What is Bartering?

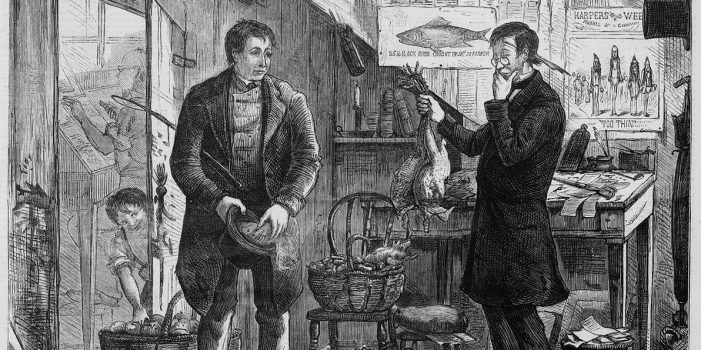

Bartering is the exchange of goods and services between two interested parties that does not utilize the current U.S. fiat monetary system, or any national currency system for that matter. Movies and television have presented numerous visuals that help people conceptualize what this might look like on a large scale like “The Hob” in the movie The Hunger Games. In lay terms, incorporating barter items in your preparedness plans is an attempt to anticipate the future needs of those near you or at your destination if bugging out.

Words of caution when it comes to bartering:

- Anyone contemplating the accumulation of bartering goods, do so only after you’ve gotten your own situation/home squared away.

- Considerable time, financial resources, and planning are generally required to begin including barter items in your preparedness plans.

- If you find yourself bartering in a post-SHTF world, then do so away from prying eyes until things settle down unless there is organized community or regional swap/faire with reasonable security.

First things first, let’s differentiate between some common terms often found floating around the concept of bartering. How does bartering differ from preparing and hoarding?

| Preparing | Hoarding | Bartering |

Optimal Purchasing Prices

|

Sub-Optimal Purchasing Prices

|

Tradeable Commodities, Goods, and Services |

| Goal Oriented | Price Gouging | Fill Gaps in Planning |

| Buy in Bulk | Non-Christian and Sociopathic | Replenish Resources and Rebuild Local Economy |

| Survival/Preparedness Driven | Greed-Driven | Mutual Self-Interest |

If a fiat currency (U.S. or other) becomes untenable, what do you use to ‘buy’ the things you need? Well, first, you have to look at how you are actually defining the word ‘currency.’ The term ‘currency’ CAN be defined as a tangible commodity, equivalent value, or tradeable skill. Here’s a brief explanation of each:

- Tangible Commodity:

Items that contain some sort of intrinsic monetary value.

Examples: bars, coins, nuggets, and jewelry. - Equivalent Value:

Items that can be bartered or swapped in a like-for-like scenario.

Example: Excess items in your larder, finished goods, and animals are traded for needed items being ‘sold’ by someone else. - Tradeable Skill:

Knowledge/experience-based skillset exchanged for a similar service.

Example: room/board/food for security or fieldwork.

Tangible Commodity

If you’re considering the inclusion of coins, gold, silver, etc. then you will need to plan years ahead and budget accordingly as none of these options are on the inexpensive side of the scale. However, if you are looking to utilize silver in the form of coinage, before you go to the bank and start procuring roll after roll of quarters, dimes, and nickels here’s what the US Mint has to say regarding the specifics for each modern coin they presently produce:

Modern Coinage Weight & Composition Table

| Denomination | Composition | Weight |

| Penny | Copper Plated Zinc (Zn) 2.5% Copper (Cu) Balance Zinc |

2.500 g |

| Nickel | Cupro-Nickel 25% Nickel (Ni) 75% Copper (Cu) |

5.000 g |

| Dime | Cupro-Nickel 8.33% Nickel (Ni) Balance Copper (Cu) |

2.268 g |

| Quarter | Cupro-Nickel 8.33% Nickel (Ni) Balance Copper |

5.670 g |

| Half-Dollar | Cupro-Nickel 8.33% Nickel (Ni) Balance Copper |

11.340 g |

| Presidential and Other Dollars | Manganese Brass 88.5% Copper (Cu) 6% Zinc (Zn) 3.5% Manganese (Mn) 2% Nickel (ni |

