Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at the developing stock market panic. (See the Economy & Finance section.) But first, a personal note from JWR:

The Paywalling of The News

I must report that I’m finding it increasingly difficult to gather the requisite news links to assemble my regular blog columns. I attribute this to the continuing trend of “Paywalling” of the news. Increasingly, the web sites of newspapers and television news outlets now require paid subscriptions, to read articles or to view news clips. The latest affront is that CNBC has now put a lot of its news pieces behind a paywall, in “CNBC Pro.” I expect this endeavor to be a reincarnation of the short-lived (and laughable) CNN+. Despite all of the big launch hoopla, the international CNN+ service only gathered about 150,000 subscribers. For comparison, the regional Los Angeles Times has 1.4 million print edition subscribers and 100,000 digital subscribers. Just 30 days into the CNN+ “long term” programming plan, they abruptly announced they were shutting down, and firing 400 staff members.

If the news paywalling situation gets any worse, then I will probably have to scale back or even discontinue several of my regular columns. This column, for example, presently appears on Mondays and Fridays. I might have to dial that back to just once a week. Granted, I can afford to buy a few news site subscriptions. But there is no point in doing so and then posting links to articles that require subscriptions at third-party sites for my readers to read them. That would frustrate nearly everyone.

My commitment to you is that SurvivalBlog will remain free to fully access — both current posts and online archives — for as long as possible, with the blog under my ownership. Some other blogs now offer a paid “premium” service. I have no plans to emulate that. Our subscriptions will remain entirely voluntary. I greatly appreciate the 2% of readers who kindly subscribe, for 10 cents a day. – JWR

—

Precious Metals:

Gold, silver punished by strong USDX that hits 20-year high. Wyckoff notes:

“July silver futures prices closed nearer the session low and hit a 22-month low today.”

JWR’s Comment: Ratio traders should take note that the hard-hit silver market pushed the silver-to-gold ratio Back up to 87.77-to-1. If you have confidence in silver in the long term, and enough vault space, then this is a good juncture to swap,

o o o

Gold Forecast: Metals and Miners Could Decline with Broader Markets.

Economy & Finance:

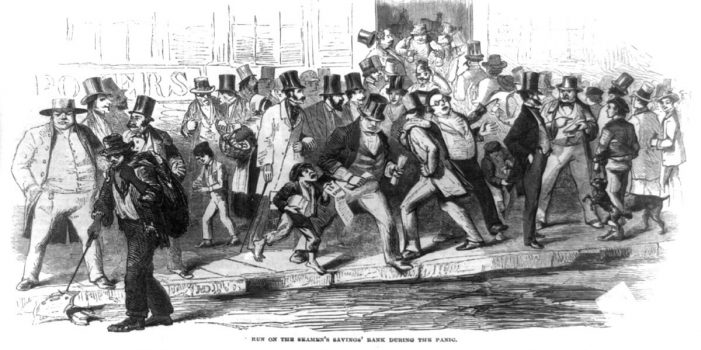

Last week’s stock market selloff was substantial. The editors of the WSJ called it “a brutal trading week.” Despite a 1.47% rebound in Friday’s session, the Dow was down I hope that readers took my advice in the past year to minimize their stock holdings and shift into tangibles. The recent stock market crash has indirectly created drops in cryptos and precious metals. Apparently, some big investors are liquidating their cryptos and metals to generate cash to cover their long option positions. We can expect plenty of turmoil to continue. Buckle up!

In the long term? Plan on further declines in equities, plenty of Dollar inflation, and stronger metals prices, once folks realize that the metals are a safe harbor, in the midst of double-digit inflation. Presently, there is a rush to cash, but that won’t last long.

o o o

Explainer: Why the U.S. stock market is tumbling in 2022.

o o o

At Wolf Street: Signs of a Downshift in the Freight Cycle, Trucking, and Demand.