Here are the latest items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on antique rifle scopes.

Precious Metals:

To begin, there is this from Jim Wyckoff: Gold At 3-Week High As U.S. Dollar Fades

o o o

The 2017 Silver and Gold Summit will be held November 20th and 21st, in San Francisco. Many of the cognoscenti of the precious metals world will be there, to share their knowledge. Plan to attend, if you have the time.

o o o

India gold demand seen falling to lowest in 8 years in 2017: WGC

Forex:

Dollar hits nine-day low versus Yen as rally runs out of steam

Commodities:

Moving on to oil: The price of crude oil contracts is remaining high, in the December futures market.

o o o

The good folks at OilPrice.com recently brought together all of the different oil prices in the world and placed them freely in the public domain. (Analyst groups formerly had to pay as much as $50,000 per year for this pricing data.) There is much more to global oil pricing than just West Texas Intermediate (WTI) crude!

Taxes and Regulations:

How to Break Out of Our Long National Tax Nightmare

Economy and Finance:

Next, from Brandon Smith, over at Alt-Market: $300 Million In Crypto Currency Lost Forever Thanks To A Bug In A Digital Wallet. JWR’s Comment: This debacle is just one more reason to invest in tangibles rather than “conceptuals”.

Troubling Trends:

Reader H.L. suggested this essay by Jim Quinn: Things Couldn’t Be Better… Right?

o o o

Even left-winger Nomi Prins can see the big picture, and predicts a crash. Video: Nomi Prins – Central banks will Destroy the planet

o o o

Penny wise and Pound foolish: Uprooting FDR’s “Great Wall of Trees”

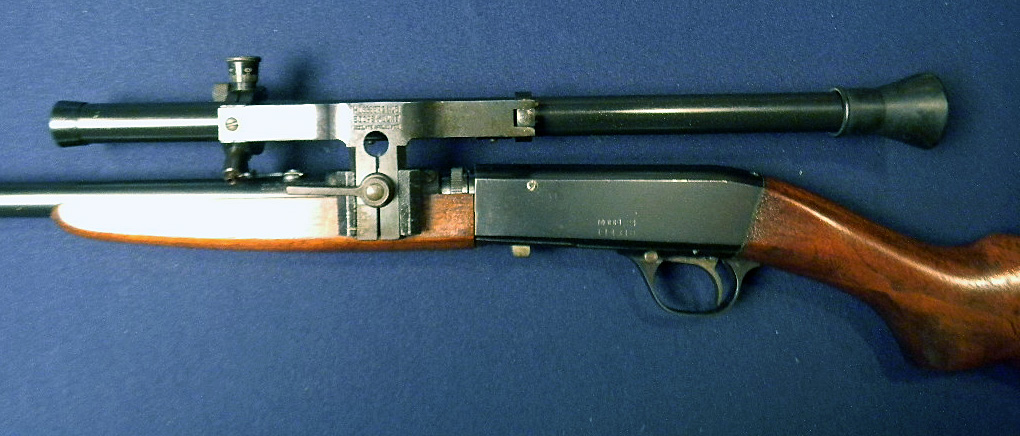

Tangibles Investing (Antique Rifle Scopes)

At a recent gun show, I had a fascinating conversation with a dealer in antique gun sights, scopes, and scope mounts. This often overlooked aspect of gun collecting promises to be quite lucrative in the long haul. In the late 1950s and early 1960s, a new generation of compact scopes–typified by the Weaver K4–was hitting the market. Few shooters had the wisdom save their old “long scopes”. Many of them simply ended up in landfills or in scrap metal boxes. This makes a lot of vintage scopes now more scarce than the rifles they were mounted on. Vintage peep sight are also highly sought after by collectors looking to restore old rifles.

One key reference is the book Old Gunsights And Rifle Scopes: Identification and Price Guide, written by Nick Stroebel. I noticed that it hasn’t been updated since 2008. I hope that a new edition is released soon.

Important note: From a prepper standpoint, do not mistake the collectibility of antique rifle scopes for practicality. Their optics quality are generally poor compared to those of modern scopes. Even the most expensive pre-1960 Leupold, Zeiss, K. Kahles, or Hensoldt scopes are optically inferior to an inexpensive modern American or Japanese scope.

Also, keep in mind that the supply of pre-1950 civilian market scopes is fairly stable (and slowly declining), but the supply of military scopes is occasionally beset with new releases of surplus–primarily from Europe. This can depress the prices of some military scope models. Sometimes these price slumps can last several years.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. So please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often “get the scoop” on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!