“The consequences of inflation are malinvestment, waste, a wanton redistribution of wealth and income, the growth of speculation and gambling, immorality and corruption, disillusionment, social resentment, discontent, upheaval and riots, bankruptcy, increased government controls, and eventual collapse.” – Henry Hazlitt

- Ad California Legal Rifles & Pistols!WBT makes all popular rifles compliant for your restrictive state. Choose from a wide range of top brands made compliant for your state.

- Ad Survival RealtyFind your secure and sustainable home. The leading marketplace for rural, remote, and off-grid properties worldwide. Affordable ads. No commissions are charged!

Preparedness Notes for Wednesday — December 10, 2025

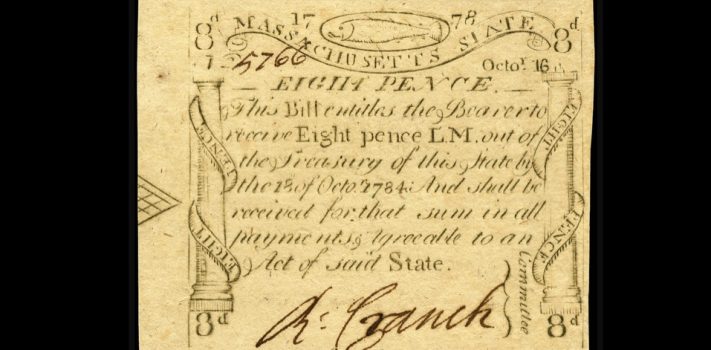

On December 10, 1690, Massachusetts Bay became the first American colonial government to issue paper money — the Massachusetts Codfish Notes. They were engraved and printed by Paul Revere. Shown above is a Codfish 8-Pence Note.

—

December 10, 1520: Martin Luther publicly burned the papal edict demanding that he recant or face excommunication.

—

And on December 10, 1906, US President Theodore Roosevelt became the first American to be awarded the Nobel Peace Prize.

—

SurvivalBlog Writing Contest

Today we present another entry for Round 122 of the SurvivalBlog non-fiction writing contest. The prizes for this round include:

First Prize:

- A Gunsite Academy Three-Day Course Certificate. This can be used for any of their one, two, or three-day course (a $1,095 value),

- A Peak Refuel “Wasatch Pack” variety of 60 servings of premium freeze-dried breakfasts and dinners in individual meal pouches — a whopping 21,970 calories, all made and packaged in the USA — courtesy of Ready Made Resources (a $350 value),

- American Gunsmithing Institute (AGI) is providing a $300 certificate good towards any of their DVD training courses. Their course catalog now includes their latest Survival Gunsmithing course.

- HSM Ammunition in Montana is providing a $350 gift certificate. The certificate can be used for any of their products.

- Harvest Guard is providing a 200-Piece Bulk Mix Pack of their Regular and Wide-Mouth Reusable Canning Jar Lids & Gaskets. This is a $161 + shipping value.

Second Prize:

- A SIRT STIC AR-15/M4 Laser Training Package, courtesy of Next Level Training, that has a combined retail value of $679

- Two 1,000-foot spools of full mil-spec U.S.-made 750 paracord (in-stock colors only) from TOUGHGRID.com (a $287 value).

- Preparedness author Jennifer Rader is offering a $200 purchase credit for any of her eight published food storage and medical preparedness books, including the

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun. There is no paperwork required for delivery of pre-1899 guns into most states, making them the last bastion of gun purchasing privacy!

Third Prize:

- A Berkey Light water filter, courtesy of USA Berkey Filters (a $305 value),

- Two sets of The Civil Defense Manual, (in two volumes) — a $193 value — kindly donated by the author, Jack Lawson.

- A $200 credit from Military Surplus LLC that can be applied to purchase and/or shipping costs for any of their in-stock merchandise, including full mil-spec ammo cans, Rothco clothing and field gear, backpacks, optics, compact solar panels, first aid kits, and more.

- A transferable $150 FRN purchase credit from Elk Creek Company, toward the purchase of any pre-1899 antique gun.

