Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. This column emphasizes JWR’s “tangibles heavy” investing strategy and contrarian perspective. Today, we look at the risk of war and the platinum market. (See the Precious Metals section.)

Precious Metals:

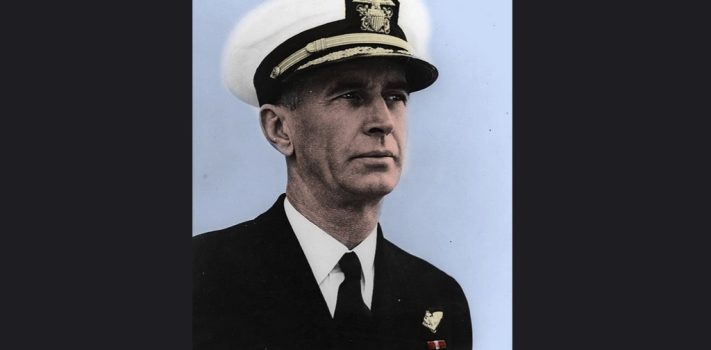

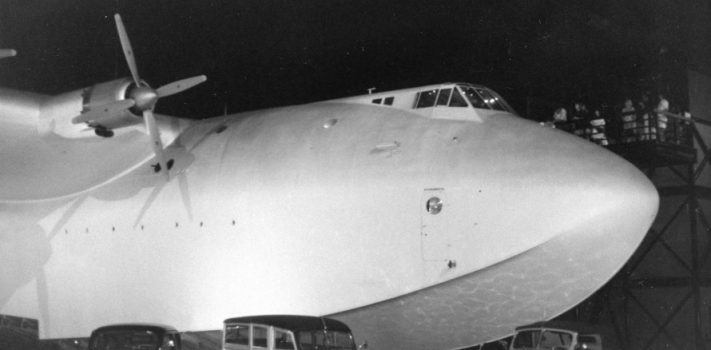

A “gut” platinum trade? Earlier this week, I had a consulting client ask me what might happen to the precious metals market, in the event of a regional war in the Middle East, or World War Three. This client already owns more than a dozen ounces of gold (in various 1-ounce coins) and a couple of $1,000 face-value bags of pre-1965 silver quarters. My advice to him was: “If you have a gut feeling that Team Biden is going to get our aircraft (both manned and long-range drones), and missiles into action in a wider war, then you should save your silver, but ratio trade most of your gold into platinum coins.” (Specifically, U.S. Mint Liberty Platinum coins, or Isle of Man Platinum Noble coins — pictured, above.) Here are the current numbers, as of Thursday, November 2, 2023: Spot gold was $2002 per Troy ounce. Meanwhile, spot platinum was only around $936 per Troy ounce. I consider that under-valued, at present. If the U.S. gets into a large-scale shooting war, then I expect the relative value of gold and platinum to flip-flop. (Thus, instead of platinum being half the price of gold, it will quickly run up to be twice the price of gold. Let’s say that gold zooms up to $2,800 per ounce. But because of its strategic military importance, platinum might reach $5,600 per troy ounce. Platinum is used a lot in making all sorts of high-tech weapons, most notably missiles. Not much platinum is produced by U.S. mining companies. Most of it comes from South Africa, Russia, and Zimbabwe. So I must ask two questions, dear readers: 1.) Do you trust your gut?, and 2.) How adverse are you to risk? But I must also add this caveat: Gut instinct-motivated moves can also be gutsy moves — meaning higher risk. – JWR

o o o

The bidding has been surprisingly strong on this American Redoubt 1-ounce silver coin, considering its uneven toning/patina. (Note: It isn’t my auction. I just stumbled into it.)

Economy & Finance:

US Treasury Reveals Lower Than Expected Rate Of Debt Sales In Quarterly Refunding Plan; Yields Slide.

o o o

Treasury details plans to step up size of bond sales to manage growing debt load and higher rates.

o o o

Can The Fed Really Risk A Dovish Turn In This Kind Of Environment?

o o o

What the ‘Great Trucking Recession’ is warning us about the economy.

o o o

WeWork to file for bankruptcy after once being valued at $47B: report.