Much of my career has been in banking or related financial services including day-to-day, hands-on management of large-scale transaction processing centers for one of the world’s largest banks.

Question 1: What’s your personal measure of inflation?

Weekly grocery bill? Filling up your tank at the gas pump? 9mm or 5.56 ammo when you find some? Medical bills? Your individual perceptions are influenced by personal purchasing preferences, geographic differences, urban vs. rural spending habits, size of family, and income level.

For starters, take a very skeptical look at the 7.5% CPI reported as the 12-month increase for January 2022. The figures published by the Bureau of Labor Statistics are the ones most often cited in the news. It’s hard to ignore them especially the comparison to the CPI as reported in 1979, 1980, and 1981 which reached a high in March 1980 of 14.8%. That number in isolation provides little economic context. The Fed Funds overnight rate hit 19% in December 1980 and again in June 1981. Mortgage interest rates peaked at 18.5% in 1981 while the prime rate reached 21%. In early February 2022, 30-year fixed rate mortgages ranged from 3.75% to 4.125%. The prime rate for large corporate borrowers was 3.25%, and Fed Funds had a weighted average of 0.08% (less than 1/10 of 1% or very close to zero!)

According to the US Energy Information Agency at the national average fuel price was $2.00 at the time of the election in 2020. The comparable price today is $3.37 or a 68% increase in 15 months. Even that high price will look cheap in another 9 months. Energy prices ripple through the economy making them an important leading indicator.

There are two major problems using CPI as your yardstick. First, these published numbers are a trailing indicator and not a measure of what you will pay next month for groceries, gas, heating oil, or ammo. Second, by its own published record, the BLS has made three major changes since 1980 in its methodology (1987, 1998, and 2018) morphing from what was previously a comparison of a fixed basket of goods (COGI or cost of goods index) to a lifestyle choice of substitutable items (COLI or cost of living index). Suffice to say that comparing CPI for 1980 to 2022 is a rigged way of reporting a lower rate of real inflation. (For readers interested in the details, check out the BLS reported changes. As you can imagine, it’s like comparing the cost of one pound of fresh ground hamburger at the local butcher shop in 1980 to four Quarter Pounders at a McDonald’s drive through in 2022. What can a good bureaucrat do to keep a lid on anxiety? Change the rules…

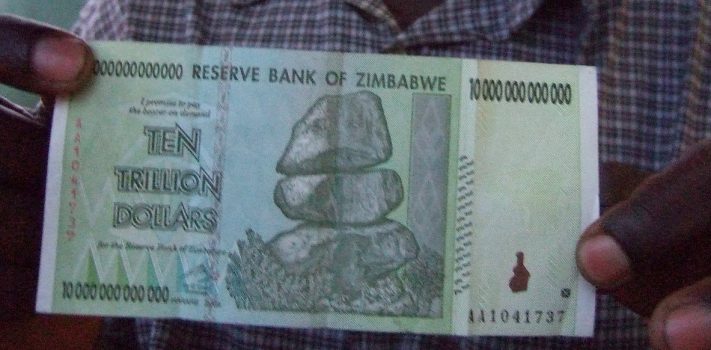

In the simplest terms, prices rise when demand outstrips supply and when massive deficit spending is paid for by increasing the money supply and keeping interest rates artificially low.Continue reading“Inflation: How Bad Could it Get? – Part 1, by Banker Bob”