—

More than $978,000 worth of prizes have been awarded since we started running this contest. Round 122 ends on January 31st, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging. In 2023, we polled blog readers, asking for suggested article topics. Please refer to that poll if you haven’t yet chosen an article topic.

- Ad STRATEGIC RELOCATION REALTYFOR SALE: Self-sustaining Rural Property situated meticulously in serene locales distant from densely populated sanctuary cities. Remember…HISTORY Favors the PREPARED!

- Ad Click Here --> Civil Defense ManualNOW BACK IN STOCK How to protect, you, your family, friends and neighborhood in coming times of civil unrest… and much more!

Building a Simple One-Tube Radio Kit – Part 1, by Mike in Alaska

Introductory Disclaimer: I have not been paid for writing this article, and I own the radio being reviewed.

Scenario: The world has gone mad, it is now TEOTWAWKI and it’s just not a pretty picture folks. And if that wasn’t bad enough, what with the power grid being down, looters and such, and some bozo declaring martial law effectively shutting down all radio, internet, and anything capable of receiving any information except what “THEY” want you to hear … hard to imagine? If you can find a holocaust survivor, or anyone who lived during WWII ask them if that sounds impossible.Continue reading“Building a Simple One-Tube Radio Kit – Part 1, by Mike in Alaska”

- Ad Trekker Water Station 1Gal Per MinuteCall us if you have Questions 800-627-3809

- Ad USA Berkey Water Filters - Start Drinking Purified Water Today!#1 Trusted Gravity Water Purification System! Start Drinking Purified Water now with a Berkey water filtration system. Find systems, replacement filters, parts and more here.

SurvivalBlog Readers’ & Editors’ Snippets

Our weekly Snippets column is a collection of short items: responses to posted articles, practical self-sufficiency items, how-tos, lessons learned, tips and tricks, and news items — both from readers and from SurvivalBlog’s editors. Note that we may select some long e-mails for posting as separate letters.

—

Reader Richard T. recommended this article about a millionaire survivalist: Trailblazer: Vernon Pick’s Apocalypse Now. For some context, Richard also sent these two links:

- Vernon Pick mansion on Google Maps.

- Vernon Pick mansion visit on YouTube. The comments to the video from people who knew Pick are very informative.

o o o

And, speaking of Canada, there is this report, in the country’s most popular magazine, Maclean’s: Alberta’s New Separatists. A key quote:

“Today, talk of sovereignty is rising again. It would be easy for Canadians to dismiss it as a resurgence of age-old grievances—after all, despite a century of western alienation, Alberta is still here. The difference is that this time there may actually be a referendum on separation, and soon. Albertans can propose “citizen initiatives” to put forth referendum topics. Previously, proponents needed to collect 600,000 supporting signatures in 90 days to do so. This May, Premier Danielle Smith lowered that to 177,000 signatures in 120 days. A group called the Alberta Prosperity Project is already planning to collect enough signatures to force a secession referendum by 2026.”

o o o

Jerome mentioned this news: Trump DOJ Adding ‘Second Amendment Rights Section’ to Civil Rights Division.

o o o

- Ad Ready Made Resources, Trijicon Hunter Mk2$2000 off MSRP, Brand New in the case

- Ad USA Berkey Water Filters - Start Drinking Purified Water Today!#1 Trusted Gravity Water Purification System! Start Drinking Purified Water now with a Berkey water filtration system. Find systems, replacement filters, parts and more here.

The Editors’ Quote Of The Day:

- Ad SIEGE belts: Our famous "Thousand-Year Buckles" are hand-crafted in USA from a solid metal block with 5.5 to 7 oz of incredible persuasive power. Built for comfort. Go anywhere-even salt water. A must-have for EDC & travel. The perfect gift!SIEGE STOVES: prepare for the great outdoors with the ultimate portable survival stove. SIEGE BELTS have saved many: NEW: Use code "SBLOG" at checkout for $20 off any belt!

