The United States and many other Western nations are facing a demographic disaster. As I’ve mentioned before in SurvivalBlog, birth rates have fallen below the population replacement rate. In this essay, I will spell out some root causes of these demographic shifts that might surprise you, as well as some practical solutions. The primary cause of the current negative societal trends goes even deeper than a liberalized academic system, an activist mass media spouting progressive blather, entrenched D.C. “Swamp” politicians and bureaucrats, and uncontrolled illegal migration. The taproot of the pernicious weedpatch of our societal problems is monetary. It all comes down to the very nature of our money in circulation since 1913.

I’ll get into some of the current societal ills in detail, but first I must spell out some important pieces of history:

The U.S. Constitution declared gold and silver to be lawful money. The Coinage Act of 1792 essentially cloned the traditional Milled Spanish Silver Dollar’s weight, size, and purity as the U.S. Dollar. This was later codified in Title 12, Section 152 of the U.S. Code. The same law standardized the weight, size, and purity of U.S. gold coins. When the U.S. Mint struck $10 Gold Eagles and $20 Gold Double Eagles (containing 0.9675 Troy ounces of gold) and silver dollars (containing 0.7734 Troy ounces of silver), that at that time indicated respective values of $20.67 per ounce for gold and $1.29 per ounce of silver. That worked out to a silver-to-gold ratio of nearly 16-to-1. And that ratio roughly matched mine production (and costs), at the time.

The Federal Reserve Act of 1913 established the Federal Reserve System as the central bank of the United States. This new central bank scheme allowed a heretofore unconstitutional form of money to be created. Because banks only had to hold a fraction of their deposits as reserves, the rest could be loaned out at interest. Thus, new Dollars were effectively loaned into existence. Henceforth, the size of the nation’s money supply was expanded not by mintage and currency printing but instead by manipulation of interest rates. Interest rates are controlled by the Federal Reserve’s Open Market Committee (FOMC) — which was also created in 1913.

And, by what an amazing coincidence, the personal income tax was also created in 1913, with the ratification of the 16th Amendment. That Amendment was created by Congress in 1909, and fraudulently ratified by the 48 states in February of 1913. By what an amazing coincidence, the bill establishing the Department of Labor was signed on March 4, 1913, by President William Howard Taft — the lame duck incumbent — just hours before Woodrow Wilson took office. Oh, and, by what an amazing coincidence, the First World War broke out in July, 1914.

Fractional Reserve Banking

Since 1913, the Fed’s institutionalized fractional reserve banking system has flooded trillions of new “dollars” into existence. These make-believe dollars have no real substance. And ever since 1968, the currency hasn’t been redeemable in real tangible specie — silver. Federal Reserve Notes (FRNs) are an enormous fraud. The Federal Reserve is not Federal (it is a private banking cartel) and there are no Reserves. An FRN is an unredeemable “IOU Nothing” note. The creation of an endless supply of electronic FRNs (banking ledger entries) assures ongoing inflation. And inflation, as I’ve explained in other blog posts, is a hidden form of taxation.

There are two beneficiaries of the Federal income tax, fractional reserve banking, FRN Funny Money creation, and currency inflation: 1.) Politicians who are allowed to overspend and 2.) Bankers who reap the interest on loans. This includes the National Debt, which has been carried on globally, like some sort of Ponzi Scheme or floating Craps Game for more than a century. If you analyze the history of the United States since 1913, you will see one immutable law. This law is short and sweet: The bankers always win. Even in severe economic, trade, and credit crises, the bankers always win. And whenever they begin to lose, Congress works quickly to bail them out, at taxpayer expense.

Global banking tycoon Mayer Amschel Rothschild said it best: “Give me control over a nation’s currency, and I care not who makes its laws.”

Since 1913, the purchasing power of the U.S. Dollar has dropped about 97%, and much of that drop has occurred since 1970, when the last of our silver coinage left circulation. In 1971, President Nixon closed the Gold Window, for redeem-ability of U.S. Dollars into gold. Again, those changes and the decline of “The Almighty Dollar” were not coincidences. Congress really started “putting it on plastic” once they no longer had to keep any promises of redeemability. See this chart from the St. Louis Federal Reserve Bank: Consumer Price Index for All Urban Consumers: Purchasing Power of the Consumer Dollar in U.S. City Average. (Click to expand.)

(Note the deflationary periods between the end of the First World War and the middle of the Second World War. Both wars were financed with massive debt.)

Paper and Electronic Funny Money

Before 1964, there were two types of currency printed by the U.S. Mint: U.S. Treasury Certificates and Federal Reserve Notes. They circulated side by side, at equal value, and both were marked as legal tender. People didn’t pay much attention to the disparity, because they were both used to settle debts and credit clearing on an equal footing. If you deposited four silver quarters or a $1 silver certificate or a One Dollar FRN bill at your local bank, all three were logged in their ledgers equally, as one “dollar.” In fact, they still are logged as such, but only, the ignorant, uneducated children, crackheads, and idiots deposit silver coins in banks at face value.

Up until 1968, just Silver Certificates were “redeemable on demand.” The last series of silver certificates was printed by the U.S. Mint in 1957. The Silver Law of 1963 discontinued domestic redemption of paper currency for silver coinage as of 1964, and then discontinued domestic redemption for silver bullion, in 1968. The latter had been based on a pegged silver price of $1.29 per ounce.

Note The Differences

There are some profound differences between U.S. Treasury Certificates and Federal Reserve Notes. (I should also mention that up until 1933, Gold Certificates were also issued.) The following series of photos demonstrate the differences between Silver Certificates and FRNs. Click on any of them, to see them in detail:

The promise to redeem:

The promise of silver on deposit:

Note the key phrases: “Payable to the bearer on demand”, and “Silver on deposit”. That was genuine redeemability — at least until that was later revoked by Congress. In contrast, a FRN cannot be truly redeemed, it can only be exchanged for other FRN debt instruments!

