Here are the latest items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on numismatics. (See the Tangibles Investing section, near the end of this column.)

Precious Metals

First up, at Sharps-Pixley: Silver, the Bargain of the Century, sure to Explode after Gold Breakout

o o o

The futures contracts for gold are still reflecting a lot of uncertainty, globally. (The recent hydrogen bomb test in North Korea seems to be the source of considerable angst.)

Stocks:

Moving on to stocks: No great surprise, but the share price of Home Depot is up 2.37%, even before Hurricane Irma reaches the U.S. mainland.

o o o

Harvey, Irma And Trump: Strong Tailwinds For Infrastructure Stocks

Commodities:

From sugar mills to hog farms, U.S. agriculture braces for Irma

o o o

Hurricane Irma Could Affect Crops in Southeast

o o o

And over at Oil Price: Hurricane Irma Could Destroy Oil Demand

Forex:

Whether the BoC Hikes or Not, USD/CAD And Crosses Will Move

o o o

Sound as a Pound? GBP/USD Daily Fundamental Forecast

Economy & Finance:

European Central Bank under PRESSURE: Fragile eurozone hangs on Draghi’s next move

o o o

This piece posted back by Euromonitor back in March is worth reading: Top Three Trends in Economy, Finance and Trade in 2017

Derivatives:

Hong Kong, Singapore in talks to grab bigger share of derivatives business

Troubling Trends:

What in the World Is Causing the Retail Meltdown of 2017?

o o o

Fed’s Fischer first to flee from Trump administration, Yellen not far behind

Tangibles Investing (Numismatics):

Should I Buy Numismatic Coins? Three Risks of Collectible Gold Coins

o o o

o o o

Strategies of a Numismatic Expert… Revealed

o o o

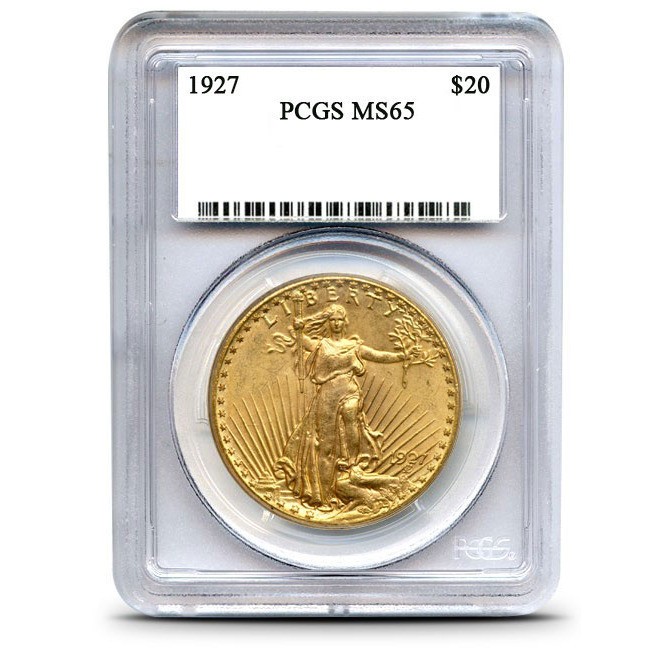

Finally, at The Spruce: Slabbed Coins Offer the Best Protection

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. So please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often “get the scoop” on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!

Re: retail sales down

Another reason for the decline is lack of help in these stores. One cannot find a clerk to help, and once the item is found/selected one stands in a long line or cannot find an open register. It is far easier for me to shop online.

Couldn’t agree more. Was in Sears the other day. Had clerks at the registers, but otherwise, staff-wise it looked like a ghost town. Help, what help?

1) The US News media appears to be deliberately misleading the American voters about the size of the North Korean test.

2) By the Bower Rule, the USGS seismic reading of 6.3 indicates a nuclear explosion of 542 kilotons !!!!!, NOT the 70 to 120 kilotons being widely reported.

Bower Rule: mb = 4.25 + 0.75* log (Y), where Y is nuclear yield, mb is seismic magnitude and log is base 10.

3)542 kilotons is equal to the yield of US nukes.

4) Norway’s NORSAR initially estimated 120 kilotons but that was based on a lowball 5.8 seismic reading by fake organization called the Comprehensive Test Ban Treaty Organization (CTBTO). Since the Test Ban hasn’t been approved yet, CTBTO is a political lobbying “preparatory organization”

https://en.wikipedia.org/wiki/Preparatory_Commission_for_the_Comprehensive_Nuclear-Test-Ban_Treaty_Organization

5) CTBTO has since admitted its seismic reading of the North Korea test was too low and raised it to 6.1. With the Bower Rule, even that would indicate a yield of 293 kilotons.