- Ad Civil Defense ManualClick Here --> The Civil Defense Manual... The A to Z of survival. Looks what's in it... https://civildefensemanual.com/whats-in-the-civil-defense-manual/

Preparedness Notes for Tuesday — December 9, 2025

On December 9th, 1315, the Swiss Woudsteden renewed their Eternal Covenant. (Eidgenossenschaft or Oath Commonwealth). According to Wikipedia: “[Eidgenossenschaft] means “oath commonwealth” or “oath alliance”, in reference to the “eternal pacts” formed between the Eight Cantons of the Old Swiss Confederacy of the late medieval period. In Swiss historiography, this relates most notably to the Rütlischwur (Rütli Oath) between the three founding cantons Uri, Schwyz and Unterwalden, which traditionally dates to 1307. In modern usage, Eidgenossenschaft is the German term used as an equivalent to “Confederation” in the official name of Switzerland, Schweizerische Eidgenossenschaft (rendered, respectively, as Confédération suisse and Confederazione svizzera in French and Italian).

—

December 9, 1854: Alfred Tennyson‘s poem “Charge of the Light Brigade”, written at Farringford, was published in The Examiner.

—

December 9th, 1914 was the birthday of Maximo Guillermo “Max” Manus. He passed away in 1996. His exploits are fairly accurately shown in the 2008 movie Max Manus: Man of War.

—

Today’s feature article was written by JWR.

—

We need more entries for Round 122 of the SurvivalBlog non-fiction writing contest. More than $978,000 worth of prizes have been awarded since we started running this contest. Round 122 ends on January 31st, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging. In 2023, we polled blog readers, asking for suggested article topics. Please refer to that poll if you haven’t yet chosen an article topic.

- Ad LifeSaver 20K JerryCan Water PurifierThe best water jerrycan you can buy on the market! Mention Survivalblog for a Free Filter ($130 Value)

- Add Your Link Here

Planning Your Silver Bull Market Exit Strategy

[Updated on January 24th, 2026.]

The recent physical silver shortage and the run-up in the spot and futures prices of silver (around $59 USD per Troy ounce the last time that I checked) has prompted me to issue some supplementary advice about how and when to SELL some of your silver. We should all be ready to start slowly SELLING or trading a large part of our silver once the spot price passes $125 per ounce. There will almost certainly be a peak and then a crash in silver. I don’t have a crystal ball, but I’ll go out on a limb and predict that the peak could be at just under $200 USD per Troy ounce.Continue reading“Planning Your Silver Bull Market Exit Strategy”

SurvivalBlog’s American Redoubt Media of the Week

This weekly column features media from around the American Redoubt region. (Idaho, Montana, eastern Oregon, eastern Washington, and Wyoming.) Much of the region is also more commonly known as The Inland Northwest.

Redoubt News Links

- Wyoming Girl, 12, Stuns With One-Shot Kill From 600 Yards To Bag Huge Elk.

- Two In Jail On Claims They Were Being Paid To Drive Teen Girl Through Wyoming.

- The Innovative “Wood Bank” In Buffalo That Provides Free Firewood For People In Need.

- Skylar Meade pleads guilty to two counts of 1st-degree murder following Idaho prison break.

Send Your Media Links

Please send your links to media from the American Redoubt region to JWR. Any photos that are posted or re-posted must be uncopyrighted. You can do so either via e-mail or via our Contact form.

The Editors’ Quote Of The Day:

“What good is the warmth of summer, without the cold of winter to give it sweetness.”

– John Steinbeck, “Travels with Charley: In Search of America”

Preparedness Notes for Monday — December 8, 2025

On December 8th, 1864, James Clerk Maxwell‘s paper “A Dynamical Theory of the Electromagnetic Field” was first read by the Royal Society in London. (It was published by the Royal Society in 1865.)

—

December 8th, 1880: 5,000 armed Boers gathered in Paardekraal, South Africa.

—

Today also marks the birthday of Eli Whitney, (1765–1825) the inventor of the labor-saving cotton gin, several firearms, and dozens of other mechanical devices. He was the first to demonstrate the advantages of fully interchangeable parts in firearms manufacture.

—

Today’s feature is by SurvivalBlog Field Gear Editor Tom Christianson.

—

We need more entries for the nonfiction writing contest. Send ’em in!

