Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. Most of these items are from JWR’s “tangibles heavy” contrarian perspective. Today, we look at the risk of additional bank failures.

Precious Metals:

Price declines for gold, silver as USDX continues climb.

o o o

I missed seeing this, when it was posted back in March: Power cuts, war, and hybrid cars are predicted to cause a platinum price surge in 2023.

Economy & Finance:

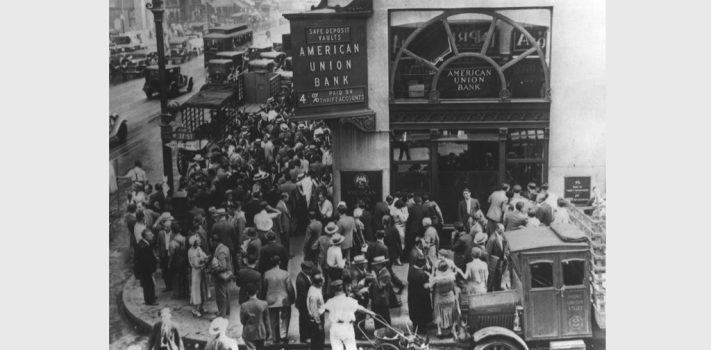

Jamie Dimon Warns QT Will Lead To More Bank Failures. a quote from Dimon:

“We haven’t been through Quantitative Tightening. So we really don’t know what’s going to happen to deposits at all [ZH; actually we do: deposits will shrink dollar for dollar alongside reserves]. And that’s why I’ve been quite concerned about that. I’m probably more concerned about quantitative tightening with anybody in this room.

We’ve never had QT before. It just started, okay? And you see huge distortions in the marketplace already. We’ve never had the Fed in the market like this with that RRP program that Jeremy mentioned ever. They have $2.3 trillion basically lent out to money funds. And I don’t know the full effect of that. And obviously, that’s a direct deduction from deposits are rolling out it made sense to do.

So I think people should build into their mindset that they may have to move deposit beta more than they think and manage that. So I mean, if I was any bank or any company, I’d be saying, can you handle higher interest rates and surprise in deposits, etc?”

o o o

o o o

Janet Yellen told bank CEOs more mergers may be necessary, sources say.

o o o

Japan’s Banks Resist Buybacks After Predicting Bumper Profit.

o o o

At Zero Hedge: Self-Checkout Machines Are Now Begging For Tips.

Commodities and Transport:

H.L. sent us this: Maersk Warns of a Downturn in Global Trade.

o o o

Hydropower in jeopardy? Major US power source facing extinction thanks to red tape, sparking calls for reform.

o o o

Panama Canal Imposes Shipping Restrictions to Cope With Worsening Drought.

o o o

From OilPrice News: Declining Iron Ore Prices Show China’s Recovery is Still Dragging.

Inflation Watch:

Americans’ Inflation Pain Hits a New High.

o o o

Will The Housing Market Crash in 2023? Experts Give 5-Year Predictions.

o o o

Why is inflation so stubborn? Cars are part of the answer.

Forex & Cryptos:

Euro Latest: US Dollar Strength Weighs on EUR/USD, Euro Area PMIs Near.

o o o

At Currency Thoughts: Some Reasonably Good Data Reports But Debt Ceiling Countdown Rumbling On.

o o o

Ethereum price prediction: Will ETH top the $2k level soon?

o o o

The Digital Pound: “More Likely Than Not”.

o o o

Reader C.B. sent us this news from the UK: Paper Money Diehards Refuse to Fold.

Tangibles Investing:

RV Bust Worsens As Dealers Discount Trailers.

o o o

Car Dealerships Finally Have Inventory, Potentially Leading To “More Pricing Pressures”.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. Thanks!