Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today’s focus is on Tungsten. (See both the Commodities and Tangibles Investing sections.)

Precious Metals:

Arkadiusz Sieroń: Palladium Price Hits Record High. JWR’s Comments: I’ve been mentioning the platinum group metals off and on in SurvivalBlog since 2007. One mention of palladium in the blog was back in February of 2009, when palladium contracts were just $219 an ounce, and meanwhile platinum was at $1,091 an ounce! My current advice is to avoid getting sucked into the current hype about palladium. Don’t buy at the top. Platinum–which is presently priced below gold–is the real bargain, and far more likely to double in the next few years.

Economy & Finance:

At the great Zero Hedge site: NYC Dangerously Close To Bankruptcy, Experts Warn. Here is a quote:

“Financial analysts warn tax burdened businesses and individuals would flee in droves, and public spending would have to surge to record levels, which would set off a fiscal nuclear bomb.

Long-term debt is about $81,100 per household, and Mayor de Blasio will spend as much as $3 billion more in the new budget for a total of $89.2 billion.

Analysts said Mayor de Blasio had detailed $750 million in savings for the preliminary fiscal 2020 budget, but that amount won’t be enough to create a soft bottom during the next recession. Gov. Andrew Cuomo’s preliminary budget has $600 million in cuts for the city in 2020.

Spending is up 32% since Mayor de Blasio took office, the analysts told the Post that more spending cuts would be needed to get the fiscal house in order to avert bankruptcy during the next recession.

NYC’s long-term pension obligations have also expanded to levels that may not be manageable.

New York state is ranked No. 1 in the nation for the highest taxes, and the top 1% of NYC earners pay some 50% of income tax revenue, per the Post. If businesses and people continue to flee to lower tax states while spending continues to rise, it could lead to financial hardships for the city, analysts warn.”

o o o

Another form Zero Hedge: February Payrolls Shocker: Hiring Plunges To 20K As Wage Growth Soars

o o o

The latest from Harry Dent: What Boomers Will Do to Real Estate and Nursing Homes. A selection from his piece:

“Real estate prices will buckle under the deluge.

Japan’s aging population and eight million empty homes, trending towards 15 million, would vouch for this trend.

So, don’t believe this housing shortage will continue, especially with the “Great Reset” in consumer and asset prices just ahead from 2020 into 2023 or so. It will reverse and likely rapidly!

Lower prices and Boomers moving rapidly into nursing homes will make homebuying more affordable again and raise ownership for Millennials.

But, this younger generation seems to buy less and rent more regardless of affordability. They’re more interested in spending money on “experiences.” So, Millennial home buying won’t save the property market.

Mark my words: real estate will never be what it was before the 2006-2012 crash.”

Commodities (Tungsten):

I was recently asked by a consulting client about the current tensions in the South China Sea. His key question: What it would mean for global markets if we ever got close to a wartime situation with the People’s Republic of China? My response centered on strategic minerals. My advice: Invest in domestically-produced rare earths and tungsten. Since 80% of the world’s supply of tungsten comes from China, its price rise would be spectacular. And by the way, there is only one operating tungsten mine in the United States, in Utah. This remarkably self-contained mine is owned by the privately-held Scheelite Metals. They also own an inactive tungsten mine 50 miles east of Fallon, Nevada. That mine is currently up for sale for $2.3 million.

Tangibles Investing (Tungsten):

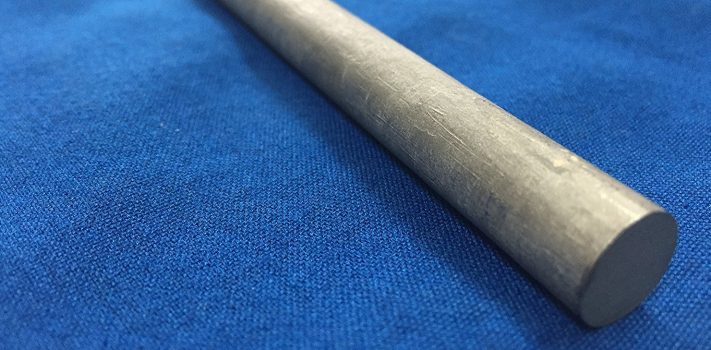

Individual investors can invest tangibly in pure tungsten rod, for speculation.

o o o

For most Americans, their house is their principal tangible investment: New Houses Are Getting Smaller – But They’re Still Much Larger Than What Your Grandparents Had

Forex & Cryptos:

Trump says strong dollar hurting U.S. competitiveness

o o o

FBI Nabs OneCoin Ringleader at LAX as Massive Crypto Scam Unravels

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often get the scoop on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!

If you are going to invest in physical Tungsten buying pieces of 1/4 inch rod most likely will not be a very viable investment. They would be difficult to find a buyer for as their use is very specialized. You might consider smaller rod used in Tungsten Inert Gas Welding (TIG) these small diameter rods are used all over for welding Aluminum and other non ferrous metals.

I have to thank JWR for the heads up on rhodium. I think it was around $650.00 an ounce, a couple of years ago. He gave the back story and I figured the price per ounce, like silver, was way under production costs. Just for grins I bought two Baird mint bullion pieces. It’s all I could afford at the time. Kitco today is selling them for $3,185.00. I realize there is the bid and ask price, but, WOW!!

Thanks James for the heads up.

Regarding buying a tungsten rod. That may be good, but you have to figure a way to sell it, when the time comes.

A lot here today. The following thoughts represent my opinions based on what I have just read.