Diamond “Strike-A-Fire” Fire Starters, by Thomas Christianson

Each Diamond “Strike-A-Fire” Fire Starter (SAF stick) is kind of like a giant match which is 5.75 inches long, 1.13 inches wide, and 0.25 inches thick. The shaft of a SAF stick seems to be made out of some sort of pressed wood that is impregnated with a waxy substance. When the match-like head of a SAF stick is struck on the striking strip on the box, it ignites the SAF stick which then burns for approximately 12 minutes. In the process, the SAF stick creates enough heat to effectively ignite most types of kindling.

[JWR Adds: The SAF sticks are somewhat similar in size to the famous locofoco matches of the 1800s.]

The only significant drawback of SAF sticks that I discovered during my testing is that they are easily blown out when first struck in windy conditions.

A box of 48 SAF sticks cost $14.73 at walmart.com at the time of this writing. That comes out to just under $0.31 each. SAF sticks are “Assembled in USA”.Continue reading“Diamond “Strike-A-Fire” Fire Starters, by Thomas Christianson”

Recipe of the Week:

The following simple recipe for Sago, Rice, or Barley Soup is from The New Butterick Cook Book, copyright 1924, now in the public domain. That is just one of the dozens of bonus books included in the 2005-2025 20th Anniversary Edition of the waterproof SurvivalBlog Archive USB stick that will be available to order in January of 2026.

Ingredients

- 1 quart brown or white stock, cleared or not cleared

- 2 tablespoons sago, rice, or barley

- Salt and pepper

Directions

- Soak sago one-half hour in enough stock or water to cover it.

- After that, bring the remainder of the stock to a simmering-point.

- Add soaked sago and simmer in a closed saucepan for one-half hour, or until sago is soft. Season and serve.

NOTES

Rice may be substituted for sago. If barley is used it should be soaked overnight.

—

Do you have a well-tested recipe that would be of interest to SurvivalBlog readers? In this weekly recipe column, we place emphasis on recipes that use long-term storage foods, recipes for wild game, dutch oven recipes, slow cooker recipes, and any recipes that use home garden produce. If you have any favorite recipes, then please send them via e-mail. Thanks!

SurvivalBlog Graphic of the Week

Today’s graphic: An Aurora Borealis display photographed on December 5, 2025 by Vince Medina of North Pole, Alaska. (Posted with permission.)

The thumbnails below are click-expandable.

—

Please send your graphics or graphics links to JWR. (Either via e-mail or via our Contact form.) Any graphics that you send must either be your own creation or uncopyrighted.

The Editors’ Quote Of The Day:

“I think part of preparedness is always being quite cognizant of just how tenuous our lives can be. We know that there is a future where we’re huddled around a campfire of burning 2×4s where the tornado took the house, where we look in the fridge and theres nothing but a box of baking soda and ketchup, where we spend hours a day looking for a job as we watch our bank accounts dwindle, where we feel unsafe, insecure, and hopeless. That’s why we prepare…to mitigate those events, to reduce our fragility, to increase our resilience. And when you’re aware of what the bad side of life could look like, it tends to make you more aware and grateful for the good side that you’re experiencing.” – Commander Zero, from his Notes From The Bunker blog

Preparedness Notes for Sunday — December 7, 2025

On this day in 1941 — also a Sunday — Japanese bombers launched a surprise aerial attack on the U.S. naval base at Pearl Harbor on the island of Oahu, Hawaii, precipitating the entry of the United States into World War II.

On the same day, Adolf Hitler issued his Night and Fog (“Nacht und Nebel”) Decree, a secret order for the arrest and execution of “persons endangering German security.”

—

On December 7, 1972, American astronaut Eugene Andrew Cernan commanded the last crewed flight to the Moon, effectively ending the Apollo program.

—

On Dec. 7, 1787, Delaware became the first state to ratify the U.S. Constitution.

—

Today’s feature article is by JWR.

—

We need entries for Round 122 of the SurvivalBlog non-fiction writing contest. More than $978,000 worth of prizes have been awarded since we started running this contest. Round 122 ends on January 31st, so get busy writing and e-mail us your entry. Remember that there is a 1,500-word minimum, and that articles on practical “how-to” skills for survival have an advantage in the judging. In 2023, we polled blog readers, asking for suggested article topics. Please refer to that poll if you haven’t yet chosen an article topic.