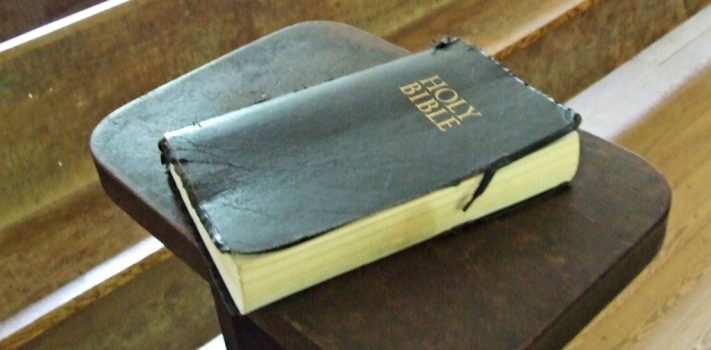

“And the Lord spake unto Moses in mount Sinai, saying,

Speak unto the children of Israel, and say unto them, When ye come into the land which I give you, then shall the land keep a sabbath unto the Lord.

Six years thou shalt sow thy field, and six years thou shalt prune thy vineyard, and gather in the fruit thereof;

But in the seventh year shall be a sabbath of rest unto the land, a sabbath for the Lord: thou shalt neither sow thy field, nor prune thy vineyard.

That which groweth of its own accord of thy harvest thou shalt not reap, neither gather the grapes of thy vine undressed: for it is a year of rest unto the land.

And the sabbath of the land shall be meat for you; for thee, and for thy servant, and for thy maid, and for thy hired servant, and for thy stranger that sojourneth with thee.

And for thy cattle, and for the beast that are in thy land, shall all the increase thereof be meat.

And thou shalt number seven sabbaths of years unto thee, seven times seven years; and the space of the seven sabbaths of years shall be unto thee forty and nine years.

Then shalt thou cause the trumpet of the jubile to sound on the tenth day of the seventh month, in the day of atonement shall ye make the trumpet sound throughout all your land.

And ye shall hallow the fiftieth year, and proclaim liberty throughout all the land unto all the inhabitants thereof: it shall be a jubile unto you; and ye shall return every man unto his possession, and ye shall return every man unto his family.

A jubile shall that fiftieth year be unto you: ye shall not sow, neither reap that which groweth of itself in it, nor gather the grapes in it of thy vine undressed.

For it is the jubile; it shall be holy unto you: ye shall eat the increase thereof out of the field.

In the year of this jubile ye shall return every man unto his possession.

And if thou sell ought unto thy neighbour, or buyest ought of thy neighbour’s hand, ye shall not oppress one another:

According to the number of years after the jubile thou shalt buy of thy neighbour, and according unto the number of years of the fruits he shall sell unto thee:

According to the multitude of years thou shalt increase the price thereof, and according to the fewness of years thou shalt diminish the price of it: for according to the number of the years of the fruits doth he sell unto thee.

Ye shall not therefore oppress one another; but thou shalt fear thy God:for I am the Lord your God.

Wherefore ye shall do my statutes, and keep my judgments, and do them; and ye shall dwell in the land in safety.

And the land shall yield her fruit, and ye shall eat your fill, and dwell therein in safety.” – Leviticus 25:1-19 (KJV)