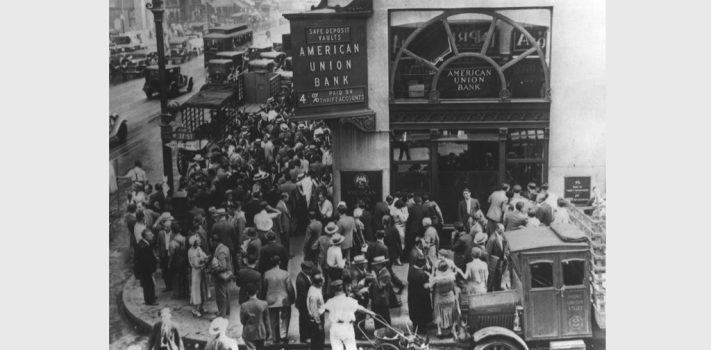

Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. Most of these items are from JWR’s “tangibles heavy” contrarian perspective. Today, we look at the risk of additional bank failures.

Precious Metals:

Price declines for gold, silver as USDX continues climb.

o o o

I missed seeing this, when it was posted back in March: Power cuts, war, and hybrid cars are predicted to cause a platinum price surge in 2023.

Economy & Finance:

Jamie Dimon Warns QT Will Lead To More Bank Failures. a quote from Dimon:

“We haven’t been through Quantitative Tightening. So we really don’t know what’s going to happen to deposits at all [ZH; actually we do: deposits will shrink dollar for dollar alongside reserves]. And that’s why I’ve been quite concerned about that. I’m probably more concerned about quantitative tightening with anybody in this room.

We’ve never had QT before. It just started, okay? And you see huge distortions in the marketplace already. We’ve never had the Fed in the market like this with that RRP program that Jeremy mentioned ever. They have $2.3 trillion basically lent out to money funds. And I don’t know the full effect of that. And obviously, that’s a direct deduction from deposits are rolling out it made sense to do.

So I think people should build into their mindset that they may have to move deposit beta more than they think and manage that. So I mean, if I was any bank or any company, I’d be saying, can you handle higher interest rates and surprise in deposits, etc?”

o o o

May 2023 Debt Limit Analysis.

o o o

Janet Yellen told bank CEOs more mergers may be necessary, sources say.

o o o

Japan’s Banks Resist Buybacks After Predicting Bumper Profit.

o o o

At Zero Hedge: Self-Checkout Machines Are Now Begging For Tips.

Continue reading“Economics & Investing For Preppers”