Amazon may have had insider knowledge and they canceled their reservation on the Titanic.

I may have missed it in the article but I believe that county and state planning commissions purposely want large expensive homes built so they can send out large expensive property tax bills.

In the area where we live single story homes on acreage are in short supply. If your nest is empty and you plan to stay in your home as long as possible downsize your house now.

I cannot see the strength of the dollar being the problem. I see the problem being the central banks world wide providing cheap money (crack cocaine) to bankers and Wall Street (addicts) and now increasing the price of the drug. Time to detox! Weeping and gnashing of teeth and all.

Any thoughts on investing in 80% lowers for those of us living in the commie states?

@Lee,

As a fellow inhabitant of a “commie state” (the Democratic People’s Republic of Kalifornia), get your 80% billet lowers and a proper jig now, while they’re plentiful and cheap. The political pendulum swings back and forth, and once the Federal branches are controlled by Dems again, you’d better believe there will be gun control legislation passed going after parts kits. Gov Newsom has already requested bills from his Sacramento colleagues, and Pelosi is having the same conversation at the Federal level. If such bills are passed into law, companies that currently offer parts kits and 80% lowers will have a difficult time staying afloat due to pressure from enforcement, and may not survive the time needed (years?) for challenges to work their way up to SCOTUS for disposition.

Get ’em now, even if you don’t plan on building right now.

80% lowers are worse than useless if you don’t have the skill, ability, machines, etcetera to complete them properly.

Just sayin….

Yep I agree. A lot of us old retired guys have life experience and acquired skills that are under utilized.

The reason that house sizes are going up is because of builders. They put in close to the same number of hours of work on a 2500 sq foot house as a 2000 but the profit is much larger on the 2500.

In regards to the unfortunate massacre in New Zealand yesterday (appearing on our news feeds this morning for most of us), I agree with JWR that the NZ Gov will likely react with UK- or Aussie-style gun control measures.

A couple of years ago, a small group of my friends and I were discussing politics after a church event, and one of the men present was a New Zealander who was in the U.S. under a student visa to finish seminary (he is now a new pastor back in his homeland). The conversation segued over to firearms, and while one of the guys and I were speaking ballistics, our Kiwi friend was silent the entire time, waiting for us to finish so he could steer the topic over to something else. I then asked him if he had ever fired a gun before (with the intent of inviting him to the range), and he said he’d never touched a gun before and didn’t want to. He explained that guns are “an American thing” that isn’t part of the Kiwi culture.

Contrast that reaction to another conversation I had recently with another seminary student from Kenya who’s also here completing his seminary. He told me only the government and criminals own guns back in Kenya, but he wholeheartedly supports our 2nd Amendment. He ecstatically accepted our invitation to join us at our next mens shooting trip out in the desert in a couple of weeks, and is looking forward to bringing his teenage son to share the experience, which for them would likely be once-in-a-lifetime.

I fear that the legislative over-reaction will reach far beyond New Zealand.

It appears that it took only 24 hours for New Zealand’s Prime Minister to declare that the country’s gun laws “will certainly change”.

https://www.zerohedge.com/news/2019-03-15/new-zealand-change-gun-laws-after-mosque-shooting

Now we wait to see the extent of the ripple effect.

I once talked to a man from Canada who was about fifty years old and he told me that he’s never even known anyone who actually owned a handgun. I told him that people from Canada weren’t citizens, they were subjects. He said that he was offended and that night I lost almost thirty seconds of sleep over it.

Guesty, your kiwi friend was not telling the whole truth. There is a huge shooting, hunting and fishing culture in n.z. Rumour has it that one of the bigger gunshops in n.z has a room full of military and full auto gear, they like showing visiting Aussies in there, it makes us emotional, because we lost all that. 🙂 The kiwis like to tease us, but we’re mates and we have this habit of going to war together.

The n.z prime minister is whats known downunder as a green, usually understood to be a communist disguised as an eco warrior. There will be much autistic screeching in favour of gun bans/sensible gun laws/protect the children/if it only saves one life etc. I pray that the decent folk in n.z have the political strength to resist the inevitable storm of stupidity.

Jim

This type of action always precipitates the gun ban wackos. Prayers for those families. Disturbing. One note to all S Blog readers: was just at Cabelas in SE Wisconsin and the gun guy was stocking the pistol/ rifle powders. Almost couldn’t believe the new prices. What was 26.00 a pound, like WW 760 or H380 has now shot up to 33.00 to 36.00 a lb. he told me price increases are coming on all ammo and components. The vendors/ manufacturers gave them price hikes. So stock up before your store or amazon vendor gets the new higher price product in. I went to another store and they had the powder I wanted at the former price, which I thought was to high to begin with. Just an FYI.

Well, I’ll admit that I only heard from the one single Kiwi on the matter of firearms, so I’ll defer to anyone who would know more. I suppose it could be likened to the fact that any group of people will have a spectrum of opinions. In our our church, half the men half enjoyed our annual shooting trips, while others decline to join for personal reasons. One of them (who used to be part of our music leadership) even went so far as to comment that “guns have no place in any church setting, let alone in talk among Christians”.

So…one single person’s opinion can never be taken to solidly represent an entire community.

He needs to read his Bible a lot more closely. Christ told his disciples to sell their cloaks and buy swords. A sword was a military weapon and the Savior had absolutely no problem being in the presence of armed, responsible men.

How ignorant of this person to say guns have no place in church. Who does he expect to defend him from violent attack? The cops? Ha! They only exist to hose the blood off the street and write the report.