8.1 g |

As you can see from that table, today’s modern coinage contains no silver other than a light flashing on some coins. If any of these coins did have silver, then you’d see the periodic table symbol ‘Ag’ in the Composition column. Today’s coins, other than the nickel, are essentially knock-offs of traditional American coinage. They look, feel, and weigh the same but in terms of using a modern coin for its precious metal content, there isn’t any. In fact, the US Mint hasn’t used silver in its composition since the mid-1960s when they went from 90% silver and 10% copper to an all copper-nickel alloy.

The following table is run down on when each denomination was changed from silver to the copper-alloy:

Historical Silver Coinage Composition

| Denomination | Composition | Weight |

| Nickel | 1942 (partial) – 1945 | Jefferson Wartime – 35% Ag |

| Dime | 1892 – 1916

1916 – 1945 1946 – 1964 |

Liberty Head “Barber” – 90% Ag

Winged Liberty Head “Mercury” –90% Ag Roosevelt – 90% Ag |

| Quarter | 1892 – 1916

1916 – 1930 1932, 1934 – 1964 |

Liberty Head “Barber” – 90% Ag

Standing Liberty – 90% Ag Washington – 90% Ag |

| Half-Dollar | 1892 – 1915

1916 – 1947 1948 – 1963 1964 1965 – 1970 |

Liberty Head “Barber” – 90% AgWalking Liberty – 90% Ag

Franklin – 90% Ag Kennedy – 90% Ag Kennedy – 40% Ag |

| Dollar | 1878 – 1904, 1921

1921 – 1928, 1934 – 1935 |

Morgan – 90% Ag

Peace – 90% Ag |

To buy silver coins (nickels, dimes, quarters) containing silver (meaning WWII-era nickels and pre-1965 for dimes, quarters, and half dollars), you could visit flea markets, swaps, private sellers, garage sales, and hope for the best or you could utilize websites and possibly some banks. However, if you’re going to go the website route, you need to make sure they are reputable dealers. A simple online search revealed these options:

- Apmex

- JM Bullion

- Provident Metals

Personally, I’ve used JM Bullion to great success if for no other reason than they had the most information available online and they had the largest in-stock selection. Also, don’t be so quick to dismiss items outside of coins, bars, and nuggets. As an example, many items currently in use contain silver. I’ll provided an article from the Fort Worth Star-Telegram at the end of Part 2 of this article for you to read about “Selling grandma’s silver”.

Lastly, jewelry is also another viable option. Earrings, necklaces, broaches, rings, and the like also carry intrinsic value and can be traded in a similar fashion to coins, gold, silver, and nuggets in a pinch. The same is true of loose jewels, pearls, etc. Also, jewelry is where you will find some more uncommon precious metals like platinum and palladium.

The following table shows the spot pricing trends for the ‘Big 5’ precious metals in gold, silver, copper, platinum, and palladium, for the last ten years. As you can see, only platinum has decreased in price during this time while gold and palladium have increased by several hundred dollars each.

Precious Metal Ten-Year Comparison (Jan 1, 2014 to Jan 1, 2024)

| Metal Type | 2014 Cost |

2024 Cost |

Price Change |

| Gold | $1,232.75 per ounce | $2,058.28 per ounce | +$825.53 |

| Silver | $19.89 per ounce | $23.65 per ounce | +$3.36 |

| Copper | $3.34 per pound | $3.80 per pound | +$0.44 |

| Platinum | $1,413.25 per ounce | $991.28 per ounce | -$421.97 |

| Palladium | $741.25 per ounce | $1,081.09 per ounce | +$339.84 |

However, in the first 6 months of 2024, the spot price for silver has increased by $7-$10 and is currently trading consistently in the $29 to $30 range. Gold has risen as well and is consistently trading in the $2,300-$2,400 range. To me, silver is by far the most economical and mentally it’s the easiest to comprehend because of its psychological association with modern coins, but don’t discount copper. Copper is a very good material if you’re planning on making things for trade especially if you can create casts or forms for bullets and/or have a lathe. The same goes for lead but the pricing for lead is in tons. Lead is ranging from $2,000 to $2,200 per ton, nowadays.