And see the difference here:

Versus:

How can a “note” (a debt) be “‘legal tender”? It cannot. It is illegal tender. It is no more genuine than a $100 bill that is spat out of a color copier. (Warning: Don’t try that. The government and the banksters hate competition.) An FRN is not genuine money. It is a fraud that the Generally Dumb Public foolishly agrees to go along with. An FRN promises nothing except the perpetuation of debt.

For some further research, take a close look and compare differences between the coloring and wording of seals on the left and right sides of the face of any bill in your wallet versus a blue seal Silver Certificate, and ponder the incongruities. In short, we transitioned from We The People’s genuine money to banksters’ fraudulent “notes”, almost without a whimper.

A redeemable Treasury Certificate was honest money. But in contrast, an unredeemable FRN “note” is a debt instrument, not true money.

The Crucial Demographic

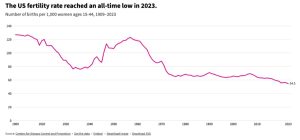

Over-taxation and currency inflation forced mothers to go back into the workforce and this in turn has discouraged couples from having more than one or two children. Most couples simply can no longer afford to have large families. Take a look at the chart found at USA Facts: How have US fertility and birth rates changed.

Both legal and illegal immigration have placed a great strain on our economy and social services. Among other factors, they have also increased urbanization, sent crime rates higher, reduced the rate of gun ownership, and shifted the electorate toward a Democrat majority.

The Debt and the Deficit

The National Debt problem has two faces: The annual deficit and the compounding debt. Federal spending and the spending deficit. The annual shortfall (the deficit) is covered each year with U.S. Treasury borrowing — both domestically and internationally.

Following the congressional shenanigans of 1913, there were three more important currency shifts that allowed overspending to go into overdrive:

First, In 1933 private ownership of most gold was banned, and the majority of citizens dutifully turned in their gold coins and bullion. They were reimbursed with paper dollars or silver coinage. In 1934 the value of gold was re-pegged from $20.67 per ounce to $35 per ounce. What a neat trick by the FDR Administration, doing that right after banning and seizing most of the available gold in the nation. In 1935 the U.S. Mint stopped producing silver dollars. But genuine silver dimes, quarters, and half-dollars were still produced. And the U.S. Mint still produced some paper currency that was redeemable for silver.

Second, in 1963, Congress authorized replacing 90 percent silver coinage with copper tokens that are flashed in silver — so-called “clad” coinage. Some silver half dollars were produced for a few more years, but after 1964 those were all debased to just 40 percent silver content.

Third, in 1981, even the copper penny was replaced with a zinc token flashed in copper. This left only cupronickel five-cent pieces (“nickels”) as the only genuine money remaining in circulation. I’ve written about the virtues of nickels for nearly 20 years, in SurvivalBlog.

More About Silver Coins

Seeing the overt change in the 1965 silver coinage debasement, the American citizenry quite logically began hoarding the older silver coins. This was Gresham’s Law, in action. (“Bad money drives out good money.”) There were so many silver coins pulled out of circulation that it created a coin shortage that lasted for several years, while the U.S. Mint slowly caught up, creating enough copper tokens to meet the needs of national coin circulation.

Digging Deeper: Demographics and Fertility

For the sake of brevity to round out this essay, I’ll make reference to some other recently-published data and analysis:

- Take the time to read this article, at USA Facts: How have US fertility and birth rates changed

- Now, read this recent article: The Future Of The American Experiment Depends On Mothers With Large Families.

- And consider this, published at Visual Capitalist: Charted: How American Households Have Changed Over Time (1960-2023).

- Then there is this interesting timeline video, at Reddit: How couples met from 1930 to 2024. How did you meet your significant other?

Demographics are Destiny

In recent years, America’s liberals have become fond of saying: “Demographics are destiny.” And in a way, they are right. They hope to create a permanent Democrat majority via massive illegal immigration from south of the border. With that majority, they hope to implement a slew of leftist and statist policies to govern every aspect of our lives. But illegal immigration may soon slow to a trickle, and large numbers of illegals will be deported if DJT keeps his campaign promises.

It also bears mention that liberal secular Democrats tend to have small families. In contrast, conservative religious Republicans tend to have large families. The bottom line: If illegal immigration is removed from the equation and legal immigration from leftist countries is slowed down, then we will win, demographically. Yes, “Demographics are destiny.”

I propose that you prayerfully consider the following plan of action:

- Be politically active and hold our representatives accountable.

- Push to have the Federal Reserve abolished.

- Push for a sound, redeemable currency.

- Urge your congressional representatives to reduce both legal and illegal immigration.

- Urge your congressional representatives to fund finishing the southern border fence.

- If in doubt, vote out all incumbents.

- Marry well, and help your children marry well. Finding like-minded spouses should be the highest priority.

- Keep your kids out of public schools. Either homeschool them or put them in the most conservative private school that you can find

- Raise large families, and raise them well, with a grounding in the Bible, history, and civics.

- Invest in tangibles — including precious metals — as hedges on continuing inflation.

- Barter whenever and wherever possible.

- Be ready to change things fundamentally as a last resort. This includes being well-armed and well-trained.

- Assistance with matchmaking will become quite important. (I’ve done a bit of that, here in SurvivalBlog.)

- Encourage and help your like-minded friends and neighbors to also do all of the aforementioned.

Pray, plan, and prepare, folks! – JWR