Economics & Investing For Preppers

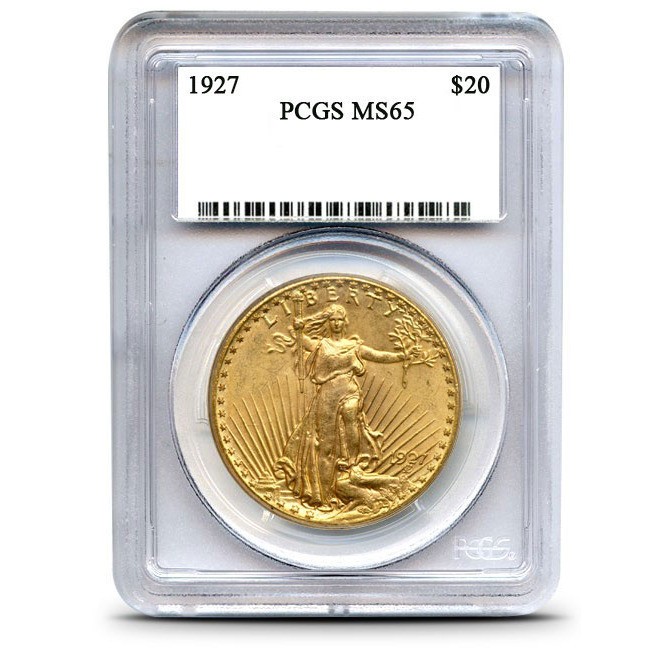

Here are the latest items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on the re-emergence of synthetic Collateralized Debt Obligation (CDO) derivatives. (See the Derivatives section.) Precious Metals First off, there is this at Zero Hedge: Gold Demand Surges As Price Suffers Worst Month Since November. JWR’s Comment: But keep in mind that Gold is still up 12% …