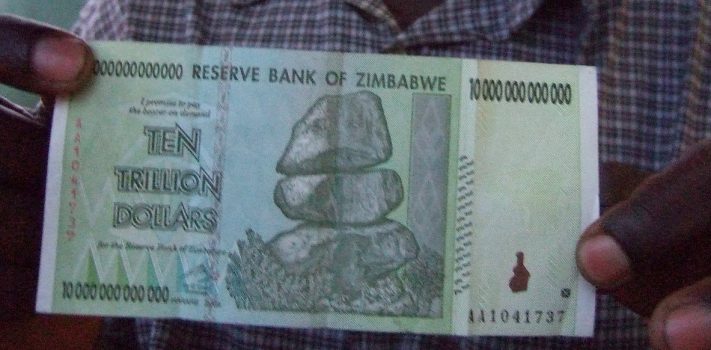

Inflation: How Bad Could it Get? – Part 1, by Banker Bob

Much of my career has been in banking or related financial services including day-to-day, hands-on management of large-scale transaction processing centers for one of the world’s largest banks. Question 1: What’s your personal measure of inflation? Weekly grocery bill? Filling up your tank at the gas pump? 9mm or 5.56 ammo when you find some? Medical bills? Your individual perceptions are influenced by personal purchasing preferences, geographic differences, urban vs. rural spending habits, size of family, and income level. For starters, take a very skeptical look at the 7.5% CPI reported as the 12-month increase for January 2022. The figures …