The only thing you need to know now is equivalence. By that I mean, when you go looking at bars of silver, gold, platinum, palladium, or copper (as opposed to coins for example), you need to know what the actual fractional weight of a nickel, dime, or quarter are, so that you can estimate/compare size and value. The information contained in the ‘Type & Composition’ column of the Modern Coinage Weight & Composition Table is what I am referring to as the psychological factor. Items with the same value can be traded as such given the accepted value associated with the weight in a post-SHTF scenario.

Personally, I like silver, but to be specific I like the 1g, 5g, and 10g bars. I find that the 1/10th bags of junk silver, while they are a very recognizable form of silver to purchase, the price point means you likely aren’t buying many of these bags. Currently, a “tenth” bag of 90% silver coins ($100 face value) range in price from $2,400-$3,200, the same as a 1oz gold coin/bar. Psychology comes into play here as well. Currently, a 1g gold bar ranges from $110-$155 and a 1g silver bar ranges from $5-$7 while a 5g bar of silver (same weight as a nickel) can be found for $12-$14 depending on the current spot price. When presented with those options, mentally, people tend to cringe when they see a $2,400 price tag for a bag of silver and even when they see a $110 price tag on a single 1g gold bar.

If we move cost analysis to the side and focus on science; silver, copper, and lead have either lower or comparable melting points to gold but can be fashioned into far more. However, gold is generally understood as the most valuable of the precious metals due to the limited availability and circulation of platinum and palladium which is almost exclusively found in jewelry, catalytic converters, and some high-tech devices.

And speaking of catalytic converters, the reason criminals are willing to take huge risks in procuring these devices is because each one contains small amounts of platinum, palladium, and rhodium. Below is a breakdown of each of these precious metals in terms of their respective spot prices as of this writing and the amount contained in each converter.

| Precious Metal | Price per Ounce | Price per Gram |

| Platinum | $941.80 | $33.28 |

| Palladium | $935.50 | $33.05 |

| Rhodium | $4,650.00 | $164.31 |

The average catalytic converter contains, on average, about 3-7 grams of platinum, and 2-7 grams of palladium, and 1-2 grams of rhodium. With approximately 28.3g comprising an ounce, criminals need to harvest the following number of catalytic converters to garner one ounce of each precious metal:

Platinum (3-7 grams):

28.3g / 3g = 9.4 catalytic converters

28.3g / 7g = 4.04 catalytic converters

Palladium (2-7 grams):

28.3g / 2g = 14.15 catalytic converters

28.3g / 7g = 4.04 catalytic converters

Rhodium (1-2 grams):

28.3g / 1g = 28.3 catalytic converters

28.3g / 2g = 14.15 catalytic converters

As you can see, if a criminal were to steal, for argument’s sake, 30 catalytic converters in a weekend, they would conceivably have several ounces of each precious metal. This would garner a substantial financial windfall of ill-gotten gains.

Additionally, an argument can be made that the inclusion of precious metals is more trouble than it’s worth due to two factors: The first being the costs associated with its acquisition due to its ever-increasing price points coupled with the price fluctuations associated with nation-states shorting/hoarding precious metals. The second factor is that by simply having precious metals, jewelry, etc. in your possession it will make you a target for robbery and a likely increase in heavy-handed tactics to relieve you of it.

(To be concluded tomorrow, in Part 2.)