China says NK test seismic reading was 6.3.

https://www.reuters.com/article/us-northkorea-missiles-quake-china/china-earthquake-administration-detects-suspected-explosion-in-north-korea-idUSKCN1BE048

Russia says 6.4:

http://tass.com/world/963356 (Line 2)

6) Plus arms control expert Jeffrey Lewis has noted that CTBTO’s seismic estimates are lower than those of other monitoring organizations.

7) Based on CTBTO’s upward revision, Japan increased its estimate of the NK yield from 70 kilotons to 160 kilotons but Japan , South Korea and China are all submitting low ball estimates because they fear the impact upon themselves if Washington attacks North Korea. In Japan’s case, they appear to be using the Ringdal Rule:

mb = 4.45 (not 4.25) + 0.75 log (Y)

But note that the Ringdal Rule was developed for hard rock areas (which transmit seismic shock well) — areas like continental Russia.

8) North Korea, in contrast , is on the Pacific Rim where molten lava underground absorbs seismic energy. Chinese researchers Zhang and Wen have noted that the Bower Rule is more appropriate for the geology of North Korean tests.

http://wellspring.ess.sunysb.edu/wen/Reprints/ZhangWen13GRL.pdf (bottom of page 2944 and eq 2 on page 2945 )

9) Arms control researchers know that the 70 to 120 kiloton estimates in the US news media are claptrap– their estimates are 300 to 500 kt, depending upon the depth of explosion.

a) http://www.bbc.com/news/world-asia-41144326 –> Middlebury Institute says yield could be between

300 and 500 depending upon depth of test

b) Well known warmonger Berkeley estimates yield at around 300 kt, based on review of seismic readings from 40 sites

http://earthquakes.berkeley.edu/blog/2017/09/03/north-koreas-most-powerful-bomb.html

c) 250 kilotons with uncertainty until depth is known

http://www.popularmechanics.com/military/weapons/news/a28057/north-korea-nuclear-test-expert/

10) So why is the US news media giving lowball estimates while ignoring far higher estimates from experts? In my opinion, because they need to cover up the massive failure of Barack Obama and his “strategic patience”. Who let North Korea go from being a trival power to possession of a hydrogen bomb that threatens the USA. Just like Bill Clinton doing nothing to stop Osama Bin Laden after the World Trade Center was first attacked , the USS Cole was attacked and two US embassies were blown up.

11) Plus lowball estimates support the continued advocacy of appeasement and cowardice being advocated by the New York Times, the Washington Post and the rest of the Democrat news media. Because Democrat billionaires place a higher priority on their investments in Asia than upon US national security.

12) Of course, their lawyers will argue that they are not actually lying to you –they are just choosing who to acknowledge and who to suppress. But the end result is the same.

Correction to above: Third sentence from bottom should read

“In my opinion, because Democrat billionaires place a higher priority on their investments in Asia than upon US national security.”

Re: retail sales down

I live 75 miles from the nearest town, yet can get anything shipped to my door usually for free.

Retail stores probably won’t exist a generation from now.

PS The reason that the News Media can get away with their claptrap is that only one federal organization is chartered to develop yield estimates — and that organization ain’t talking to the American People:

Per the US Geological Survey:

https://earthquake.usgs.gov/earthquakes/eventpage/us2000aert#executive

” If this event was an explosion, the USGS National Earthquake Information Center cannot determine its type, whether nuclear or any other possible type. The Air Force Technical Applications Center (AFTAC) is the sole organization in the federal government whose mission is to detect and report technical data from foreign nuclear explosions. ”

From AFTAC:

http://www.25af.af.mil/About-Us/Fact-Sheets/Display/Article/333995/air-force-technical-applications-center/

So much for a free press, informed voters and democracy.

Other than gas/diesel and a few groceries I buy everything on the net, not that I buy much anyway. Besides, who doesn’t already have all the junk they’ll ever need? The days of brick and mortar stores are numbered. Until the net collapses!

retail sales down: I agree with all the reasons, especially the ease with ordering on line. I also think it has to do with the aging baby boomers. We no longer need anything. And we don’t have any money to spend anymore anyway. I am downsizing and giving to the thrift stores, and buy mostly from them too. I bet if you checked the thrift store numbers, you’d find out they are doing just fine