Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at the developing stock market panic. (See the Economy & Finance section.) But first, a personal note from JWR:

The Paywalling of The News

I must report that I’m finding it increasingly difficult to gather the requisite news links to assemble my regular blog columns. I attribute this to the continuing trend of “Paywalling” of the news. Increasingly, the web sites of newspapers and television news outlets now require paid subscriptions, to read articles or to view news clips. The latest affront is that CNBC has now put a lot of its news pieces behind a paywall, in “CNBC Pro.” I expect this endeavor to be a reincarnation of the short-lived (and laughable) CNN+. Despite all of the big launch hoopla, the international CNN+ service only gathered about 150,000 subscribers. For comparison, the regional Los Angeles Times has 1.4 million print edition subscribers and 100,000 digital subscribers. Just 30 days into the CNN+ “long term” programming plan, they abruptly announced they were shutting down, and firing 400 staff members.

If the news paywalling situation gets any worse, then I will probably have to scale back or even discontinue several of my regular columns. This column, for example, presently appears on Mondays and Fridays. I might have to dial that back to just once a week. Granted, I can afford to buy a few news site subscriptions. But there is no point in doing so and then posting links to articles that require subscriptions at third-party sites for my readers to read them. That would frustrate nearly everyone.

My commitment to you is that SurvivalBlog will remain free to fully access — both current posts and online archives — for as long as possible, with the blog under my ownership. Some other blogs now offer a paid “premium” service. I have no plans to emulate that. Our subscriptions will remain entirely voluntary. I greatly appreciate the 2% of readers who kindly subscribe, for 10 cents a day. – JWR

—

Precious Metals:

Gold, silver punished by strong USDX that hits 20-year high. Wyckoff notes:

“July silver futures prices closed nearer the session low and hit a 22-month low today.”

JWR’s Comment: Ratio traders should take note that the hard-hit silver market pushed the silver-to-gold ratio Back up to 87.77-to-1. If you have confidence in silver in the long term, and enough vault space, then this is a good juncture to swap,

o o o

Gold Forecast: Metals and Miners Could Decline with Broader Markets.

Economy & Finance:

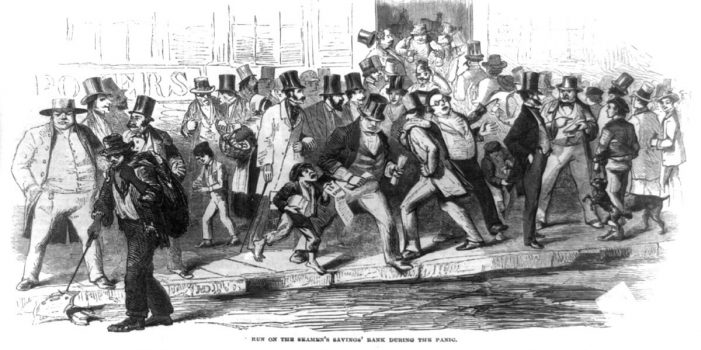

Last week’s stock market selloff was substantial. The editors of the WSJ called it “a brutal trading week.” Despite a 1.47% rebound in Friday’s session, the Dow was down I hope that readers took my advice in the past year to minimize their stock holdings and shift into tangibles. The recent stock market crash has indirectly created drops in cryptos and precious metals. Apparently, some big investors are liquidating their cryptos and metals to generate cash to cover their long option positions. We can expect plenty of turmoil to continue. Buckle up!

In the long term? Plan on further declines in equities, plenty of Dollar inflation, and stronger metals prices, once folks realize that the metals are a safe harbor, in the midst of double-digit inflation. Presently, there is a rush to cash, but that won’t last long.

o o o

Explainer: Why the U.S. stock market is tumbling in 2022.

o o o

At Wolf Street: Signs of a Downshift in the Freight Cycle, Trucking, and Demand.

Commodities:

o o o

Americans Wake Up to Find Gas Prices Have Hit a New Record High.

o o o

Russia To Cut Electricity Supplied To Finland Saturday On Heels Of Announced NATO Bid. JWR’s Comment: Commodities embargoes can be a potent weapon. But I don’t expect the Finns to back down.

Inflation Watch:

Some fearful numbers, published by In2013Dollars.com:

“Between 2021 and 2022:

-

- Gas prices increased from $2.33 per gallon to $4.27

- Bread prices increased from $1.55 per loaf to $1.61

- Milk prices increased from $3.11 per gallon to $4.03

- Egg prices increased from $1.47 per carton to $2.52

- Chicken prices increased from $1.60 per 1 lb of whole chicken to $1.79″

o o o

CNBC: Inflation barreled ahead at 8.3% in April from a year ago, remaining near 40-year highs. JWR’s Comment: Biden’s economic sorcerors are predicting a “peak” inflation soon, but I believe that they are looking at a False Summit.

o o o

Willing to Endure the World’s Longest Flight for $12,000? Qantas Is Banking On It.

Forex & Cryptos:

Will the mighty dollar become a problem?

o o o

PKR vs USD: Pakistan currency at all-time low against US dollar.

o o o

Bitcoin dropped below $30,000 again last week. There is a strong smell of Bear in the air. See: Cryptocurrencies Melt Down in a ‘Perfect Storm’ of Fear and Panic.

o o o

What Terra’s ‘Hyperinflationary’ Collapse Teaches About ‘Crypto’ & Bitcoin.

o o o

How a bitcoin market ‘in extreme fear’ compares with the past, and what to expect next.

o o o

At The New American: Central Bank Digital Currencies: Say Goodbye to Financial Privacy.

Tangibles Investing:

Used-car prices are down from record highs, easing the impact of inflation.

o o o

I was alerted to Brownells (one of our affiliate advertisers) running a sale on Gen 3 AR-15 MagPul PMAGs. They are as low as $12 each, if bought in quantity. I bought a case of 100 of them, as an investment.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. And it need not be only about commodities and precious metals. Thanks!