Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. This column emphasizes JWR’s “tangibles heavy” investing strategy and contrarian perspective. Today, we look at the price of silver. (See the Precious Metals section.)

Precious Metals:

After seeing highs above $25 in July and August, spot silver has been pushed down by the short sellers in recent weeks. When I last checked, spot silver had rebounded a bit, to $23.60. I expect to see a trend reversion to at least the $27 USD per Troy ounce level, by mid-December. And, as always: Buy low, sell high.

o o o

Five Signs that Gold Will Increasingly Flow to the East.

o o o

A podcast from veteran analyst Jim Puplava: Big Picture: Unsustainable.

Economy & Finance:

H.L. spotted this: Is the Great U.S. Debt Crisis About to Begin?

o o o

Electric Slowdown: Tesla, General Motors, Ford Hit the Brakes on EV Production. JWR’s Comments: The key message is hidden near the end of the article: Higher interest rates are the real killer of car sales. Most EV buyers use borrowed money to purchase their vehicles. Just as with the housing market: Higher interest rates mean fewer qualified buyers.

o o o

Linked over at the Whatfinger.com news aggregation site: Dow closes nearly 300 points lower after 10-year Treasury yield tops 5% for the first time since 2007.

o o o

Amazon will start testing drones that will drop prescriptions on your doorstep, literally.

Commodities:

Reader C.B. sent us this: World’s top graphite producer China to curb exports of key battery material.

o o o

Biden admin OKs major Pacific Northwest gas pipeline in blow to environmentalists, Dems.

o o o

India Rejects Russian Demand To Pay For Oil In Chinese Yuan.

o o o

From OilPrice News: Aluminum Prices Swing Amid U.S.-EU Tariff Talks.

Inflation/Deflation Watch:

Note: This is the website that was referenced in that report: Truflation.com.

o o o

China’s unspoken deflation challenge.

o o o

The housing market was already painful, ugly and anxious. Now the 8% mortgage rate is back.

o o o

Deflation is the anti-inflation. Here’s where prices fell in September 2023 in one chart.

Forex & Cryptos:

Dollar to stay bright this year before fading in 2024, Reuters poll of analysts shows.

o o o

At Currency Thoughts: Financial Markets Remain Unsettled in Wake of Powell and Biden Speeches.

o o o

AUD To USD Forecast: Will The Dollar Recover Against the Greenback?

o o o

‘This will be our last post’ — LBRY throws in towel against the SEC. JWR’s Comment: I just checked, and yes indeed, the LBRY server is down. I will miss LBRY. It was a grand experiment. My LBRY tokens were never worth more than a few pennies. But I had a few popular posts there, including the notorious Christopher Walken “More Cowbell!” skit, from Saturday Night Live. For almost a year, that was the only place that the full skit could be found on the Internet, since it had been deleted from YouTube. But, not to worry… It is back. Sadly, I doubt that the LBRY site will ever be back. Perhaps some LBRY die-hard has a big backup tucked away.

o o o

Ethereum Set To Outperform: Crypto Analyst Predicts 18% Rise To $1,900.

Tangibles Investing:

September home sales drop to the lowest level since the foreclosure crisis.

o o o

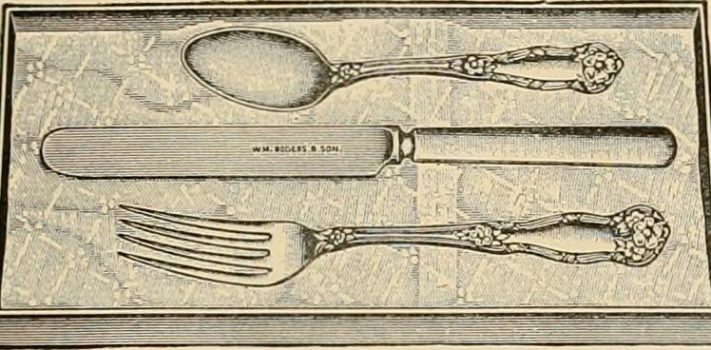

I spotted a good summary of the key factors in buying collectibles, over at the Western Trading Post auction site:

1. Rarity & Scarcity: The limited availability of items in the collectible world often drives up their value. When not everyone can own a particular item, its desirability skyrockets.

2. Historical Significance: Collectibles tied to pivotal moments or iconic figures can appreciate over time. These tangible links to history not only offer a potential financial return but tell a story.

3. Tangibility & Personal Enjoyment: Unlike stocks or bonds, collectibles are physical items. Imagine enjoying the dual satisfaction of admiring your investment on your wall and knowing it might also appreciate in value.

4. Portfolio Diversification: Collectibles can provide a hedge against traditional market fluctuations. In an uncertain economy, having tangible assets can offer some level of stability.

5. Global Appeal: With a worldwide market for collectibles, the potential pool of buyers and overall liquidity is ever-expanding.

6. Professional Authentication: Many collectibles come with authenticated grading, offering you peace of mind regarding their authenticity and condition.

7. Passion-Driven Investing: Collecting often transcends mere financial gains. Many collectors cherish the items they procure, adding an intangible value to the investment experience.

o o o

The folks at Electric Bike Company (one of our affiliate advertisers) tell me that to be sure to get an e-bike in your hands before Christmas or Hanukkah, you’ll need to put your order in before Tuesday, October 31st.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. Thanks!