrinate children up to and including college. Useless vaccines and ineffective boosters being mandated for no valid reason. And then, there are a number of explosive cases in the next two terms at the Supreme Court with outcomes certain to anger a variety of special interest groups on both sides and spark more peaceful protests.

The source has been attributed to various philosophers including Confucius. One articulation came from Robert F. Kennedy in a speech at the University of Cape Town on June 6, 1966:

“There is a Chinese curse which says ‘May he live in interesting times.’ Like it or not, we live in interesting times.”

Yes, we do. Whether you are a hard-core survivalist with a bugout bag, a homesteader with a big garden and few animals, a farmer living in Wyoming or Idaho, an armchair prepper with a luxury apartment in New York City, or a mall Ninja with a safe full of unfired guns, there is good news! The entire country has been given a wake-up call. Use the next six to eighteen months wisely.

• Buy what you need while you can before prices escalate on a quarterly or monthly basis.

• Add to your skill set by taking classes or honing existing skills.

• Practice and train with your defensive preps before you need them.

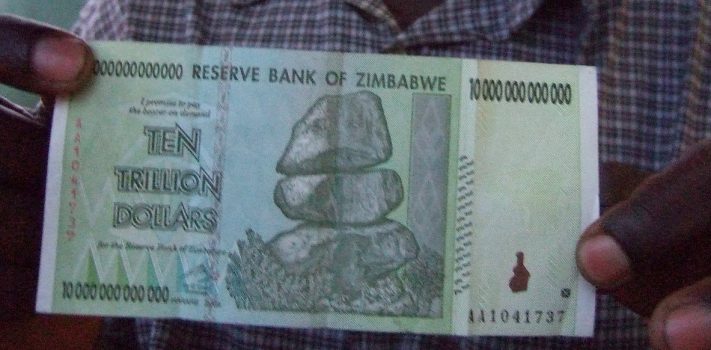

When banks are closed for an extended bank holiday, credit cards are refused, and all EBT/SNAP cards are not funded electronically. The very next step will be violence and property crime on an unprecedented scale. Desperate and hungry people do desperate things – even to neighbors. People accustomed to shopping in a riot do not stop at the checkout.

Those who are quick to respond to the immediate threats may have a chance. Playing nice and providing charity may boost your self-respect but will not reduce the animosity of the have-nots toward the haves. This will be especially true when large groups have a mob mentality.

Should this scenario occur, expect new state and federal government regulations in response to the mayhem making it illegal to have more than a 30-day supply of food (or seven days???) Martial law complete with curfews will be considered by desperate bureaucrats. Firearms of any sort may be declared illegal and special sanctions may apply for having an assault rifle. Lockdowns, vax mandates, and masks have conveniently served as a practice run to condition compliance… “Papiere, bitte.”

People who already live in the American Redoubt or rural areas throughout the country will be in the best position to weather the coming storm. Those who left Dodge, maybe five to ten years ago, will be in better shape than those who stayed to enjoy the big city life. If moving is in your long-range plan, do it now. The paper value of real estate is header higher as are mortgage rates. If you live within 100 miles of any city that experienced peaceful protests in 2020 and are still not sure what to do, then make a decision and move this year.

How bad could it get? Don’t stay to find out.